MaxCyte Investor Presentation Deck

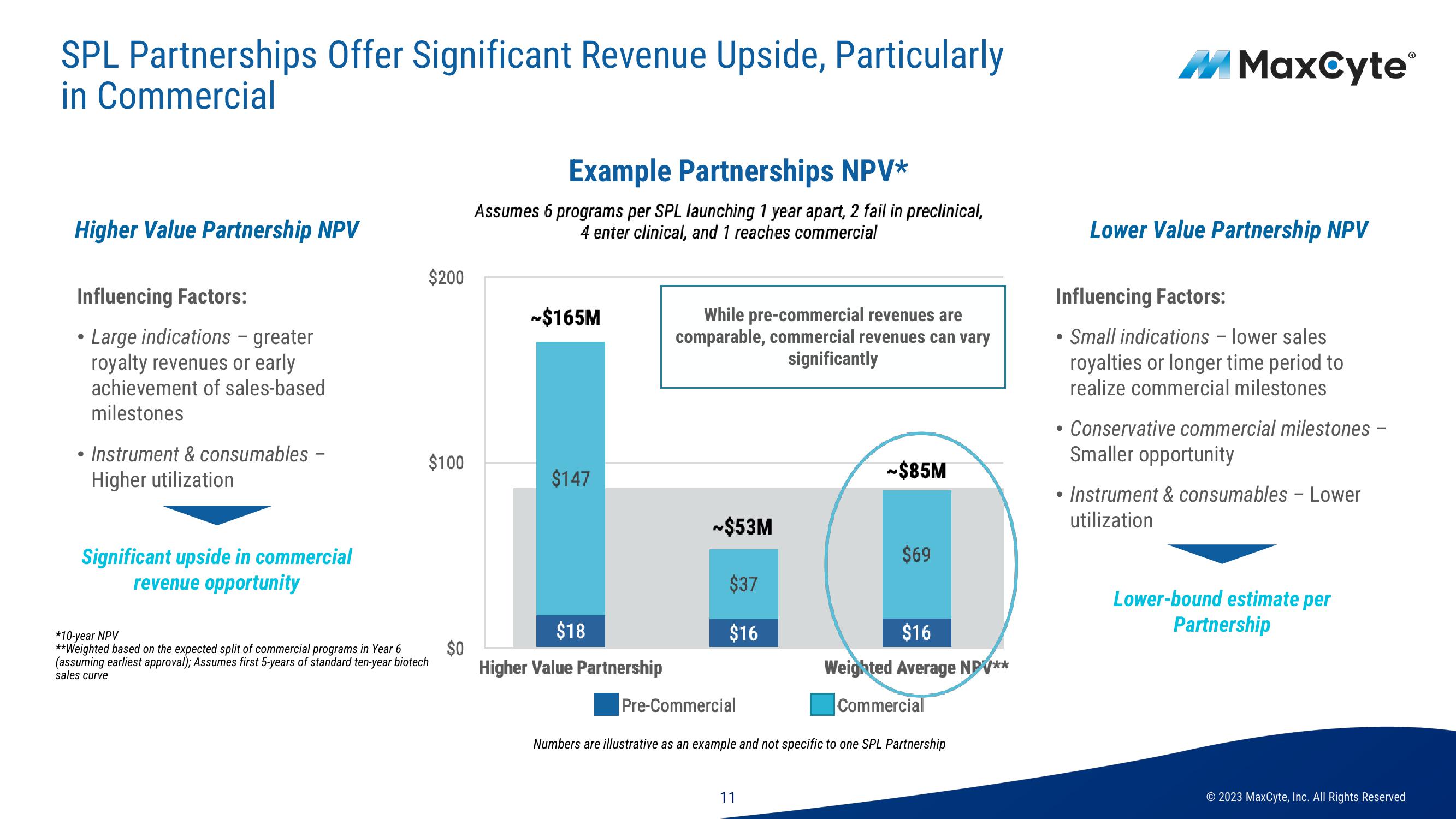

SPL Partnerships Offer Significant Revenue Upside, Particularly

in Commercial

Higher Value Partnership NPV

Influencing Factors:

• Large indications - greater

●

royalty revenues or early

achievement of sales-based

milestones

●

Instrument & consumables -

Higher utilization

Significant upside in commercial

revenue opportunity

$200

$100

*10-year NPV

**Weighted based on the expected split of commercial programs in Year 6

(assuming earliest approval); Assumes first 5-years of standard ten-year biotech

sales curve

$0

Example Partnerships NPV*

Assumes 6 programs per SPL launching 1 year apart, 2 fail in preclinical,

4 enter clinical, and 1 reaches commercial

~$165M

$147

$18

Higher Value Partnership

While pre-commercial revenues are

comparable, commercial revenues can vary

significantly

~$53M

$37

$16

~$85M

11

$69

$16

Weighted Average NPV**

Commercial

Pre-Commercial

Numbers are illustrative as an example and not specific to one SPL Partnership

M MaxCyte

Lower Value Partnership NPV

Influencing Factors:

Small indications - lower sales

royalties or longer time period to

realize commercial milestones

Conservative commercial milestones -

Smaller opportunity

• Instrument & consumables - Lower

utilization

Lower-bound estimate per

Partnership

© 2023 MaxCyte, Inc. All Rights ReservedView entire presentation