AstraZeneca Results Presentation Deck

Total Revenue ($m)

Q3 dynamics

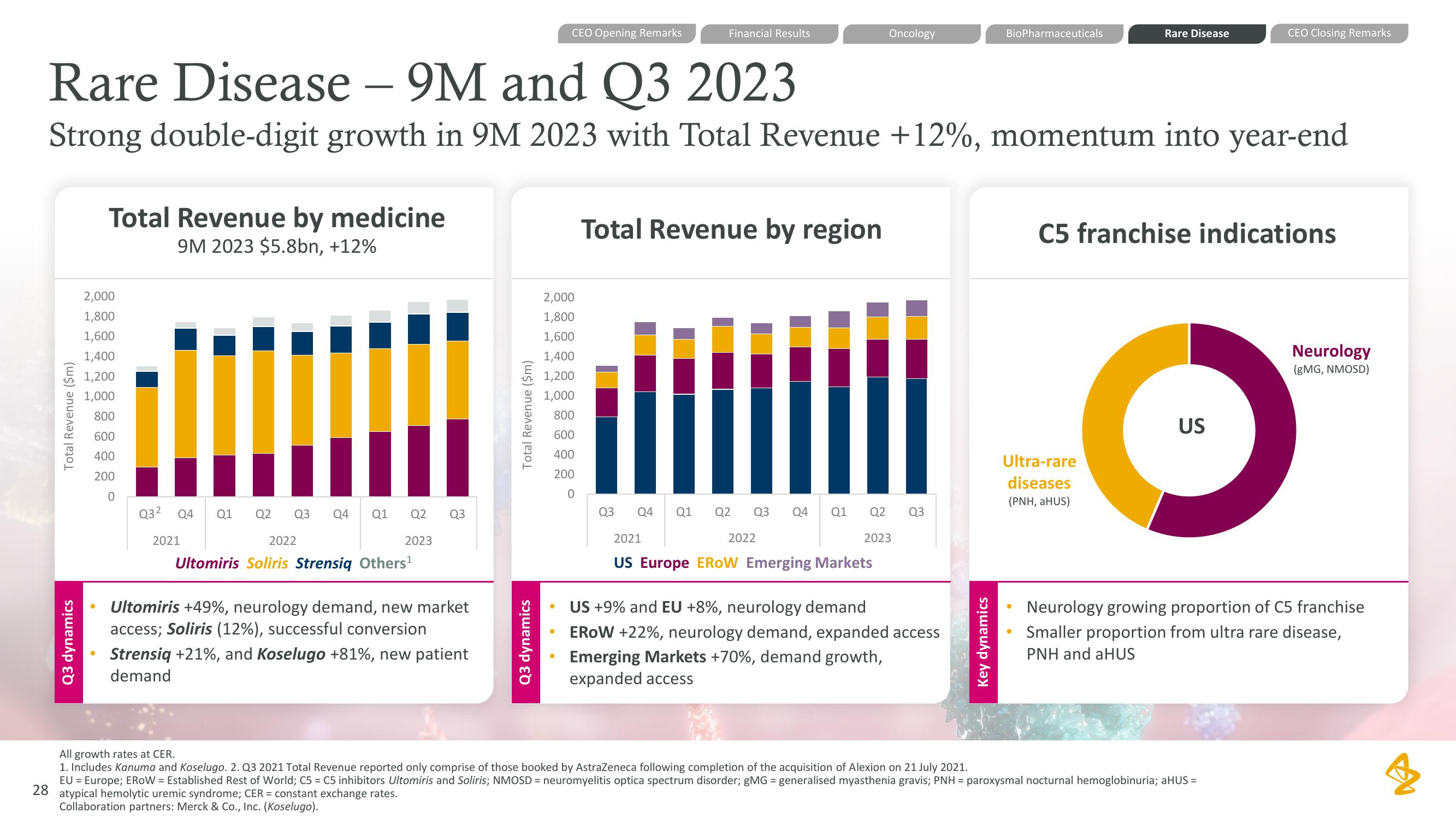

Total Revenue by medicine

9M 2023 $5.8bn, +12%

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Q3² Q4 Q1 Q2 Q3 Q4 Q1

Rare Disease - 9M and Q3 2023

Strong double-digit growth in 9M 2023 with Total Revenue +12%, momentum into year-end

2021

2022

Q2

2023

Ultomiris Soliris Strensiq Others¹

Q3.

Ultomiris +49%, neurology demand, new market

access; Soliris (12%), successful conversion

Strensiq +21%, and Koselugo +81%, new patient

demand

Total Revenue ($m)

CEO Opening Remarks

Q3 dynamics

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

Financial Results

Total Revenue by region

Q3

Oncology

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2021

US Europe EROW Emerging Markets

2022

2023

US +9% and EU +8%, neurology demand

EROW +22%, neurology demand, expanded access

Emerging Markets +70%, demand growth,

expanded access

BioPharmaceuticals

Key dynamics

Rare Disease

Ultra-rare

diseases

(PNH, aHUS)

C5 franchise indications

CEO Closing Remarks

US

All growth rates at CER.

1. Includes Kanuma and Koselugo. 2. Q3 2021 Total Revenue reported only comprise of those booked by AstraZeneca following completion of the acquisition of Alexion on 21 July 2021.

EU = Europe; EROW= Established Rest of World; C5 = C5 inhibitors Ultomiris and Soliris; NMOSD = neuromyelitis optica spectrum disorder; gMG = generalised myasthenia gravis; PNH = paroxysmal nocturnal hemoglobinuria; aHUS =

28

atypical hemolytic uremic syndrome; CER = constant exchange rates.

Collaboration partners: Merck & Co., Inc. (Koselugo).

Neurology

(gMG, NMOSD)

Neurology growing proportion of C5 franchise

Smaller proportion from ultra rare disease,

PNH and aHUSView entire presentation