Silicon Valley Bank Results Presentation Deck

Non-GAAP reconciliation*

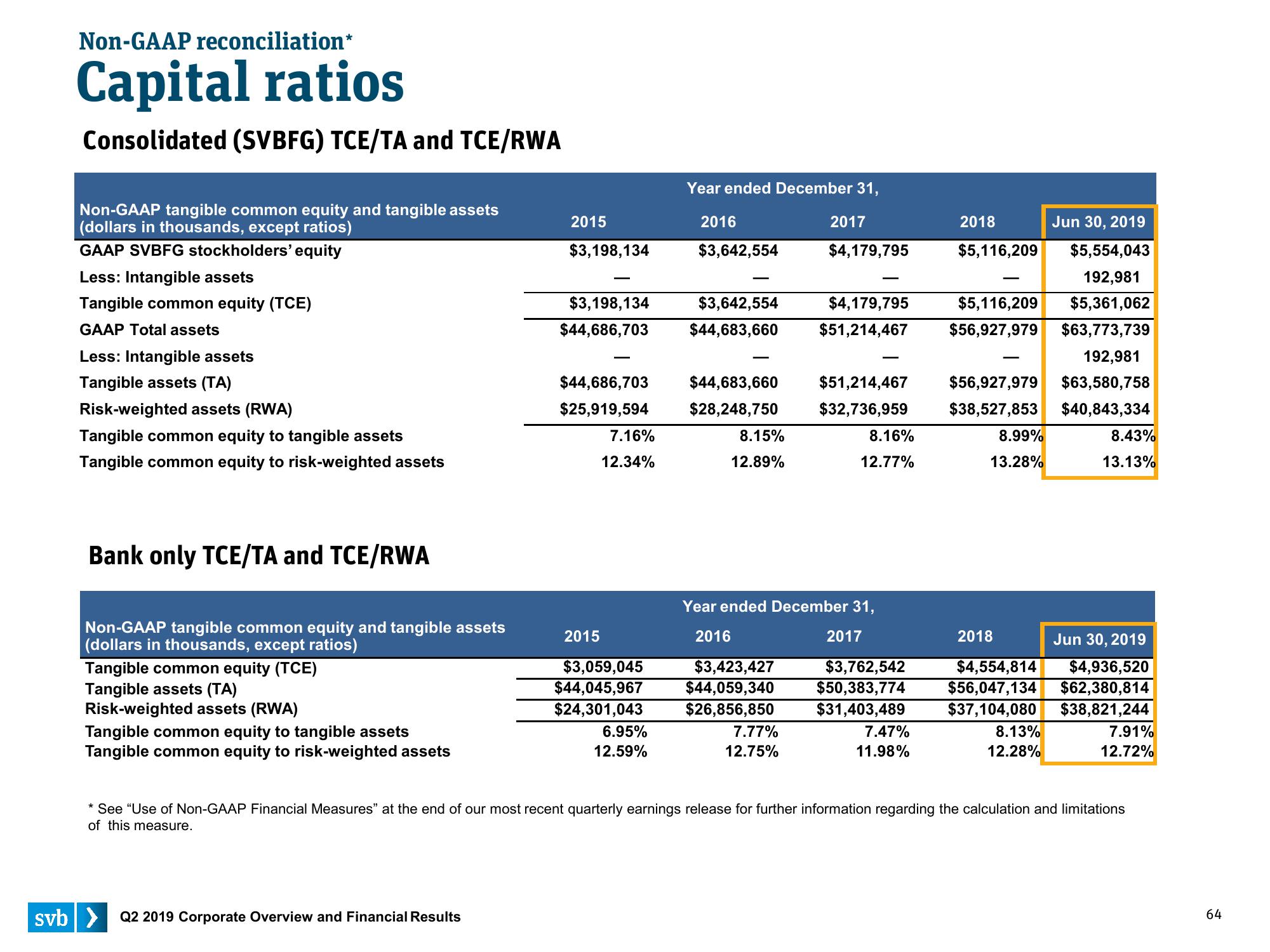

Capital ratios

Consolidated (SVBFG) TCE/TA and TCE/RWA

Non-GAAP tangible common equity and tangible assets

(dollars in thousands, except ratios)

GAAP SVBFG stockholders' equity

Less: Intangible assets

Tangible common equity (TCE)

GAAP Total assets

Less: Intangible assets

Tangible assets (TA)

Risk-weighted assets (RWA)

Tangible common equity to tangible assets

Tangible common equity to risk-weighted assets

Bank only TCE/TA and TCE/RWA

Non-GAAP tangible common equity and tangible assets

(dollars in thousands, except ratios)

Tangible common equity (TCE)

Tangible assets (TA)

Risk-weighted assets (RWA)

Tangible common equity to tangible assets

Tangible common equity to risk-weighted assets

2015

svb> Q2 2019 Corporate Overview and Financial Results

$3,198,134

$3,198,134

$44,686,703

$44,686,703

$25,919,594

2015

7.16%

12.34%

$3,059,045

$44,045,967

$24,301,043

6.95%

12.59%

Year ended December 31,

2016

$3,642,554

$3,642,554

$44,683,660

$44,683,660

$28,248,750

8.15%

12.89%

$3,423,427

$44,059,340

$26,856,850

2017

$4,179,795

7.77%

12.75%

$4,179,795

$51,214,467

$51,214,467

$32,736,959

Year ended December 31,

2016

2017

8.16%

12.77%

$3,762,542

$50,383,774

$31,403,489

7.47%

11.98%

Jun 30, 2019

$5,554,043

192,981

$5,116,209 $5,361,062

$56,927,979 $63,773,739

192,981

$56,927,979 $63,580,758

$38,527,853 $40,843,334

2018

$5,116,209

8.99%

13.28%

2018

8.43%

13.13%

$4,554,814

Jun 30, 2019

$4,936,520

$62,380,814

$56,047,134

$37,104,080 $38,821,244

7.91%

8.13%

12.28%

12.72%

* See "Use of Non-GAAP Financial Measures" at the end of our most recent quarterly earnings release for further information regarding the calculation and limitations

of this measure.

64View entire presentation