The Urgent Need for Change and The Superior Path Forward

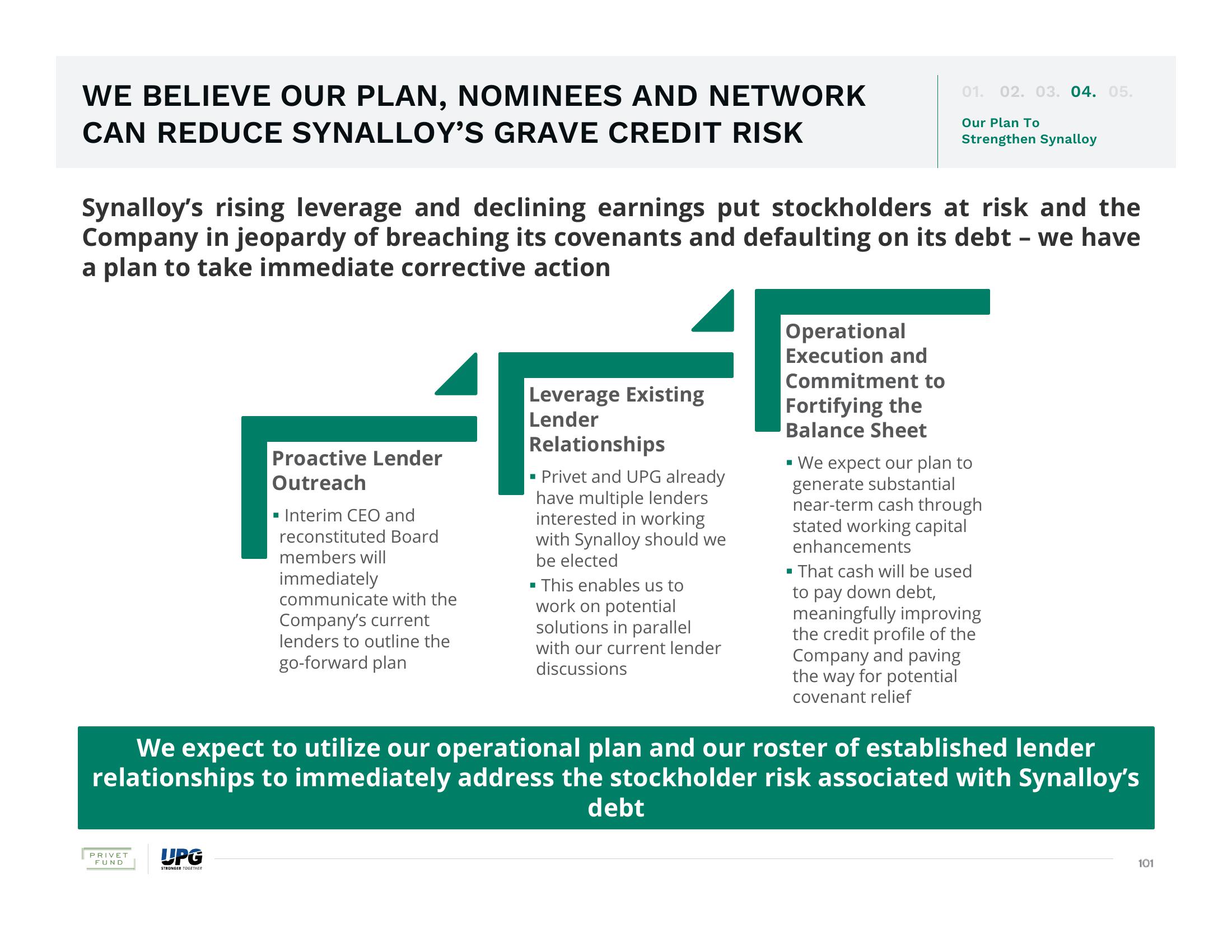

WE BELIEVE OUR PLAN, NOMINEES AND NETWORK

CAN REDUCE SYNALLOY'S GRAVE CREDIT RISK

Synalloy's rising leverage and declining earnings put stockholders at risk and the

Company in jeopardy of breaching its covenants and defaulting on its debt - we have

a plan to take immediate corrective action

PRIVET

FUND

Proactive Lender

Outreach

UPG

STRONGER TOGETHER

▪ Interim CEO and

reconstituted Board

members will

immediately

communicate with the

Company's current

lenders to outline the

go-forward plan

Leverage Existing

Lender

Relationships

Privet and UPG already

have multiple lenders

interested in working

with Synalloy should we

be elected

M

▪ This enables us to

work on potential

solutions in parallel

with our current lender

discussions

01. 02. 03. 04. 05.

Operational

Execution and

Commitment to

Fortifying the

Balance Sheet

Our Plan To

Strengthen Synalloy

We expect our plan to

generate substantial

near-term cash through

stated working capital

enhancements

We expect to utilize our operational plan and our roster of established lender

relationships to immediately address the stockholder risk associated with Synalloy's

debt

▪ That cash will be used

to pay down debt,

meaningfully improving

the credit profile of the

Company and paving

the way for potential

covenant relief

101View entire presentation