Enact IPO Presentation Deck

Enact | Investor Presentation

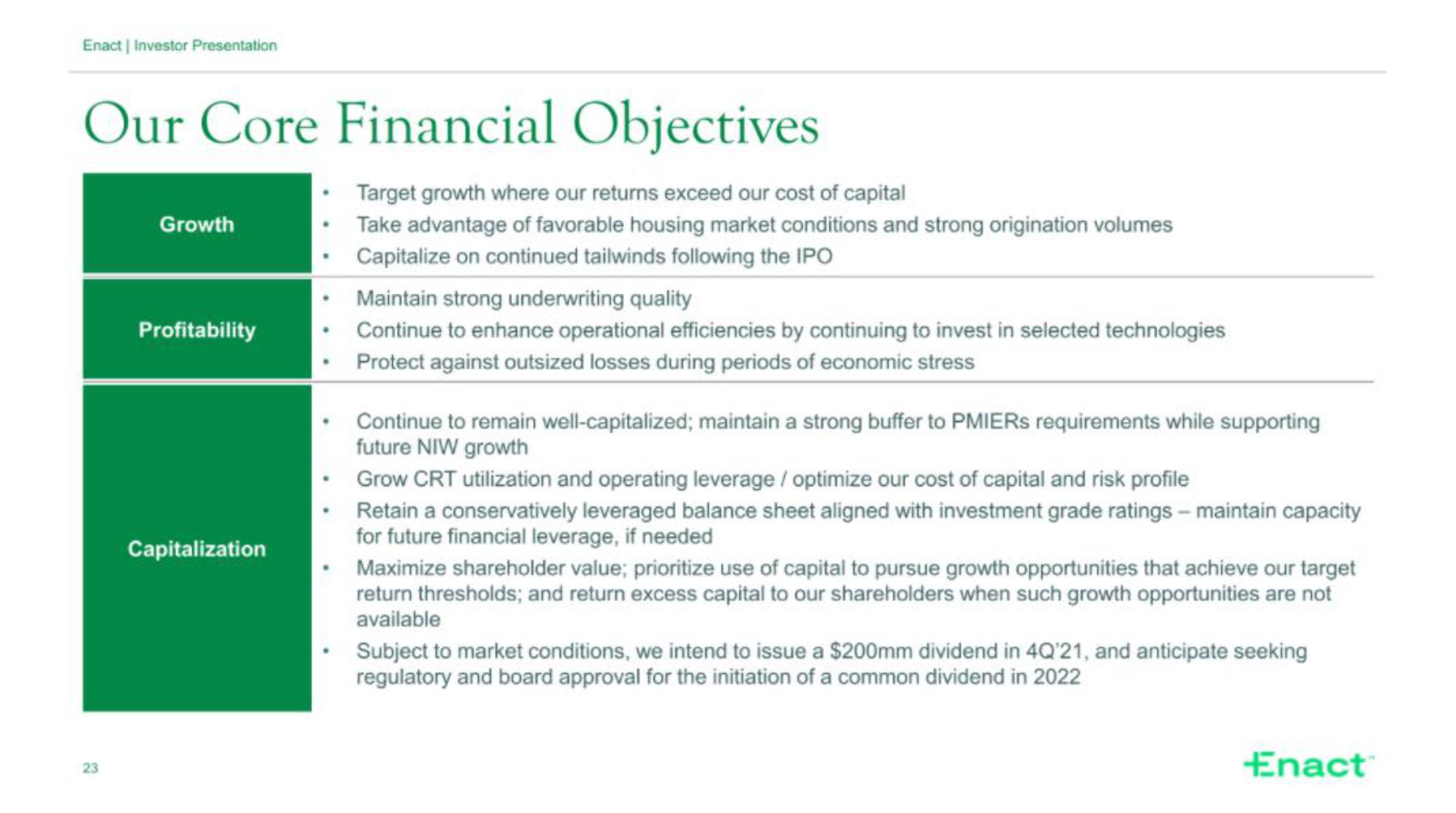

Our Core Financial Objectives

23

Growth

Profitability

Capitalization

Target growth where our returns exceed our cost of capital

Take advantage of favorable housing market conditions and strong origination volumes

Capitalize on continued tailwinds following the IPO

Maintain strong underwriting quality

Continue to enhance operational efficiencies by continuing to invest in selected technologies

Protect against outsized losses during periods of economic stress

Continue to remain well-capitalized; maintain a strong buffer to PMIERs requirements while supporting

future NIW growth

Grow CRT utilization and operating leverage / optimize our cost of capital and risk profile

Retain a conservatively leveraged balance sheet aligned with investment grade ratings - maintain capacity

for future financial leverage, if needed

Maximize shareholder value; prioritize use of capital to pursue growth opportunities that achieve our target

return thresholds; and return excess capital to our shareholders when such growth opportunities are not

available

Subject to market conditions, we intend to issue a $200mm dividend in 4Q'21, and anticipate seeking

regulatory and board approval for the initiation of a common dividend in 2022

EnactView entire presentation