DraftKings Investor Day Presentation Deck

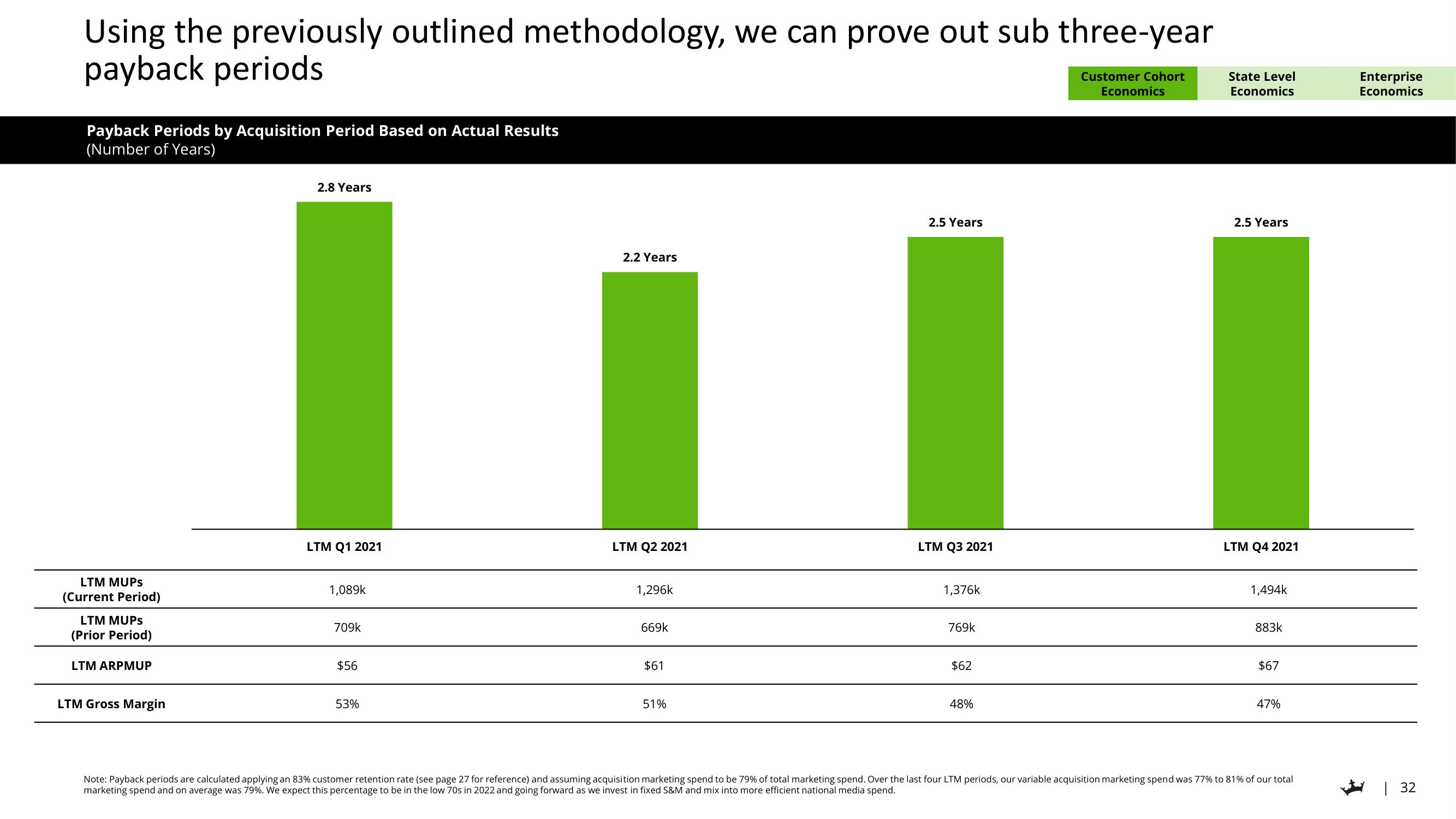

Using the previously outlined methodology, we can prove out sub three-year

payback periods

Payback Periods by Acquisition Period Based on Actual Results

(Number of Years)

LTM MUPS

(Current Period)

LTM MUPS

(Prior Period)

LTM ARPMUP

LTM Gross Margin

2.8 Years

LTM Q1 2021

1,089k

709k

$56

53%

2.2 Years

LTM Q2 2021

1,296k

669k

$61

51%

2.5 Years

LTM Q3 2021

1,376k

769k

$62

48%

Customer Cohort

Economics

State Level

Economics

2.5 Years

LTM Q4 2021

1,494k

883k

$67

47%

Note: Payback periods are calculated applying an 83% customer retention rate (see page 27 for reference) and assuming acquisition marketing spend to be 79% of total marketing spend. Over the last four LTM periods, our variable acquisition marketing spend was 77% to 81% of our total

marketing spend and on average was 79%. We expect this percentage to be in the low 70s in 2022 and going forward as we invest in fixed S&M and mix into more efficient national media spend.

Enterprise

Economics

| 32View entire presentation