LionTree Investment Banking Pitch Book

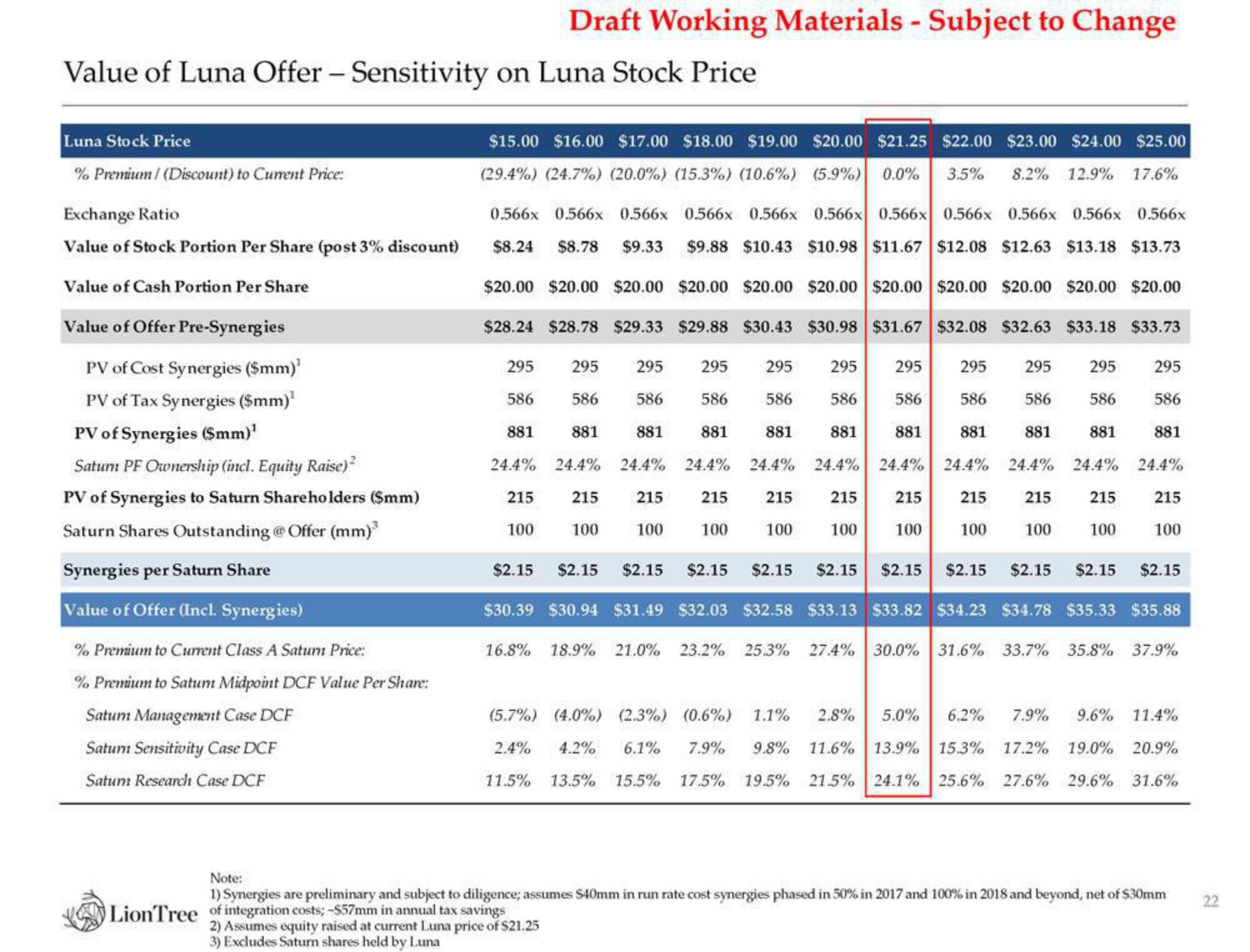

Value of Luna Offer - Sensitivity on Luna Stock Price

Luna Stock Price

% Premium/ (Discount) to Current Price:

Exchange Ratio

Value of Stock Portion Per Share (post 3% discount)

Value of Cash Portion Per Share

Value of Offer Pre-Synergies

PV of Cost Synergies ($mm)¹

PV of Tax Synergies ($mm)¹

PV of Synergies ($mm)¹

Saturn PF Ownership (incl. Equity Raise)²

PV of Synergies to Saturn Shareholders ($mm)

Saturn Shares Outstanding @Offer (mm)³

Synergies per Saturn Share

Value of Offer (Incl. Synergies)

% Premium to Current Class A Satum Price:

% Premium to Satum Midpoint DCF Value Per Share:

Satum Management Case DCF

Satum Sensitivity Case DCF

Satum Research Case DCF

$15.00 $16.00 $17.00 $18.00 $19.00 $20.00 $21.25 $22.00 $23.00 $24.00 $25.00

(29.4%) (24.7%) (20.0%) (15.3%) (10.6%) (5.9%) 0.0% 3.5% 8.2% 12.9% 17.6%

0.566x 0.566x 0.566x 0.566x 0.566x 0.566x 0.566x 0.566x 0.566x 0.566x 0.566x

$8.24 $8.78 $9.33 $9.88 $10.43 $10.98 $11.67 $12.08 $12.63 $13.18 $13.73

$20.00 $20.00 $20.00 $20.00 $20.00 $20.00 $20.00 $20.00 $20.00 $20.00 $20.00

$28.24 $28.78 $29.33 $29.88 $30.43 $30.98 $31.67 $32.08 $32.63 $33.18 $33.73

295

586

881

24.4%

Draft Working Materials - Subject to Change

215

100

16.8%

295

295 295

586

586

586

586

881

881

881

24.4% 24.4% 24.4% 24.4%

215

100

295

215

100

215

100

881

215

100

295

586

881

24.4%

215

100

$2.15

295 295 295

295

586

586

586

586

881

881

881

881

24.4% 24.4% 24.4% 24.4%

215

100

215

100

215

100

215

100

295

586

881

18.9% 21.0% 23.2% 25.3% 27.4% 30.0% 31.6% 33.7% 35.8%

24.4%

$2.15 $2.15 $2.15 $2.15

$2.15 $2.15 $2.15 $2.15 $2.15 $2.15

$30.39 $30.94 $31.49 $32.03 $32.58 $33.13 $33.82 $34.23 $34.78 $35.33 $35.88

37.9%

215

100

(5.7%) (4.0%) (2.3%) (0.6%) 1.1% 2.8% 5.0% 6,2% 7.9% 9.6% 11.4%

2.4% 4.2% 6.1% 7.9% 9.8% 11.6% 13.9% 15.3% 17.2% 19.0% 20.9%

11.5% 13.5% 15.5% 17.5% 19.5% 21.5% 24.1% 25.6% 27.6% 29.6% 31.6%

Note:

1) Synergies are preliminary and subject to diligence; assumes $40mm in run rate cost synergies phased in 50% in 2017 and 100% in 2018 and beyond, net of $30mm

LionTree of integration costs; -$57mm in annual tax savings

2) Assumes equity raised at current Luna price of $21.25

3) Excludes Saturn shares held by Luna

22View entire presentation