Oatly Results Presentation Deck

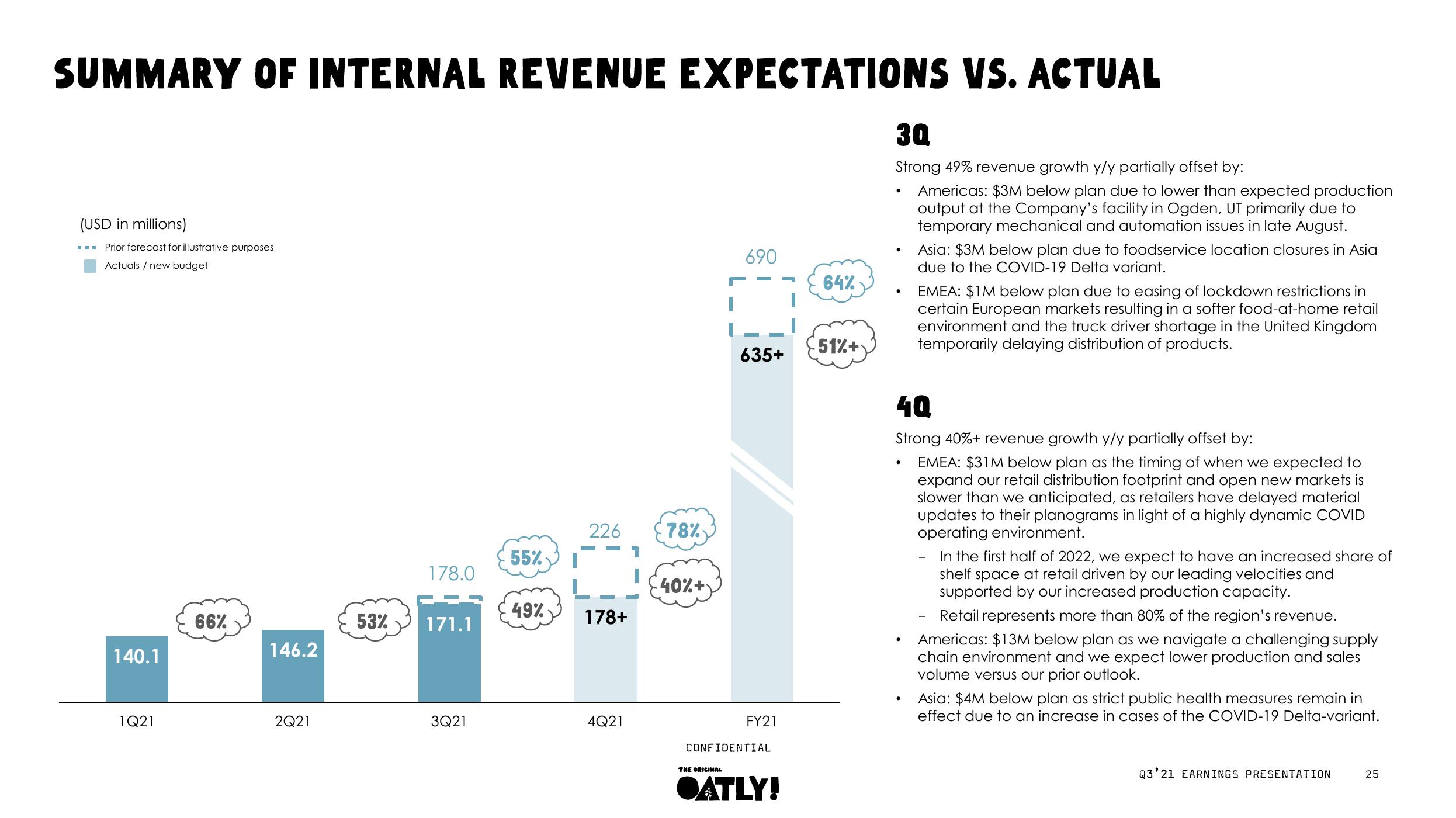

SUMMARY OF INTERNAL REVENUE EXPECTATIONS VS. ACTUAL

(USD in millions)

---

Prior forecast for illustrative purposes

Actuals / new budget

140.1

1Q21

66%

146.2

2Q21

53%

178.0

171.1

3Q21

55%

49%

226

178+

4Q21

78%

40%+

690

635+

FY21

CONFIDENTIAL

THE ORIGINAL

●ATLY!

64%

51%+

30

Strong 49% revenue growth y/y partially offset by:

Americas: $3M below plan due to lower than expected production

output at the Company's facility in Ogden, UT primarily due to

temporary mechanical and automation issues in late August.

●

●

●

Asia: $3M below plan due to foodservice location closures in Asia

due to the COVID-19 Delta variant.

40

Strong 40%+ revenue growth y/y partially offset by:

EMEA: $31M below plan as the timing of when we expected to

expand our retail distribution footprint and open new markets is

slower than we anticipated, as retailers have delayed material

updates to their planograms in light of a highly dynamic COVID

operating environment.

●

EMEA: $1M below plan due to easing of lockdown restrictions in

certain European markets resulting in a softer food-at-home retail

environment and the truck driver shortage in the United Kingdom

temporarily delaying distribution of products.

-

In the first half of 2022, we expect to have an increased share of

shelf space at retail driven by our leading velocities and

supported by our increased production capacity.

Retail represents more than 80% of the region's revenue.

Americas: $13M below plan as we navigate a challenging supply

chain environment and we expect lower production and sales

volume versus our prior outlook.

Asia: $4M below plan as strict public health measures remain in

effect due to an increase in cases of the COVID-19 Delta-variant.

Q3'21 EARNINGS PRESENTATION

25View entire presentation