Bank of America Investment Banking Pitch Book

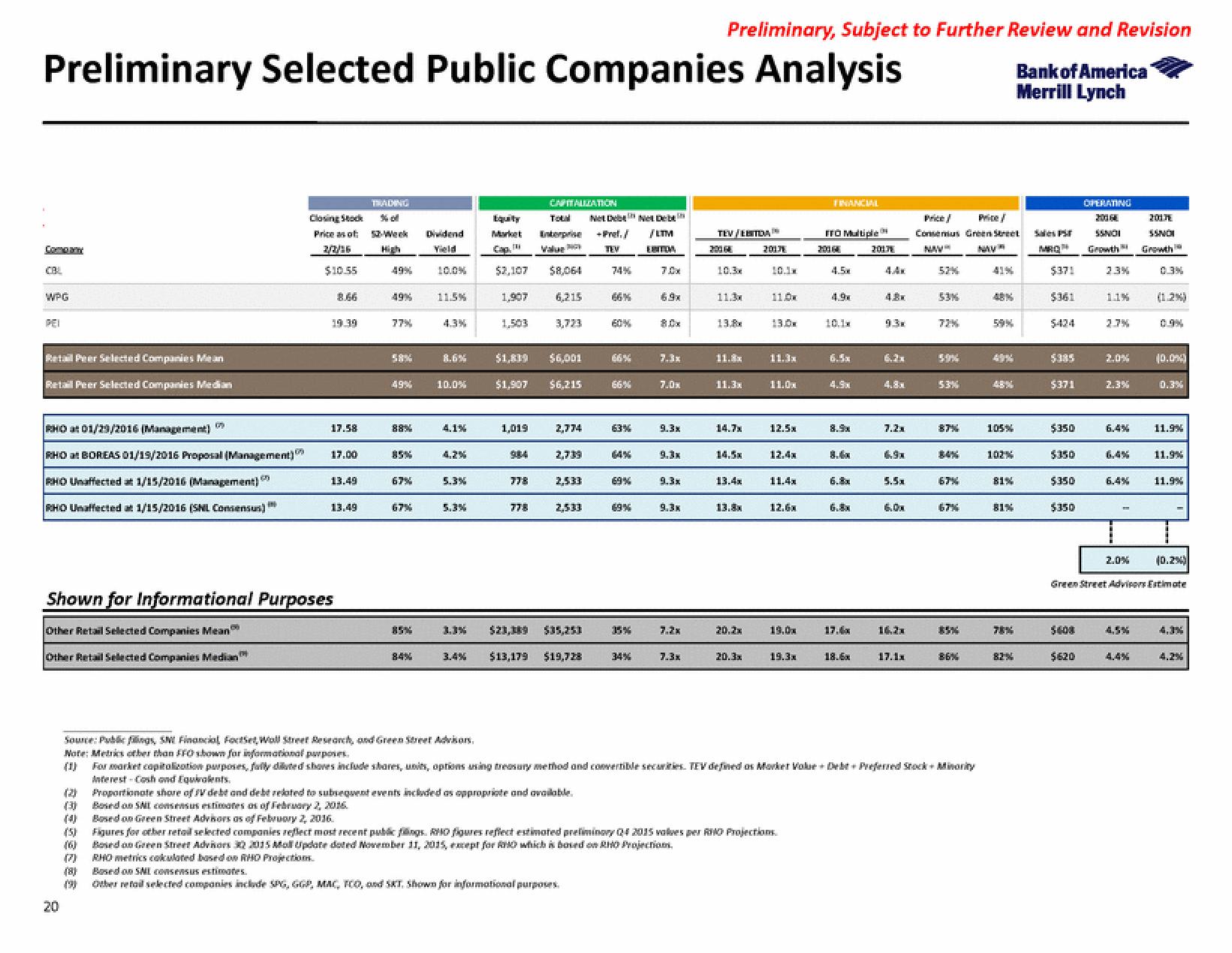

Preliminary Selected Public Companies Analysis

WPG

PEI

Retail Peer Selected Companies Mean

Retail Peer Selected Companies Median

RHO at 01/29/2016 (Management)

RHO at BOREAS 01/19/2016 Proposal (Management)

RHO Unaffected at 1/15/2016 (Management)

RHO Unaffected at 1/15/2016 (SNL Consensus)

20

8888888

Closing Stock

Price as of 52-Week

$10.55

19.39

(4)

17.58

17.00

Shown for Informational Purposes

Other Retail Selected Companies Mean

Other Retail Selected Companies edian

13.49

13.49

TRAINING

(3) Bosed on SAL consensus estimates os of February 2, 2016.

Based on Green Street Advisors as of February 2, 2016.

49%

49%

77%

49%

88%

67%

67%

85%

Dividend

Yield

11.5%

4.3%

8.6%

10.0%

4,2%

5.3%

1.3%

Lqualty

Market

$2,107

1,907

1,503

1,019

984

378

CAPITALIZATION

778

Tou

Enterprise

$1,839

$6,001

$1,907 $6,215

$8,064

6,215

3,723

2,774

2,739

2,533

2,533

$23,389 $35,253

$13,179 $19,728

Net DebNet Deb

+ Pref./ /LTM

TEV

ERITOA

74%

(8) Based on SNL consensus estimates.

Other retail selected companies include SPG, GGP, MAC, PCO, and SKT. Shown for informational purposes.

66%

63%

64%

69%

69%

15%

34%

7.0x

80x

7.0x

9.3x

9.3x

9.3x

7.2x

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

7.3x

TEV/EBITDA

30164

10.3x

11.3x

13.8

11.8x

11.3x

13.4x

13.8x

20.2x

20131

1.3x

10.1M

11.0x

14.7x 129

13.0x

11.3x

11.0x

12.4x

11.4x

12.6x

19.0x

19.3x

(5) Figures for other retail selected companies reflect most recent public fogs. RHO figures reflect estimated preliminary Q4 2015 volves per RO Projections

Based on Green Street Advisors 32 2015 Moll Update doted November 11, 2015, except for which is based on RHO Projections.

(7) RHO metrics colculated based on RHD Projection.

FINANCIAL

FFO Multiple

2014

4.5

4.9

10.1

4.5x

8.9x

6.8x

6.8x

17.4x

18.6x

20171

4.4.

4.8

7.2x

5.5x

6.0x

16.3x

Consemus Green Street

MW

NAV

53%

72%

59%

87%

Source: Public filings, SM Financial Foctet Wall Street Research, and Green Street Advisors.

Note: Metrics other than FFO shown for informational purposes.

(1) For market capitalization purposes, Jally diluted shoves include shares, units, options using treasury method and convertible securities. TEV defined as Market Volur + Debt+ Preferred Stock+ Minority

Interest-Cash and Equivalents.

(3) Proportionate shore of IV debe and debt related to subsequent events included as appropriate and available.

84%

67%

85%

86%

59%

49%

105%

102%

81%

78%

825

Sales Pr

MRO

$371

$361

$424

$371

$350

$350

$350

$350

OPERATING

20160

SSNOI

Growth

$620

2.3%

2.0%

2.3%

6.4%

6,4%

6.4%

2.0%

2017

SSNOI

Growth

0.3%

(1.2%)

(0.0%)

0.3%

11.9%

11.9%

11.9%

(0.2%)

Green Street Advisors Estimate

4.3%

4.2%View entire presentation