J.P.Morgan Investment Banking Pitch Book

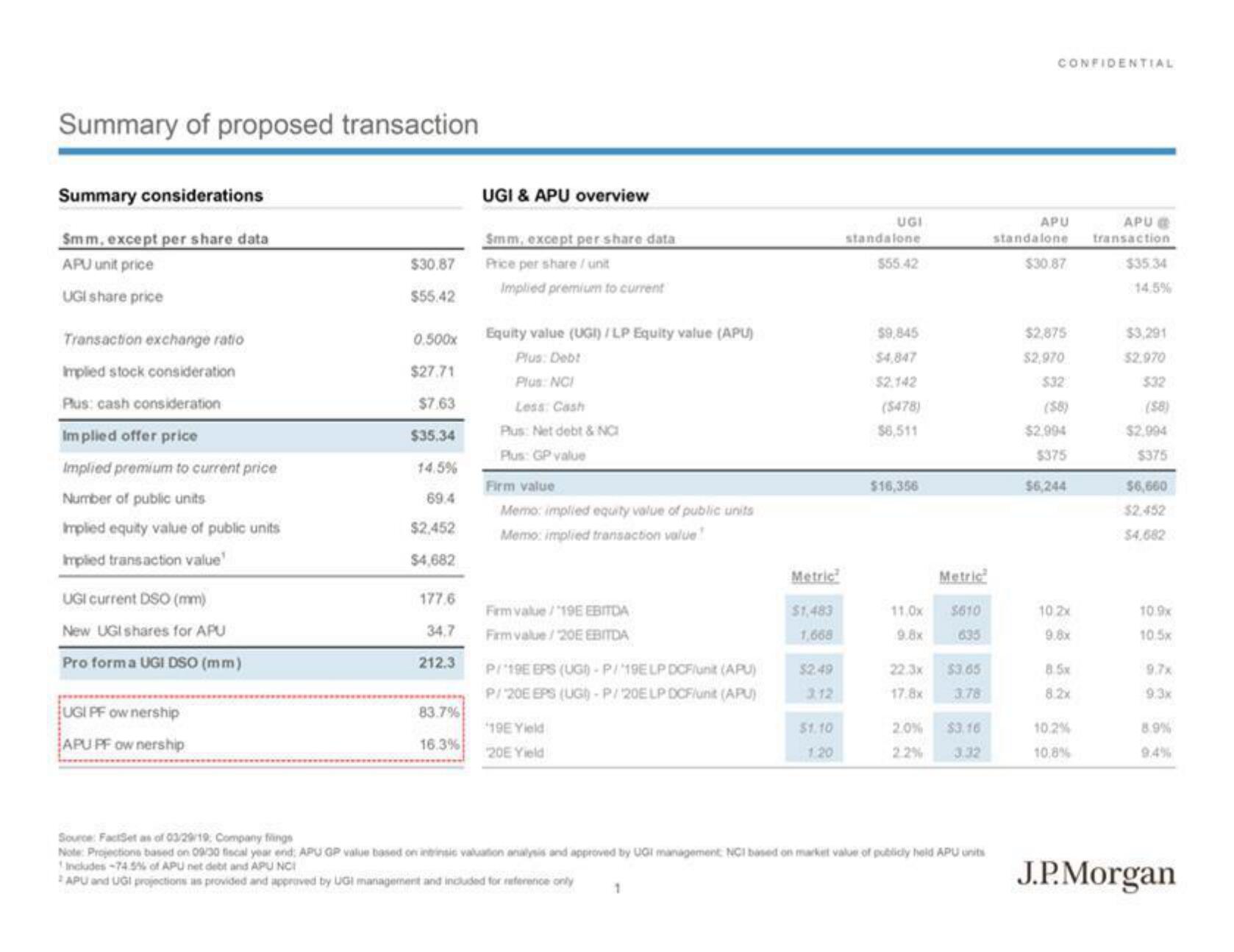

Summary of proposed transaction

Summary considerations

Smm, except per share data

APU unit price

UGI share price

Transaction exchange ratio

Implied stock consideration

Plus: cash consideration

Implied offer price

Implied premium to current price

Number of public units

Implied equity value of public units

Implied transaction value

UGI current DSO (mm)

New UGI shares for APU

Pro form a UGI DSO (mm)

UGI PF ownership

APU PF ownership

$30.87

$55.42

0.500x

$27.71

$7.63

$35.34

14.5%

69.4

$2,452

$4,682

177.6

34.7

212.3

83.7%

16.3%

UGI & APU overview

Smm, except per share data

Price per share/ unit

Implied premium to current

Equity value (UGI) /LP Equity value (APU)

Plus: Debt

Plus: NCI

Less: Cash

Plus: Net debt & NCI

Plus: GP value

Firm value

Memo: implied equity value of public units

Memo: implied transaction value

Firm value/19E EBITDA

Farm value/20E EBITDA

P/19E EPS (UGI) -P/19E LP DCF/unit (APU)

P/ 20E EPS (UG) - P/20ELP DCF/unit (APU)

19E Yield

20E Yield

Metric

1

$1,483

1,668

$2.49

3.12

$1.10

1.20

UGI

standalone

$55.42

$9,845

$4,847

$2.142

($478)

$6,511

$16,356

11.0x

9.8x

Metric

2.0%

2.2%

$610

635

22.3x

$3.65

17.8x 3.78

$3.16

3.32

Source: FactSet as of 03/29/19, Company filings

Note: Projections based on 09/30 fiscal year end; APU GP value based on intrinsic valuation analysis and approved by UGI management NCI based on market value of publicly held APU units

Includes -74.5% of APU net debt and APU NCI

APU and UGI projections as provided and approved by UGI management and included for reference only

CONFIDENTIAL

APU

standalone

$30.87

$2,875

$2,970

$32

(58)

$2.994

$375

$6,244

10,2x

9.8x

8.5x

8.2x

10.2%

10.8%

APU @

transaction

$35.34

14.5%

$3,291

$2.970

$32

($8)

$2.994

$375

$6,660

$2.452

$4.682

10.9x

103

9.7x

9.3x

8.9%

J.P.MorganView entire presentation