OppFi Investor Presentation Deck

13

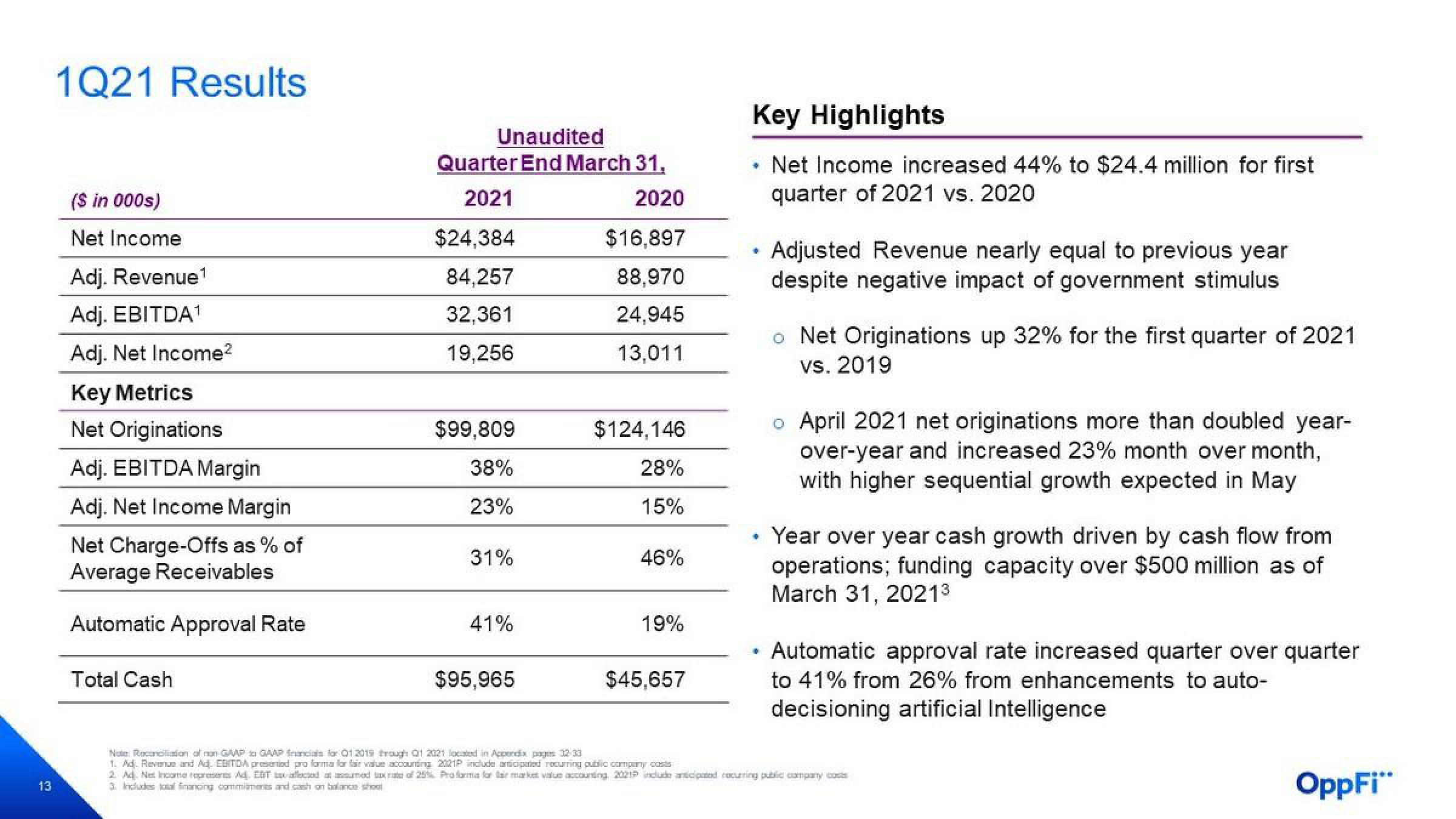

1Q21 Results

($ in 000s)

Net Income

Adj. Revenue¹

Adj. EBITDA¹

Adj. Net Income²

Key Metrics

Net Originations

Adj. EBITDA Margin

Adj. Net Income Margin

Net Charge-Offs as % of

Average Receivables

Automatic Approval Rate

Total Cash

Unaudited

Quarter End March 31,

2021

2020

$24,384

84,257

32,361

19,256

$99,809

38%

23%

31%

41%

$95,965

$16,897

88,970

24,945

13,011

$124,146

28%

15%

46%

19%

$45,657

Key Highlights

Net Income increased 44% to $24.4 million for first

quarter of 2021 vs. 2020

.

♥

Adjusted Revenue nearly equal to previous year

despite negative impact of government stimulus

o Net Originations up 32% for the first quarter of 2021

vs. 2019

o April 2021 net originations more than doubled year-

over-year and increased 23% month over month,

with higher sequential growth expected in May

Year over year cash growth driven by cash flow from

operations; funding capacity over $500 million as of

March 31, 2021³

Automatic approval rate increased quarter over quarter

to 41% from 26% from enhancements to auto-

decisioning artificial Intelligence

Not Reconciation of nan GAAP to GAAP inancials for 01 2019 through 01 2021 located in Appendix pages 32-33

1. Ad. Revenue and Ad. EDITDA presented pro forma for fair value accounting 2021P include anticipated recurring public company costs

2 Ad. Net Income

Ad. EDT alocat sumed txt of 25% Proforma for a market value accounting, 2021 include ancipated recurring public company costs

3. Includes al financing commitments and cash on balance shoo

OppFi"View entire presentation