Repay SPAC

TriSource Acquisition

TriSource

Overview

Transaction

Details

Strategic

Rationale

■

■

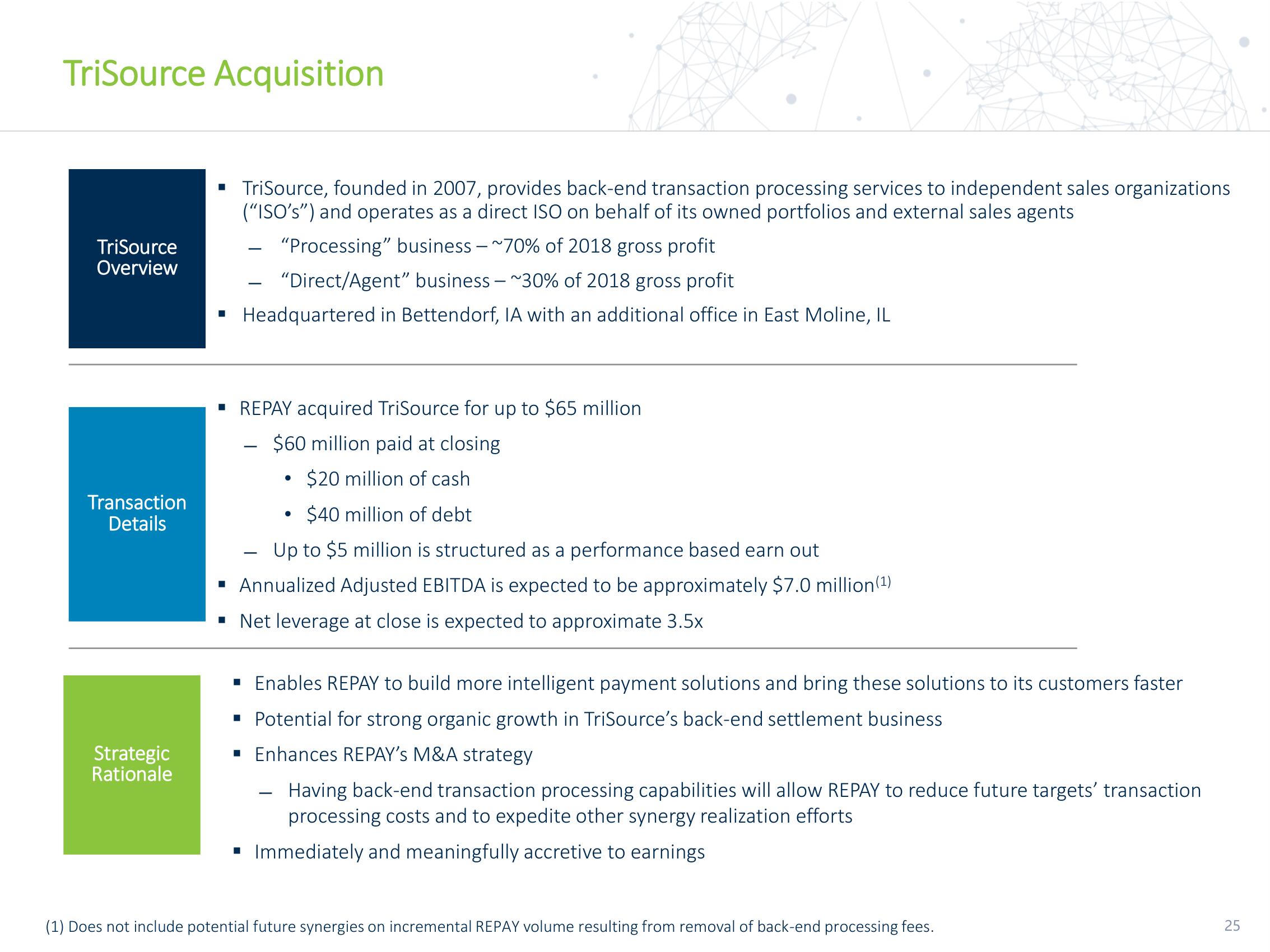

TriSource, founded in 2007, provides back-end transaction processing services to independent sales organizations

("ISO's") and operates as a direct ISO on behalf of its owned portfolios and external sales agents

"Processing" business -~70% of 2018 gross profit

"Direct/Agent" business - ~30% of 2018 gross profit

Headquartered in Bettendorf, IA with an additional office in East Moline, IL

▪ REPAY acquired TriSource for up to $65 million

$60 million paid at closing

$20 million of cash

-

●

Up to $5 million is structured as a performance based earn out

▪ Annualized Adjusted EBITDA is expected to be approximately $7.0 million (¹)

▪ Net leverage at close is expected to approximate 3.5x

• $40 million of debt

●

▪ Enables REPAY to build more intelligent payment solutions and bring these solutions to its customers faster

▪ Potential for strong organic growth in TriSource's back-end settlement business

▪ Enhances REPAY's M&A strategy

-

Having back-end transaction processing capabilities will allow REPAY to reduce future targets' transaction

processing costs and to expedite other synergy realization efforts

▪ Immediately and meaningfully accretive to earnings

(1) Does not include potential future synergies on incremental REPAY volume resulting from removal of back-end processing fees.

25View entire presentation