OSP Value Fund IV LP Q4 2022

OSP

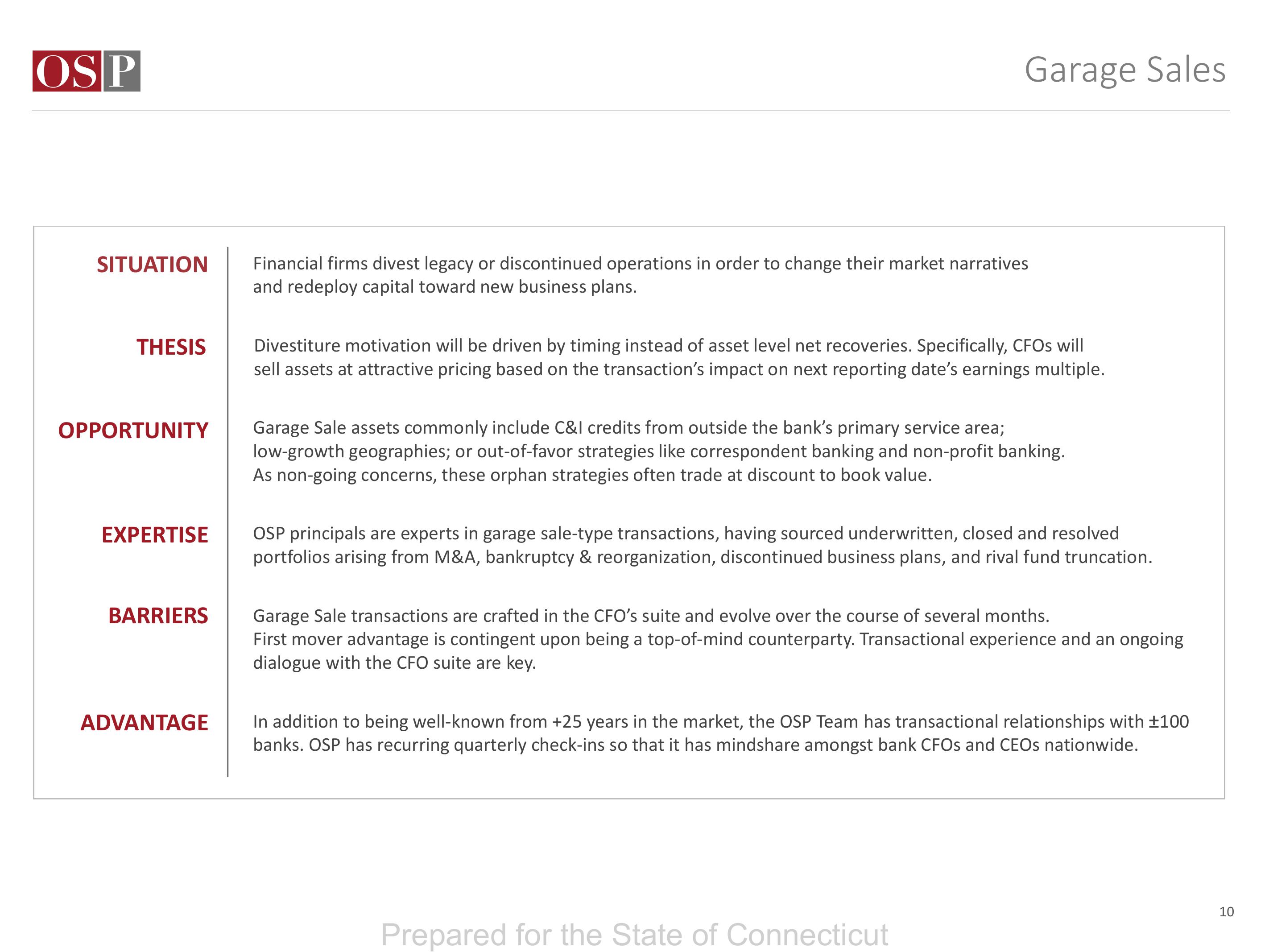

SITUATION

THESIS

OPPORTUNITY

EXPERTISE

BARRIERS

ADVANTAGE

Garage Sales

Financial firms divest legacy or discontinued operations in order to change their market narratives

and redeploy capital toward new business plans.

Divestiture motivation will be driven by timing instead of asset level net recoveries. Specifically, CFOs will

sell assets at attractive pricing based on the transaction's impact on next reporting date's earnings multiple.

Garage Sale assets commonly include C&I credits from outside the bank's primary service area;

low-growth geographies; or out-of-favor strategies like correspondent banking and non-profit banking.

As non-going concerns, these orphan strategies often trade at discount to book value.

OSP principals are experts in garage sale-type transactions, having sourced underwritten, closed and resolved

portfolios arising from M&A, bankruptcy & reorganization, discontinued business plans, and rival fund truncation.

Garage Sale transactions are crafted in the CFO's suite and evolve over the course of several months.

First mover advantage is contingent upon being a top-of-mind counterparty. Transactional experience and an ongoing

dialogue with the CFO suite are key.

In addition to being well-known from +25 years in the market, the OSP Team has transactional relationships with ±100

banks. OSP has recurring quarterly check-ins so that it has mindshare amongst bank CFOs and CEOs nationwide.

Prepared for the State of Connecticut

10View entire presentation