Embracer Group Mergers and Acquisitions Presentation Deck

KOCH MEDIA ACQUIRES VERTIGO GAMES

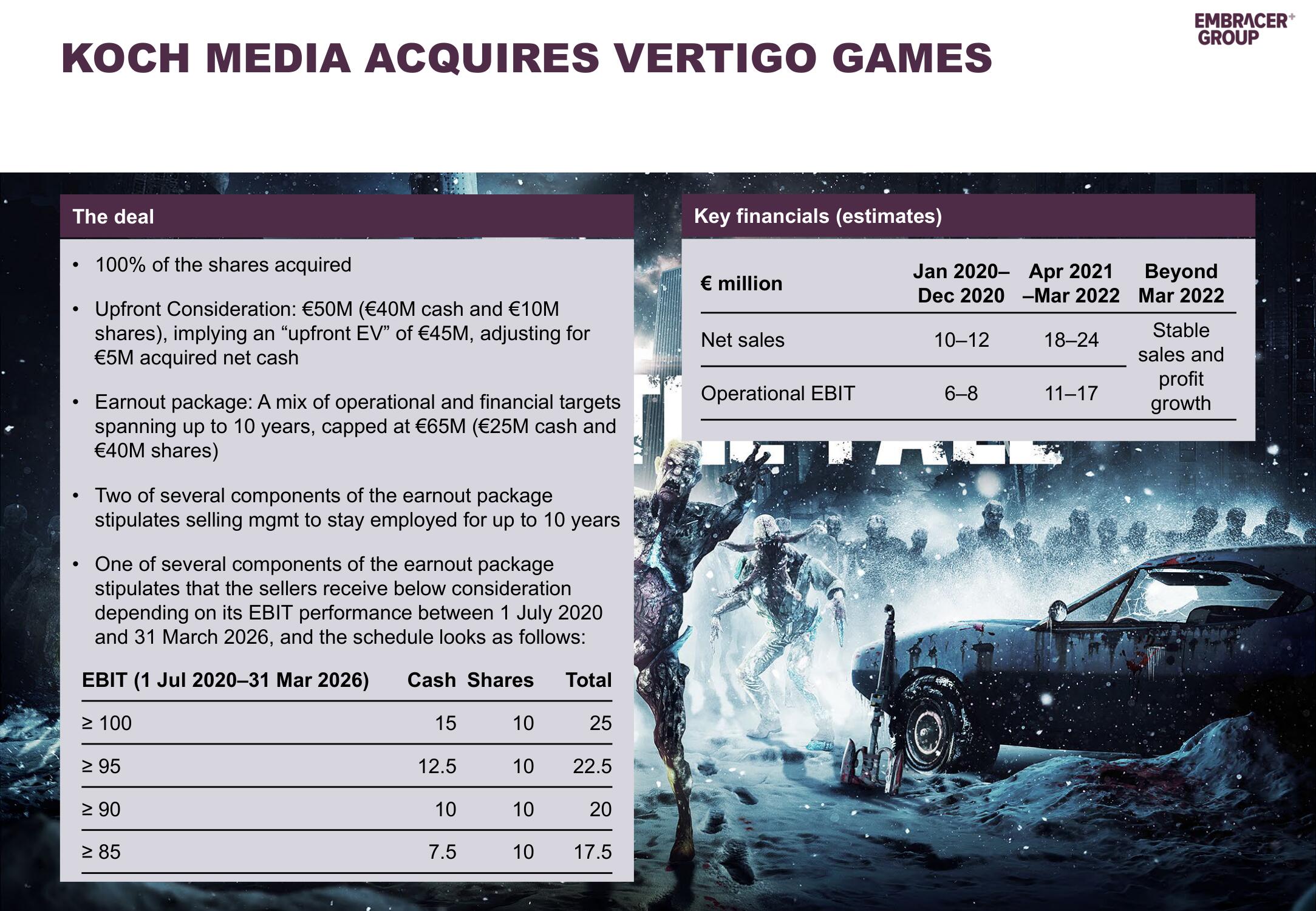

The deal

●

●

●

100% of the shares acquired

Upfront Consideration: €50M (€40M cash and €10M

shares), implying an "upfront EV” of €45M, adjusting for

€5M acquired net cash

Earnout package: A mix of operational and financial targets

spanning up to 10 years, capped at €65M (€25M cash and

€40M shares)

Two of several components of the earnout package

stipulates selling mgmt to stay employed for up to 10 years

One of several components of the earnout package

stipulates that the sellers receive below consideration

depending on its EBIT performance between 1 July 2020

and 31 March 2026, and the schedule looks as follows:

EBIT (1 Jul 2020-31 Mar 2026) Cash Shares Total

≥ 100

15

≥ 95

≥ 90

≥ 85

12.5

10

7.5

10

10

10

20

10 17.5

25

22.5

Key financials (estimates)

€ million

Net sales

Operational EBIT

Jan 2020- Apr 2021

Dec 2020-Mar 2022

10-12

6-8

18-24

11-17

EMBRACER

GROUP

Beyond

Mar 2022

Stable

sales and

profit

growth

+View entire presentation