Clover Health SPAC Presentation Deck

Transaction Overview (Cont'd)

Pro forma enterprise value of $3.70B

$400M PIPE raised at $10.00 per share, including

$155M from IPOC sponsors

100% rollover by existing Clover management

Existing shareholders to receive super voting

shares (10:1) with sunset provisions

Over $733M of pro forma net cash held on balance

sheet

Completion of transaction is expected by 1021

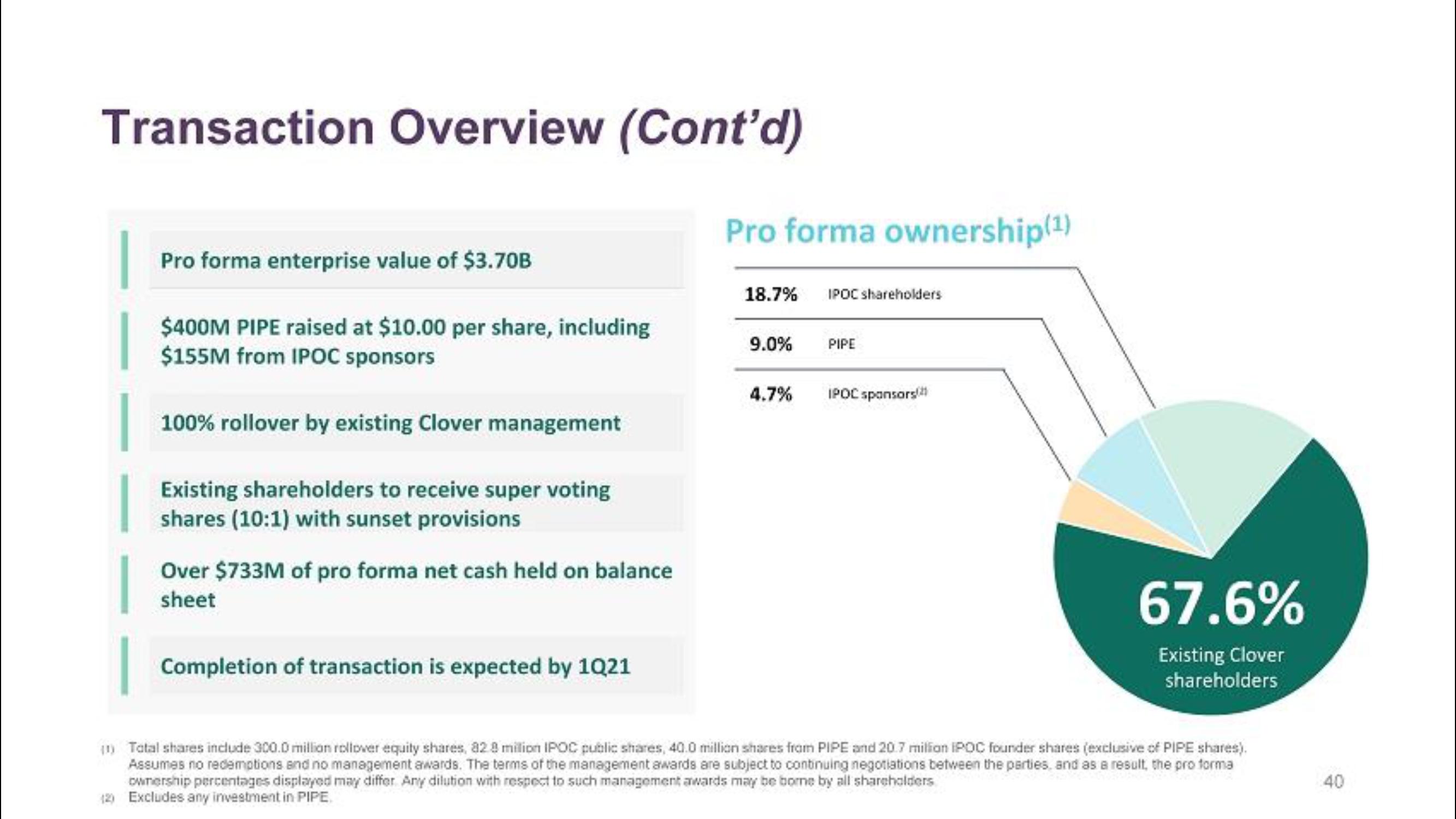

Pro forma ownership(¹)

18.7% IPOC shareholders

9.0%

4.7%

PIPE

IPOC sponsors

67.6%

Existing Clover

shareholders

Total shares include 300.0 million rollover equity shares, 82.8 million IPOC public shares, 40.0 million shares from PIPE and 20.7 milion IPOC founder shares (exclusive of PIPE shares).

Assumes no redemptions and no management awards. The terms of the management awards are subject to continuing negotiations between the parties, and as a result, the pro forma

ownership percentages displayed may differ. Any dilution with respect to such management awards may be bome by all shareholders

12) Excludes any investment in PIPE.

40View entire presentation