Blackwells Capital Activist Presentation Deck

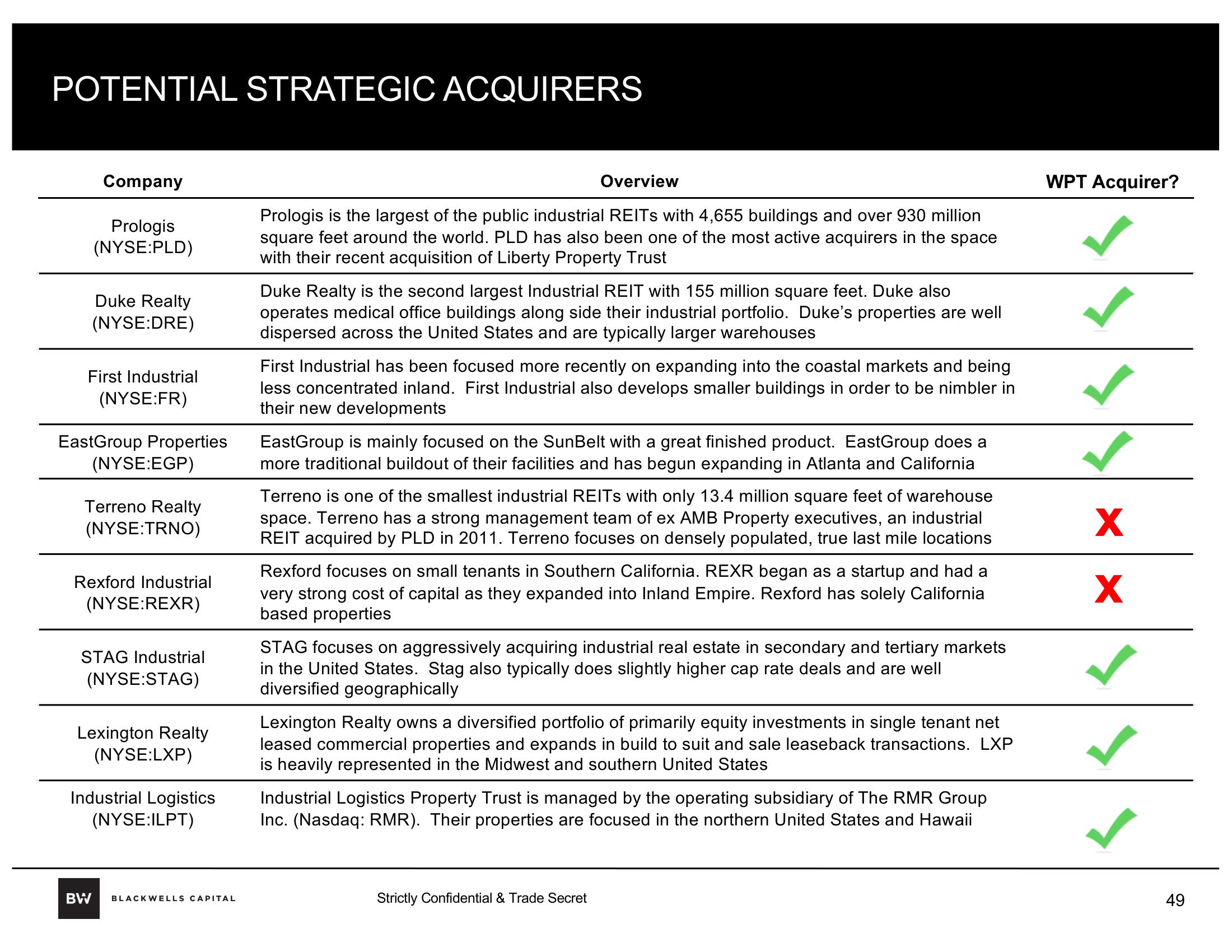

POTENTIAL STRATEGIC ACQUIRERS

Company

Prologis

(NYSE:PLD)

Duke Realty

(NYSE:DRE)

First Industrial

(NYSE:FR)

East Group Properties

(NYSE:EGP)

Terreno Realty

(NYSE:TRNO)

Rexford Industrial

(NYSE:REXR)

STAG Industrial

(NYSE:STAG)

Lexington Realty

(NYSE:LXP)

BW

Industrial Logistics

(NYSE:ILPT)

BLACKWELLS CAPITAL

Overview

Prologis is the largest of the public industrial REITs with 4,655 buildings and over 930 million

square feet around the world. PLD has also been one of the most active acquirers in the space

with their recent acquisition of Liberty Property Trust

Duke Realty is the second largest Industrial REIT with 155 million square feet. Duke also

operates medical office buildings along side their industrial portfolio. Duke's properties are well

dispersed across the United States and are typically larger warehouses

First Industrial has been focused more recently on expanding into the coastal markets and being

less concentrated inland. First Industrial also develops smaller buildings in order to be nimbler in

their new developments

EastGroup is mainly focused on the SunBelt with a great finished product. EastGroup does a

more traditional buildout of their facilities and has begun expanding in Atlanta and California

Terreno is one of the smallest industrial REITs with only 13.4 million square feet of warehouse

space. Terreno has a strong management team of ex AMB Property executives, an industrial

REIT acquired by PLD in 2011. Terreno focuses on densely populated, true last mile locations

Rexford focuses on small tenants in Southern California. REXR began as a startup and had a

very strong cost of capital as they expanded into Inland Empire. Rexford has solely California

based properties

STAG focuses on aggressively acquiring industrial real estate in secondary and tertiary markets

in the United States. Stag also typically does slightly higher cap rate deals and are well

diversified geographically

Lexington Realty owns a diversified portfolio of primarily equity investments in single tenant net

leased commercial properties and expands in build to suit and sale leaseback transactions. LXP

is heavily represented in the Midwest and southern United States

Industrial Logistics Property Trust is managed by the operating subsidiary of The RMR Group

Inc. (Nasdaq: RMR). Their properties are focused in the northern United States and Hawaii

Strictly Confidential & Trade Secret

WPT Acquirer?

X

X

49View entire presentation