A Leading Provider of Cannabis Capital

Financial Overview

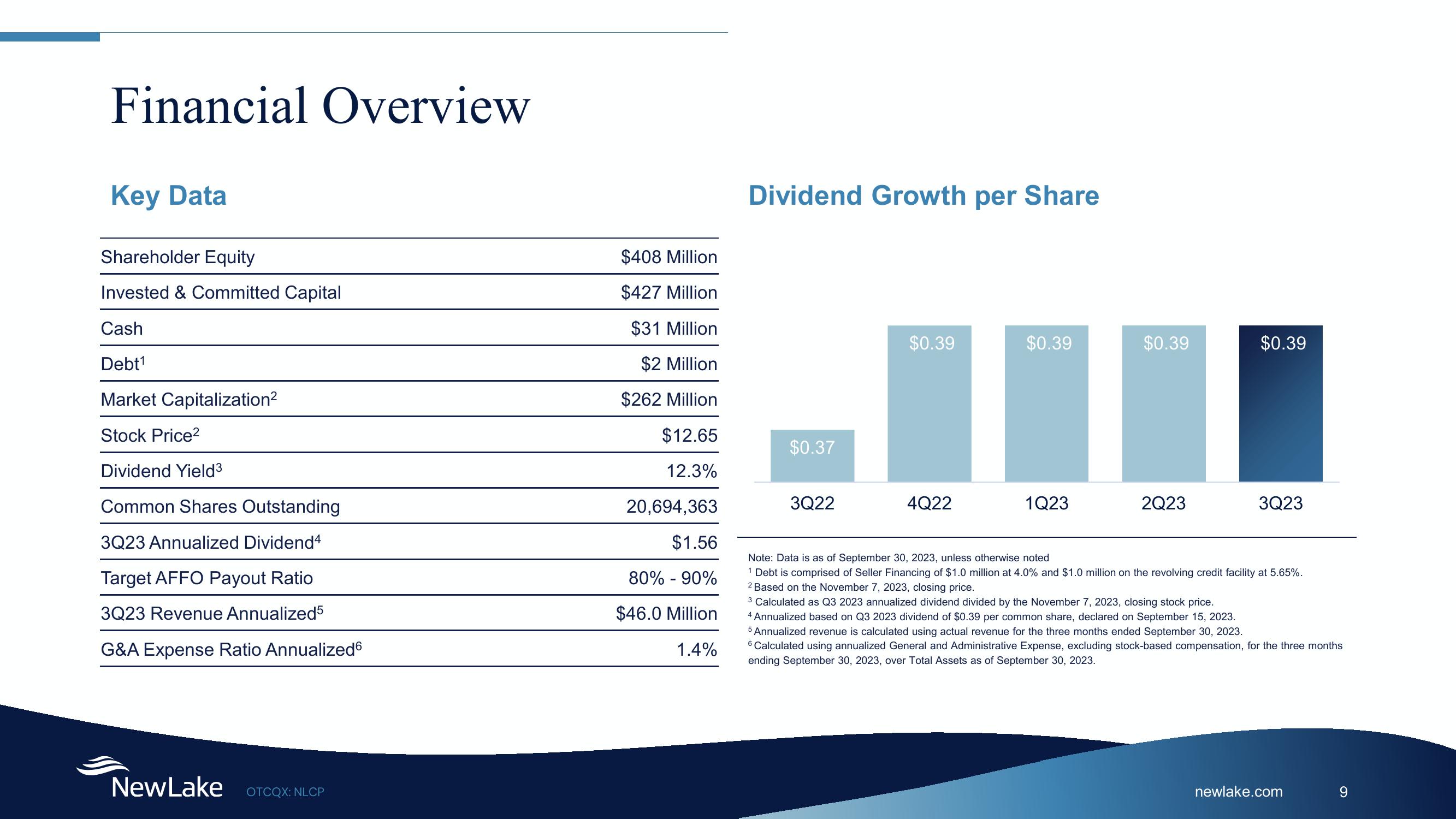

Key Data

Shareholder Equity

Invested & Committed Capital

Cash

Debt¹

Market Capitalization²

Stock Price²

Dividend Yield³

Common Shares Outstanding

3Q23 Annualized Dividend4

Target AFFO Payout Ratio

3Q23 Revenue Annualized5

G&A Expense Ratio Annualized6

New Lake

OTCQX: NLCP

$408 Million

$427 Million

$31 Million

$2 Million

$262 Million

$12.65

12.3%

20,694,363

$1.56

80% - 90%

$46.0 Million

1.4%

Dividend Growth per Share

$0.37

3Q22

$0.39

4Q22

$0.39

1Q23

$0.39

2Q23

$0.39

3 Calculated as Q3 2023 annualized dividend divided by the November 7, 2023, closing stock price.

4 Annualized based on Q3 2023 dividend of $0.39 per common share, declared on September 15, 2023.

3Q23

Note: Data is as of September 30, 2023, unless otherwise noted

1 Debt is comprised of Seller Financing of $1.0 million at 4.0% and $1.0 million on the revolving credit facility at 5.65%.

2 Based on the November 7, 2023, closing price.

5 Annualized revenue is calculated using actual revenue for the three months ended September 30, 2023.

6 Calculated using annualized General and Administrative Expense, excluding stock-based compensation, for the three months

ending September 30, 2023, over Total Assets as of September 30, 2023.

newlake.com

9View entire presentation