Maersk Investor Presentation Deck

●

Key statements

Highlights for FY 2020

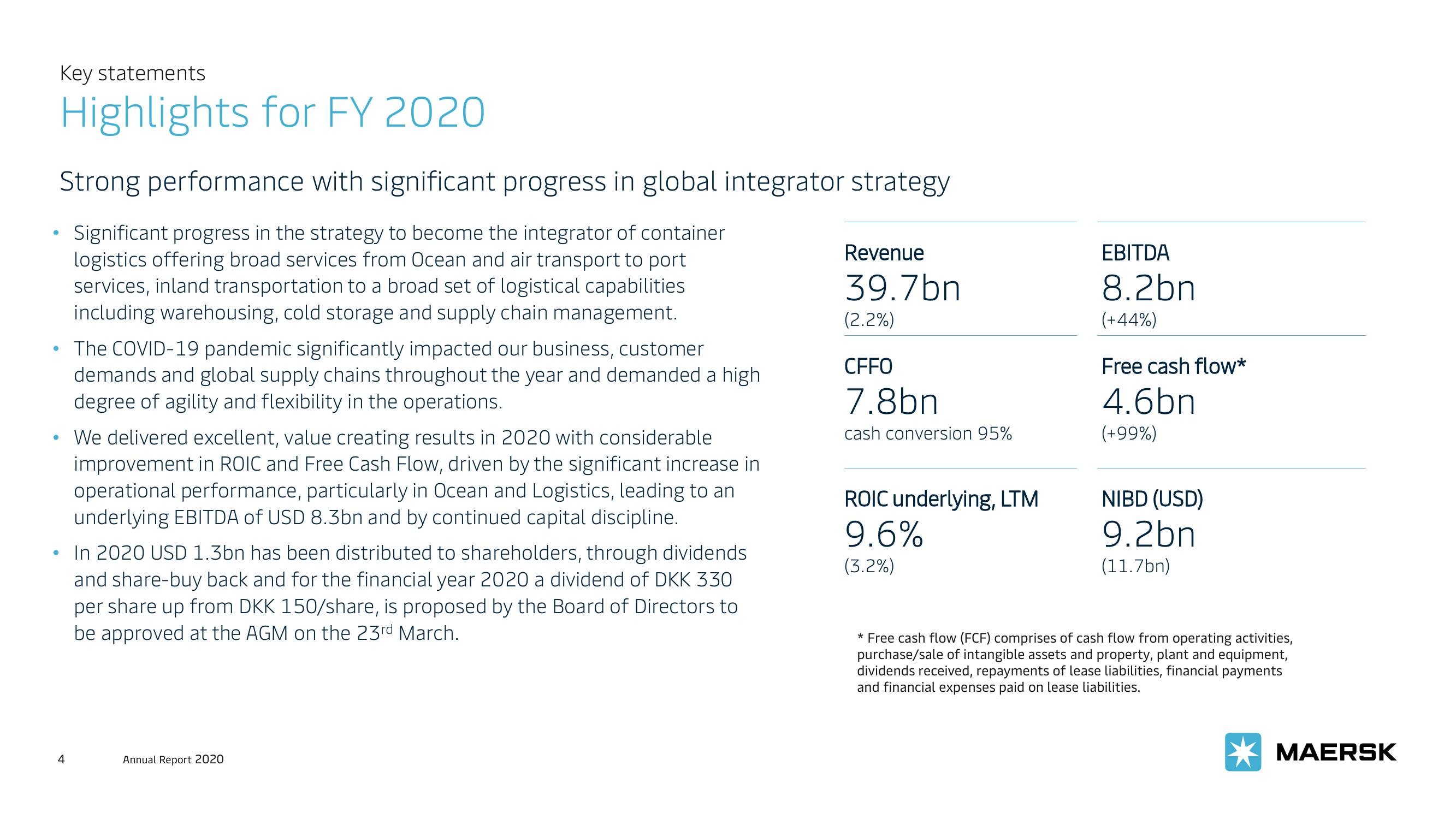

Strong performance with significant progress in global integrator strategy

Significant progress in the strategy to become the integrator of container

logistics offering broad services from Ocean and air transport to port

services, inland transportation to a broad set of logistical capabilities

including warehousing, cold storage and supply chain management.

4

The COVID-19 pandemic significantly impacted our business, customer

demands and global supply chains throughout the year and demanded a high

degree of agility and flexibility in the operations.

We delivered excellent, value creating results in 2020 with considerable

improvement in ROIC and Free Cash Flow, driven by the significant increase in

operational performance, particularly in Ocean and Logistics, leading to an

underlying EBITDA of USD 8.3bn and by continued capital discipline.

In 2020 USD 1.3bn has been distributed to shareholders, through dividends

and share-buy back and for the financial year 2020 a dividend of DKK 330

per share up from DKK 150/share, is proposed by the Board of Directors to

be approved at the AGM on the 23rd March.

Annual Report 2020

Revenue

39.7bn

(2.2%)

CFFO

7.8bn

cash conversion 95%

ROIC underlying, LTM

9.6%

(3.2%)

EBITDA

8.2bn

(+44%)

Free cash flow*

4.6bn

(+99%)

NIBD (USD)

9.2bn

(11.7bn)

* Free cash flow (FCF) comprises of cash flow from operating activities,

purchase/sale of intangible assets and property, plant and equipment,

dividends received, repayments of lease liabilities, financial payments

and financial expenses paid on lease liabilities.

MAERSKView entire presentation