Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

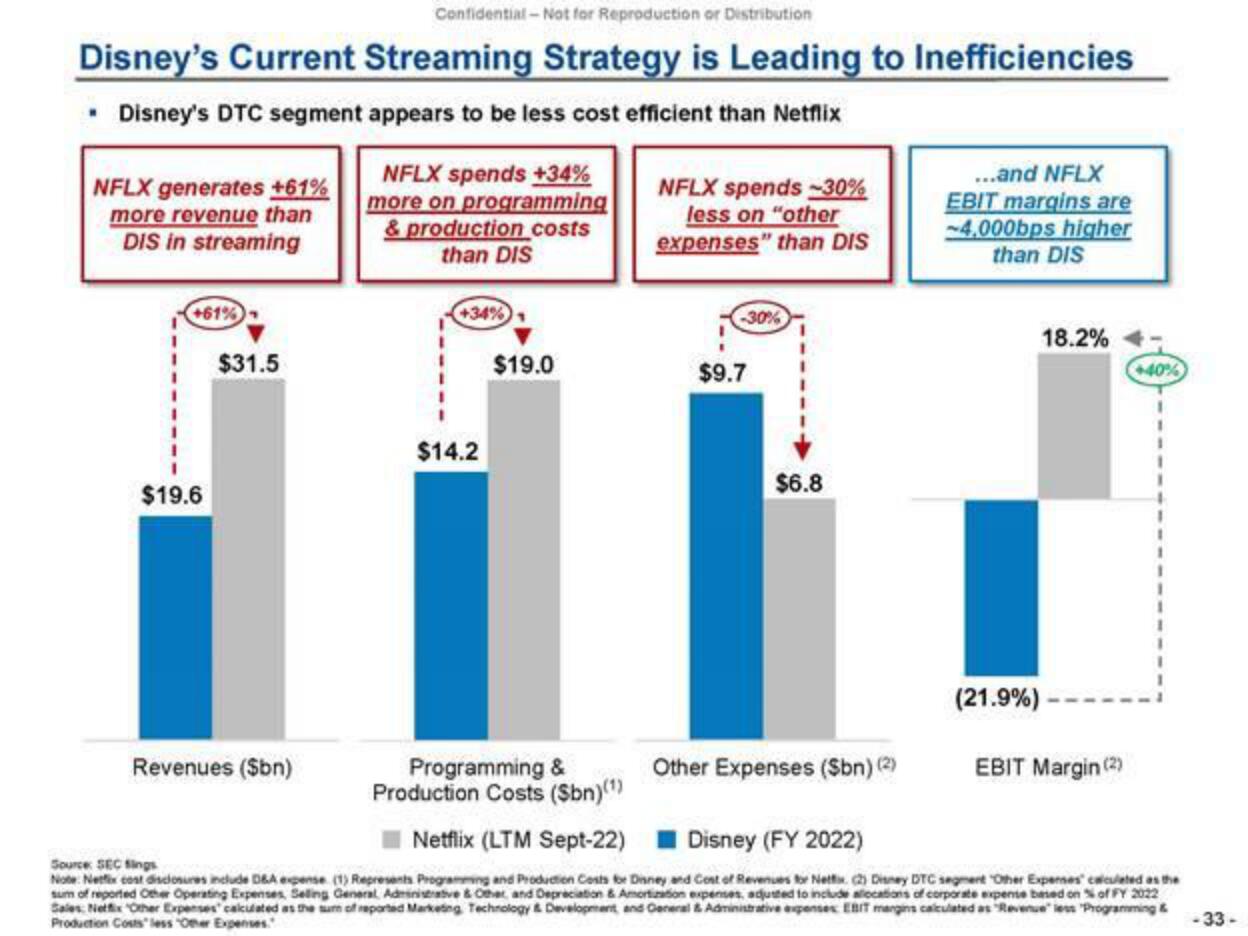

Disney's Current Streaming Strategy is Leading to Inefficiencies

• Disney's DTC segment appears to be less cost efficient than Netflix

NFLX generates +61%

more revenue than

DIS in streaming

+61%

$19.6

$31.5

Revenues ($bn)

NFLX spends +34%

more on programming

& production costs

than DIS

+34%)

$14.2

$19.0

Programming &

Production Costs ($bn)(¹)

NFLX spends -30%

less on "other

expenses" than DIS

-30%

$9.7

$6.8

Other Expenses ($bn) (2)

...and NFLX

EBIT margins are

-4,000bps higher

than DIS

18.2%

(21.9%)

EBIT Margin (2)

+40%

Netflix (LTM Sept-22) Disney (FY 2022)

Source SEC Sings

Note: Netflix cost disclosures include D&A expense (1) Represents Programming and Production Costs for Disney and Cost of Revenues for Netflix (2) Disney DTC segment "Other Expenses calculated as the

sum of reported Other Operating Expenses, Selling General Administrative & Other, and Depreciation & Amortization expenses, adjusted to include allocations of corporate expense based on % of FY 2022

Sales Netflix Other Expenses calculated as the sum of reported Marketing Technology & Development, and General & Administrative expenses EBIT margins calculated as "Revenue less Programming &

Production Costs less Other Expenses.

-33-View entire presentation