Deutsche Bank Fixed Income Presentation Deck

Diversified deposit base

In € bn, unless stated otherwise

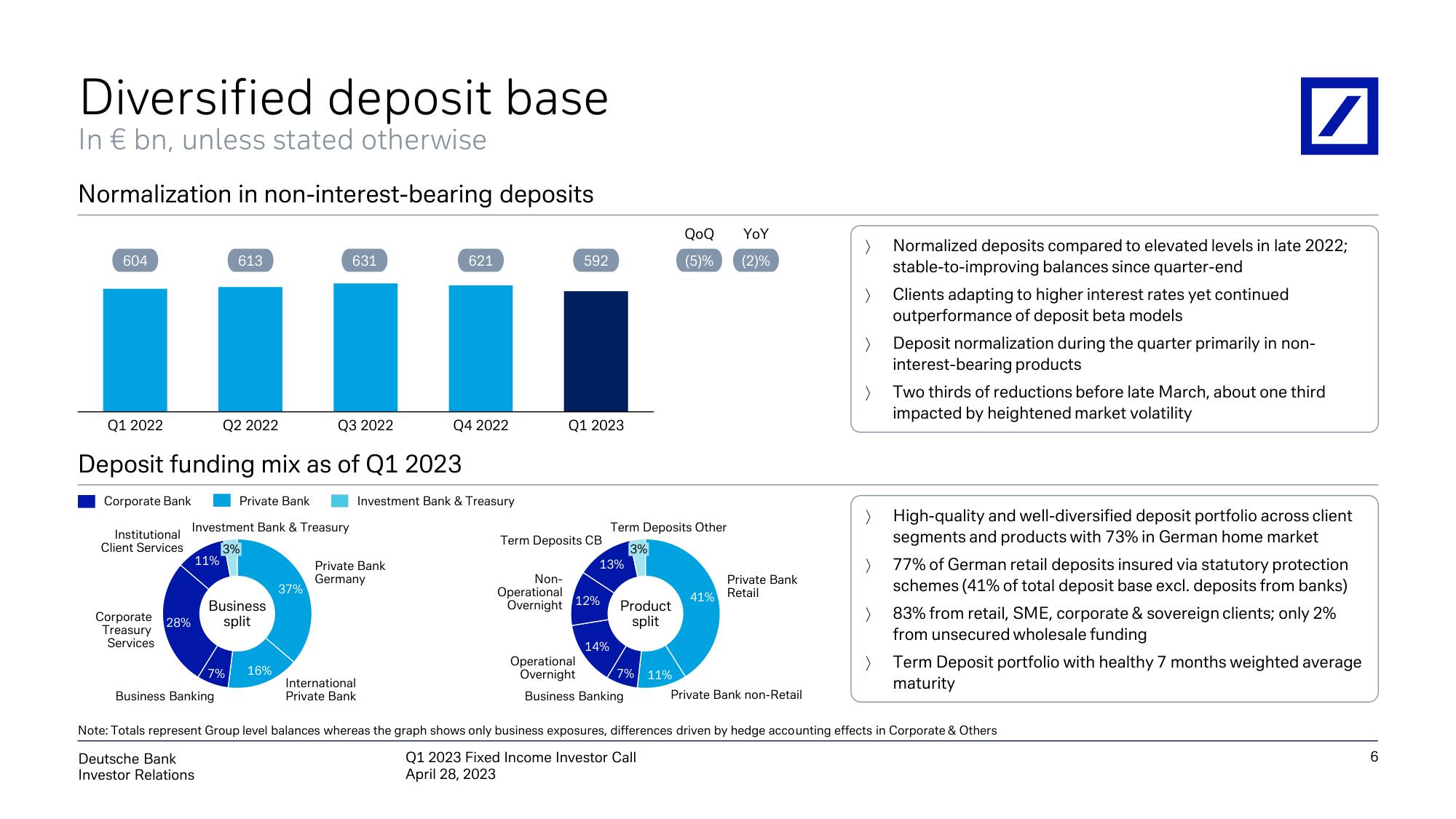

Normalization in non-interest-bearing deposits

604

Institutional

Client Services

Q1 2022

Q3 2022

Deposit funding mix as of Q1 2023

Corporate Bank

Corporate 28%

Treasury

Services

613

11%

Q2 2022

Private Bank

Investment Bank & Treasury

3%

Business

split

Business Banking

7% 16%

631

37%

Private Bank

Germany

International

Private Bank

621

Q4 2022

Investment Bank & Treasury

592

Q1 2023

Term Deposits CB

13%

Non-

Operational

Overnight 12%

14%

Term Deposits Other

3%

Product

split

Operational

Overnight

Business Banking

QoQ

(5)%

7% 11%

YoY

(2)%

Private Bank

41% Retail

Private Bank non-Retail

/

Normalized deposits compared to elevated levels in late 2022;

stable-to-improving balances since quarter-end

Clients adapting to higher interest rates yet continued

outperformance of deposit beta models

> Deposit normalization during the quarter primarily in non-

interest-bearing products

Two thirds of reductions before late March, about one third

impacted by heightened market volatility

High-quality and well-diversified deposit portfolio across client

segments and products with 73% in German home market

77% of German retail deposits insured via statutory protection

schemes (41% of total deposit base excl. deposits from banks)

83% from retail, SME, corporate & sovereign clients; only 2%

from unsecured wholesale funding

Term Deposit portfolio with healthy 7 months weighted average

maturity

Note: Totals represent Group level balances whereas the graph shows only business exposures, differences driven by hedge accounting effects in Corporate & Others

Deutsche Bank

Q1 2023 Fixed Income Investor Call

Investor Relations

April 28, 2023

6View entire presentation