TPG Results Presentation Deck

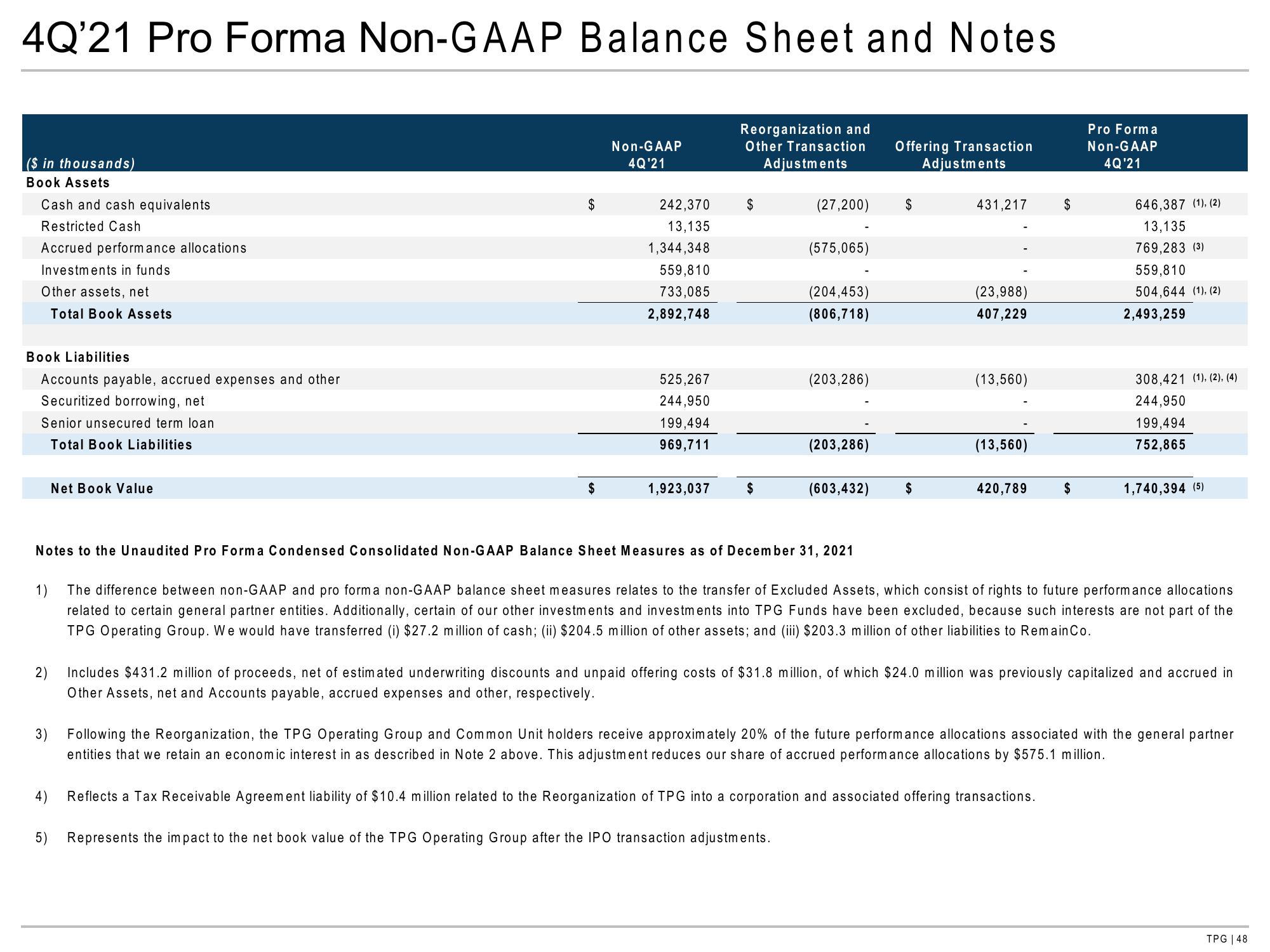

4Q'21 Pro Forma Non-GAAP Balance Sheet and Notes

($ in thousands)

Book Assets

Cash and cash equivalents

Restricted Cash

Accrued performance allocations

Investments in funds

Other assets, net

Total Book Assets

Book Liabilities

Accounts payable, accrued expenses and other

Securitized borrowing, net

Senior unsecured term loan

Total Book Liabilities

2)

3)

Net Book Value

4)

$

5)

$

Non-GAAP

4Q'21

242,370

13,135

1,344,348

559,810

733,085

2,892,748

525,267

244,950

199,494

969,711

1,923,037

Reorganization and

Other Transaction

Adjustments

$

$

(27,200)

(575,065)

Notes to the Unaudited Pro Forma Condensed Consolidated Non-GAAP Balance Sheet Measures as of December 31, 2021

(204,453)

(806,718)

(203,286)

(203,286)

Represents the impact to the net book value of the TPG Operating Group after the IPO transaction adjustments.

(603,432)

Offering Transaction

Adjustments

$

$

431,217

(23,988)

407,229

(13,560)

(13,560)

420,789

$

$

Reflects a Tax Receivable Agreement liability of $10.4 million related to the Reorganization of TPG into a corporation and associated offering transactions.

Pro Forma

Non-GAAP

4Q'21

1)

The difference between non-GAAP and pro form a non-GAAP balance sheet measures relates to the transfer of Excluded Assets, which consist of rights to future performance allocations

related to certain general partner entities. Additionally, certain of our other investments and investments into TPG Funds have been excluded, because such interests are not part of the

TPG Operating Group. We would have transferred (i) $27.2 million of cash; (ii) $204.5 million of other assets; and (iii) $203.3 million of other liabilities to Remain Co.

646,387 (1), (2)

13,135

769,283 (3)

559,810

504,644 (1), (2)

2,493,259

308,421 (1), (2), (4)

244,950

199,494

752,865

1,740,394 (5)

Includes $431.2 million of proceeds, net of estimated underwriting discounts and unpaid offering costs of $31.8 million, of which $24.0 million was previously capitalized and accrued in

Other Assets, net and Accounts payable, accrued expenses and other, respectively.

Following the Reorganization, the TPG Operating Group and Common Unit holders receive approximately 20% of the future performance allocations associated with the general partner

entities that we retain an economic interest in as described in Note 2 above. This adjustment reduces our share of accrued performance allocations by $575.1 million.

TPG | 48View entire presentation