SoftBank Results Presentation Deck

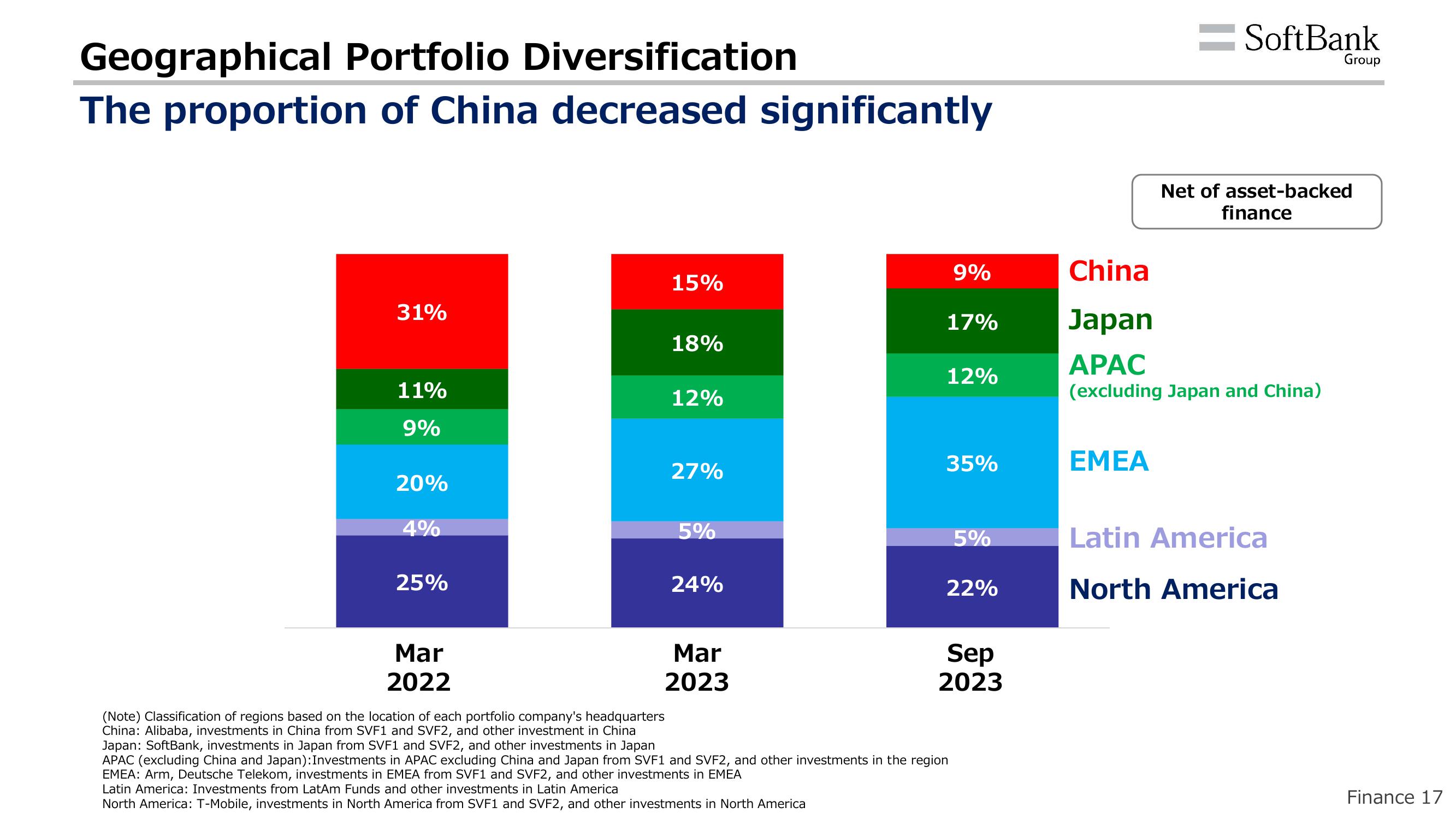

Geographical Portfolio Diversification

The proportion of China decreased significantly

31%

11%

9%

20%

4%

25%

Mar

2022

15%

18%

12%

27%

5%

24%

Mar

2023

9%

China

17% Japan

APAC

(excluding Japan and China)

12%

35%

5%

22%

(Note) Classification of regions based on the location of each portfolio company's headquarters

China: Alibaba, investments in China from SVF1 and SVF2, and other investment in China

Japan: SoftBank, investments in Japan from SVF1 and SVF2, and other investments in Japan

APAC (excluding China and Japan): Investments in APAC excluding China and Japan from SVF1 and SVF2, and other investments in the region

EMEA: Arm, Deutsche Telekom, investments in EMEA from SVF1 and SVF2, and other investments in EMEA

Latin America: Investments from LatAm Funds and other investments in Latin America

North America: T-Mobile, investments in North America from SVF1 and SVF2, and other investments in North America

Sep

2023

= SoftBank

EMEA

Net of asset-backed

finance

Group

Latin America

North America

Finance 17View entire presentation