Netstreit IPO Presentation Deck

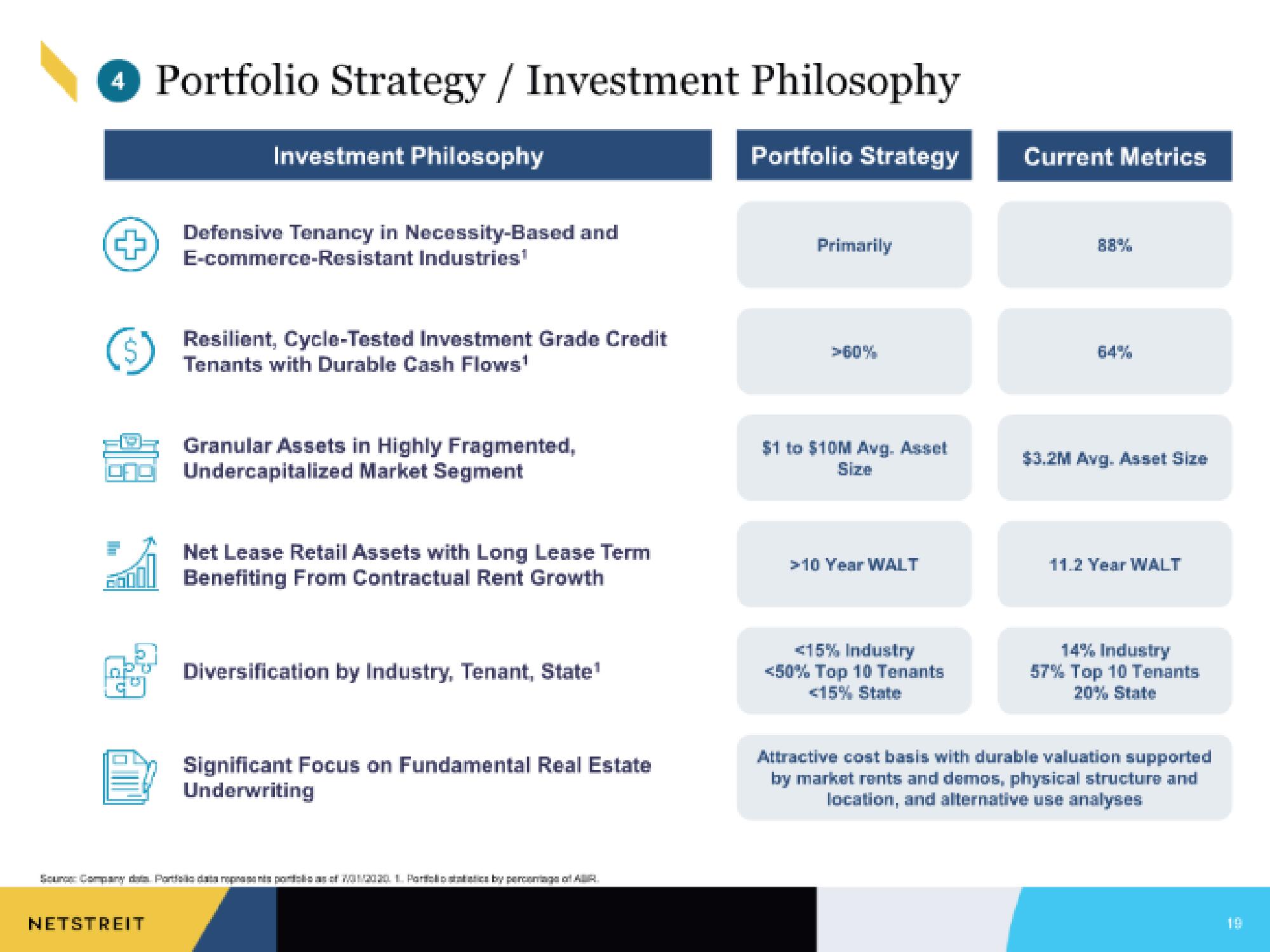

4 Portfolio Strategy / Investment Philosophy

S

Investment Philosophy

NETSTREIT

Defensive Tenancy in Necessity-Based and

E-commerce-Resistant Industries¹

Resilient, Cycle-Tested Investment Grade Credit

Tenants with Durable Cash Flows¹

Granular Assets in Highly Fragmented,

Undercapitalized Market Segment

Net Lease Retail Assets with Long Lease Term

Benefiting From Contractual Rent Growth

Diversification by Industry, Tenant, State¹

Significant Focus on Fundamental Real Estate

Underwriting

Sour Company data. Particia data represents portal of 12020, 1. Participatics by percorings of AR

Portfolio Strategy

Primarily

>60%

$1 to $10M Avg. Asset

Size

>10 Year WALT

<15% Industry

<50% Top 10 Tenants

<15% State

Current Metrics

88%

$3.2M Avg. Asset Size

11.2 Year WALT

14% Industry

57% Top 10 Tenants

20% State

Attractive cost basis with durable valuation supported

by market rents and demos, physical structure and

location, and alternative use analysesView entire presentation