Intertek Investor Conference Presentation Deck

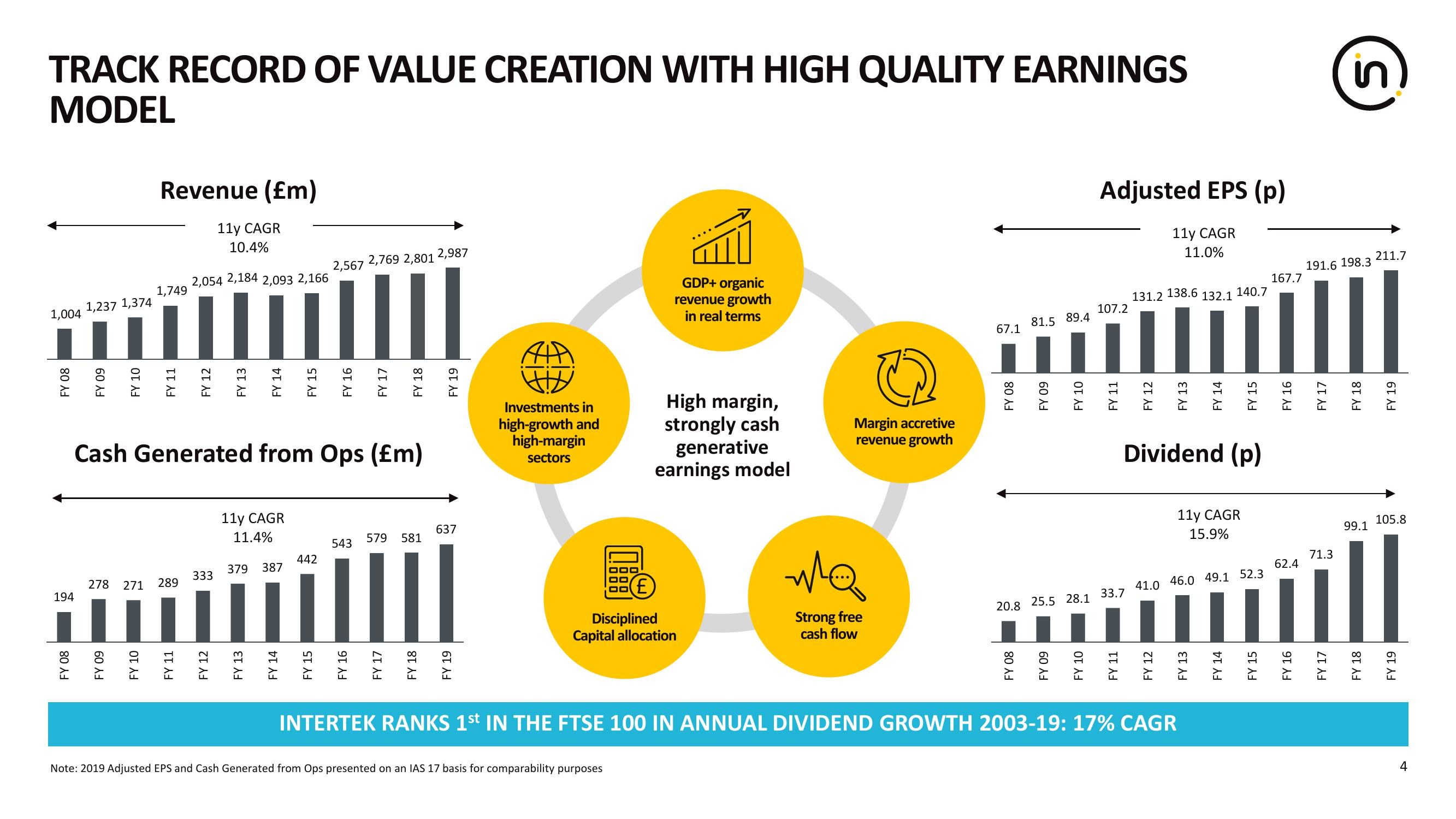

TRACK RECORD OF VALUE CREATION WITH HIGH QUALITY EARNINGS

MODEL

1,004

FY 08

194

FY 08

1,237

FY 09

1,374

FY 10

FY 09

278 271

Revenue (£m)

11y CAGR

10.4%

1,749

FY 11

2,567 2,769 2,801 2,987

2,054 2,184 2,093 2,166

11 IIII

289

FY 12

FY 13

333

FY 14

Cash Generated from Ops (£m)

11y CAGR

11.4%

379 387

FY 13

FY 15

FY 14

442

FY 16

FY 15

543

FY 17

FY 16

FY 18

579 581

FY 17

FY 18

FY 19

637

FY 19

APA

H

Investments in

high-growth and

high-margin

sectors

GDP+ organic

revenue growth

in real terms

High margin,

strongly cash

generative

earnings model

Disciplined

Capital allocation

Note: 2019 Adjusted EPS and Cash Generated from Ops presented on an IAS 17 basis for comparability purposes

Margin accretive

revenue growth

wa

Strong free

cash flow

67.1

FY 08

20.8

FY 08

81.5 89.4

FY 09

25.5

FY 09

FY 10

28.1

FY 10

Adjusted EPS (p)

11y CAGR

11.0%

107.2

138.6

132.1

140.7

....///

33.7

FY 11

131.2

FY 12

41.0

Dividend (p)

FY 12

FY 13

INTERTEK RANKS 1st IN THE FTSE 100 IN ANNUAL DIVIDEND GROWTH 2003-19: 17% CAGR

FY 14

11y CAGR

15.9%

46.0 49.1 52.3

FY 13

FY 15

FY 14

167.7

FY 15

FY 16

62.4

FY 16

191.6 198.3

FY 17

in

71.3

S

FY 17

FY 18

99.1

FY 18

211.7

FY 19

105.8

FY 19

4View entire presentation