Experian ESG Presentation Deck

Executive Summary Improving Financial Health

Employees

Supply Chain

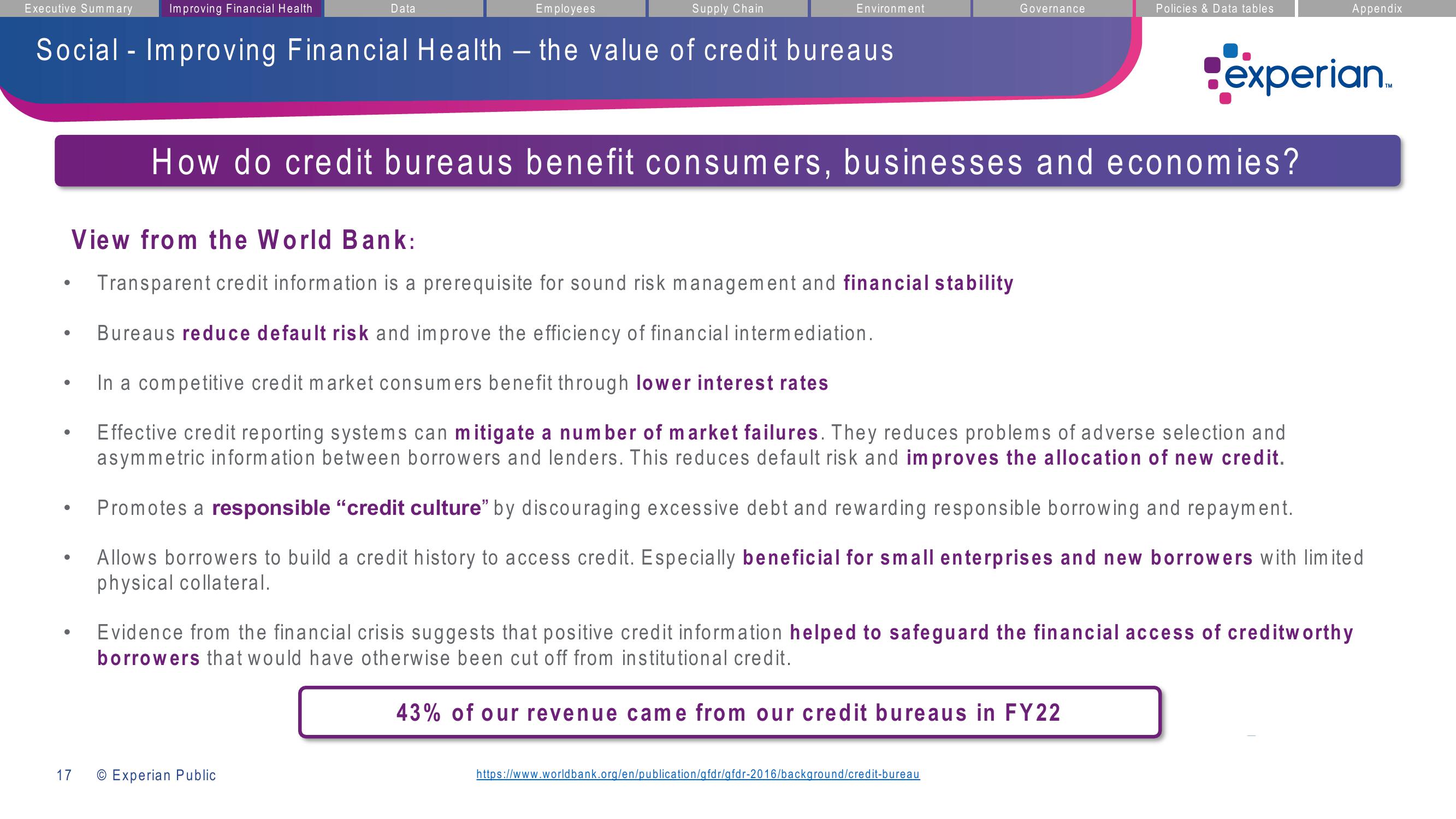

Social - Improving Financial Health - the value of credit bureaus

●

●

●

View from the World Bank:

Transparent credit information is a prerequisite for sound risk management and financial stability

Bureaus reduce default risk and improve the efficiency of financial intermediation.

In a competitive credit market consumers benefit through lower interest rates

●

●

●

17

Data

Environment

O Experian Public

Governance

How do credit bureaus benefit consumers, businesses and economies?

Policies & Data tables

Effective credit reporting systems can mitigate a number of market failures. They reduces problems of adverse selection and

asymmetric information between borrowers and lenders. This reduces default risk and improves the allocation of new credit.

Promotes a responsible "credit culture" by discouraging excessive debt and rewarding responsible borrowing and repayment.

Allows borrowers to build a credit history to access credit. Especially beneficial for small enterprises and new borrowers with limited

physical collateral.

43% of our revenue came from our credit bureaus in FY22

https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/credit-bureau

Appendix

experian.

Evidence from the financial crisis suggests that positive credit information helped to safeguard the financial access of creditworthy

borrowers that would have otherwise been cut off from institutional credit.View entire presentation