Hg Genesis 10, L.P. Recommendation Report

Hamilton Lane

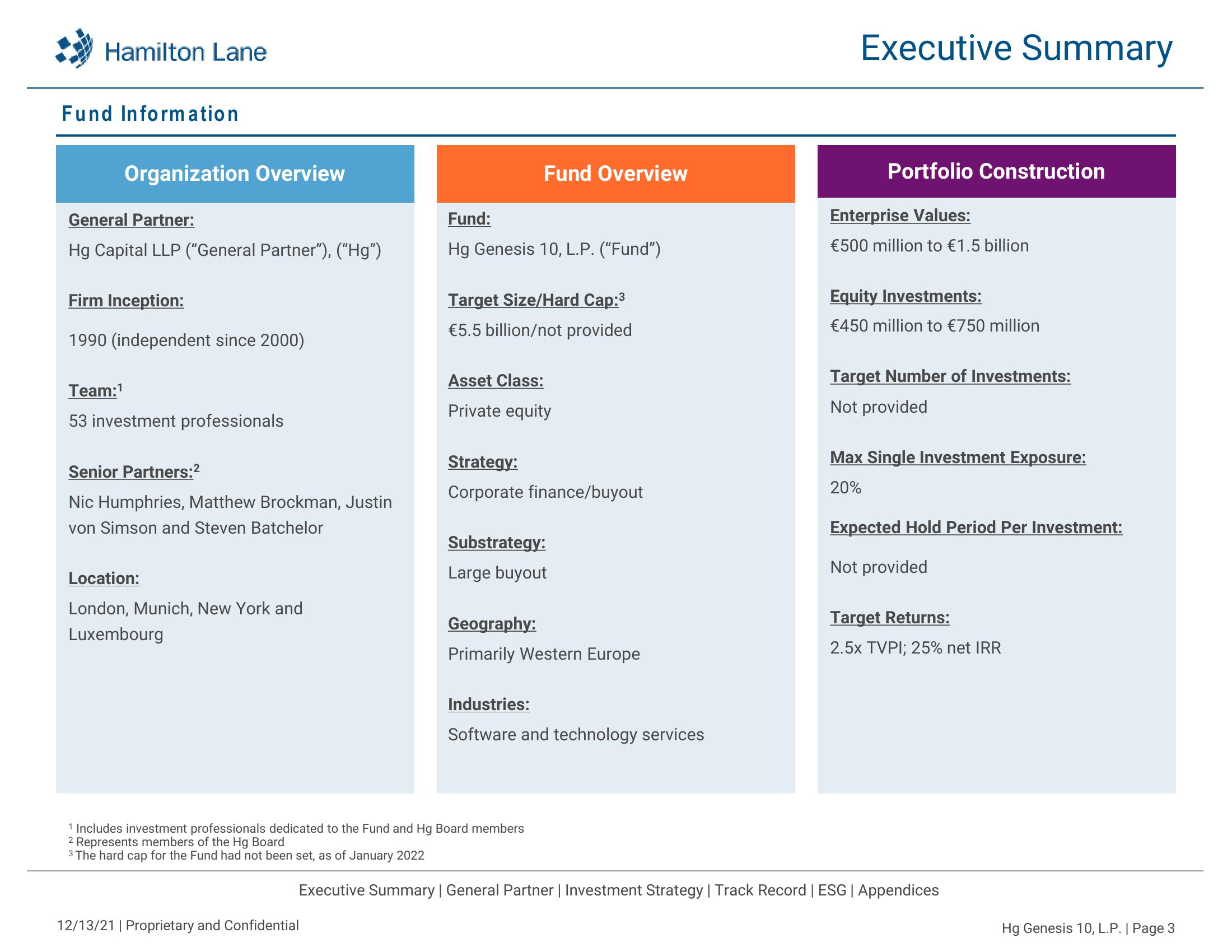

Fund Information

Organization Overview

General Partner:

Hg Capital LLP ("General Partner"), (“Hg”)

Firm Inception:

1990 (independent since 2000)

Team:¹

53 investment professionals

Senior Partners:²

Nic Humphries, Matthew Brockman, Justin

von Simson and Steven Batchelor

Location:

London, Munich, New York and

Luxembourg

Fund Overview

Fund:

Hg Genesis 10, L.P. ("Fund")

12/13/21 | Proprietary and Confidential

Target Size/Hard Cap:³

€5.5 billion/not provided

Asset Class:

Private equity

Strategy:

Corporate finance/buyout

Substrategy:

Large buyout

Geography:

Primarily Western Europe

1 Includes investment professionals dedicated to the Fund and Hg Board members

2 Represents members of the Hg Board

3 The hard cap for the Fund had not been set, as of January 2022

Industries:

Software and technology services

Executive Summary

Portfolio Construction

Enterprise Values:

€500 million to €1.5 billion

Equity Investments:

€450 million to €750 million

Target Number of Investments:

Not provided

Max Single Investment Exposure:

20%

Expected Hold Period Per Investment:

Not provided

Target Returns:

2.5x TVPI; 25% net IRR

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Hg Genesis 10, L.P. | Page 3View entire presentation