Bed Bath & Beyond Results Presentation Deck

Q3 PERFORMANCE HIGHLIGHTS & TRANSFORMATION UPDATE

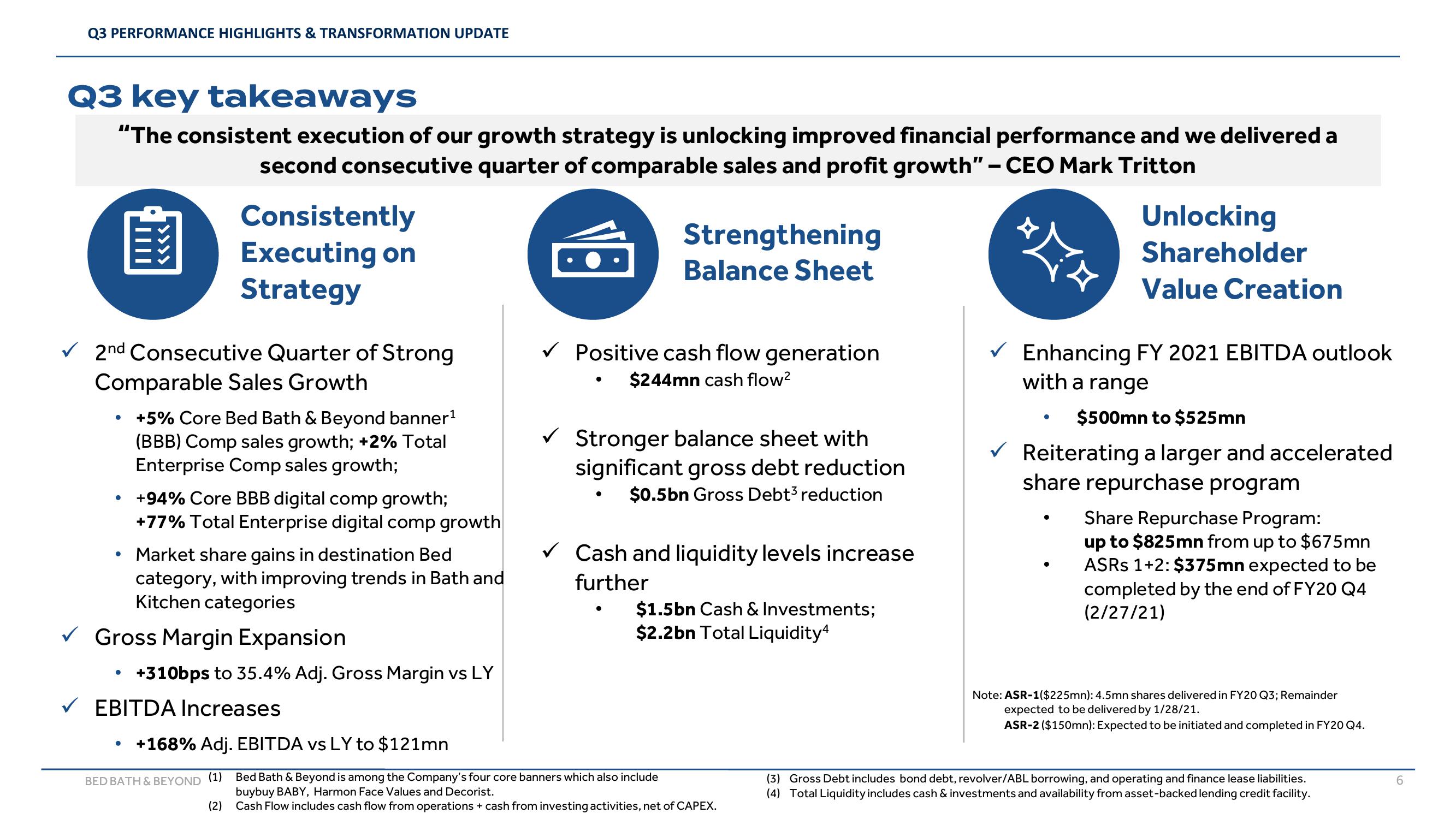

Q3 key takeaways

"The consistent execution of our growth strategy is unlocking improved financial performance and we delivered a

second consecutive quarter of comparable sales and profit growth" - CEO Mark Tritton

Consistently

Executing on

Strategy

2nd Consecutive Quarter of Strong

Comparable Sales Growth

●

+5% Core Bed Bath & Beyond banner¹

(BBB) Comp sales growth; +2% Total

Enterprise Comp sales growth;

+94% Core BBB digital comp growth;

+77% Total Enterprise digital comp growth

Market share gains in destination Bed

category, with improving trends in Bath and

Kitchen categories

✓ Gross Margin Expansion

+310bps to 35.4% Adj. Gross Margin vs LY

EBITDA Increases

• +168% Adj. EBITDA vs LY to $121mn

BED BATH & BEYOND (1)

(2)

Strengthening

Balance Sheet

✓ Positive cash flow generation

$244mn cash flow²

✓ Stronger balance sheet with

significant gross debt reduction

$0.5bn Gross Debt3 reduction

✓ Cash and liquidity levels increase

further

$1.5bn Cash & Investments;

$2.2bn Total Liquidity4

Bed Bath & Beyond is among the Company's four core banners which also include

buybuy BABY, Harmon Face Values and Decorist.

Cash Flow includes cash flow from operations + cash from investing activities, net of CAPEX.

¤×¤

Unlocking

Shareholder

Value Creation

✓Enhancing FY 2021 EBITDA outlook

with a range

$500mn to $525mn

✓ Reiterating a larger and accelerated

share repurchase program

Share Repurchase Program:

up to $825mn from up to $675mn

ASRs 1+2: $375mn expected to be

completed by the end of FY20 Q4

(2/27/21)

Note: ASR-1($225mn): 4.5mn shares delivered in FY20 Q3; Remainder

expected to be delivered by 1/28/21.

ASR-2 ($150mn): Expected to be initiated and completed in FY20 Q4.

(3) Gross Debt includes bond debt, revolver/ABL borrowing, and operating and finance lease liabilities.

(4) Total Liquidity includes cash & investments and availability from asset-backed lending credit facility.

6View entire presentation