HSBC Investor Event Presentation Deck

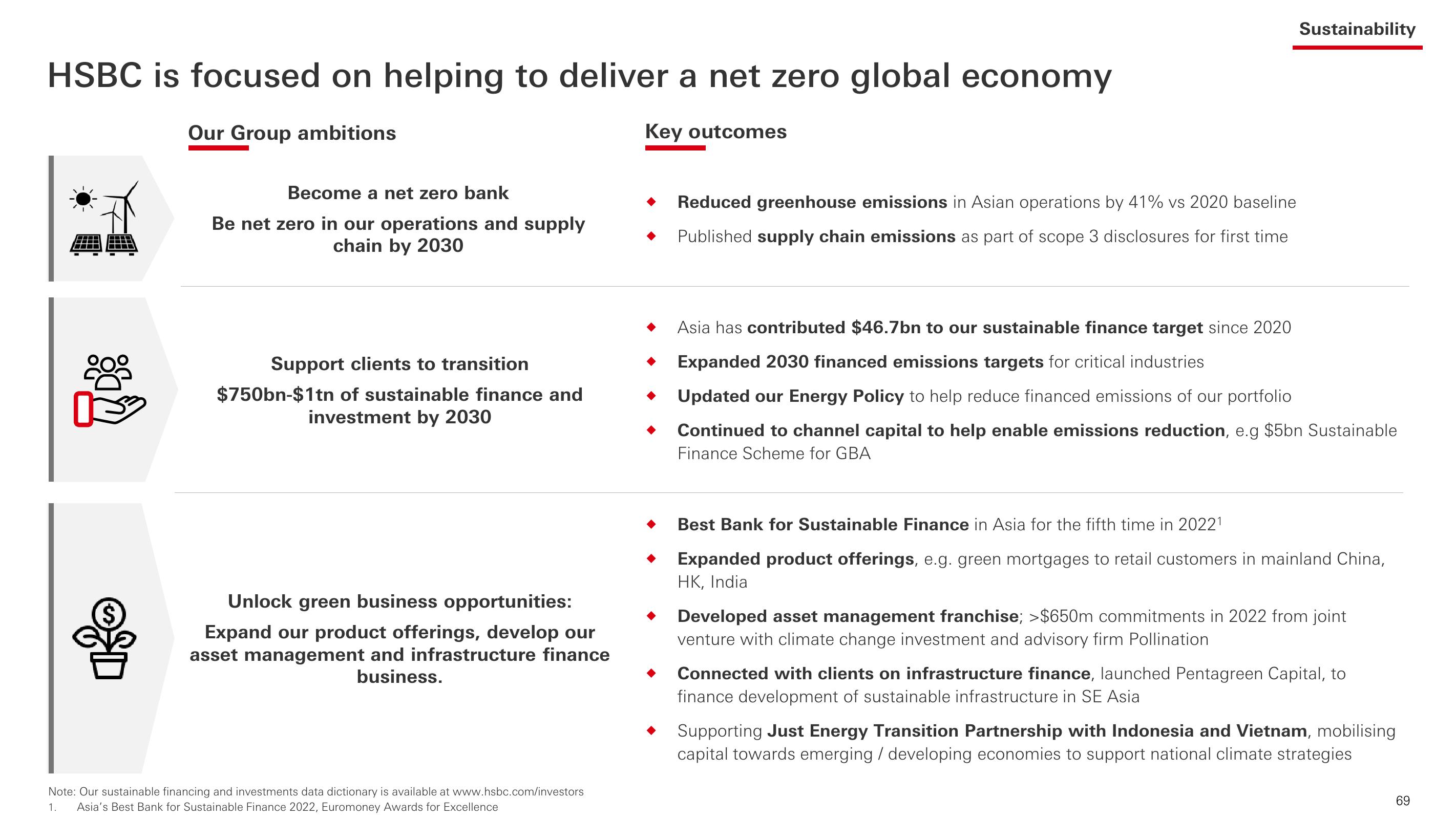

HSBC is focused on helping to deliver a net zero global economy

Our Group ambitions

Key outcomes

BA

想

&

Become a net zero bank

Be net zero in our operations and supply

chain by 2030

Support clients to transition

$750bn-$1tn of sustainable finance and

investment by 2030

Unlock green business opportunities:

Expand our product offerings, develop our

asset management and infrastructure finance

business.

Note: Our sustainable financing and investments data dictionary is available at www.hsbc.com/investors

1. Asia's Best Bank for Sustainable Finance 2022, Euromoney Awards for Excellence

◆

♦

•

Reduced greenhouse emissions in Asian operations by 41% vs 2020 baseline

Published supply chain emissions as part of scope 3 disclosures for first time

Sustainability

Asia has contributed $46.7bn to our sustainable finance target since 2020

Expanded 2030 financed emissions targets for critical industries

Updated our Energy Policy to help reduce financed emissions of our portfolio

Continued to channel capital to help enable emissions reduction, e.g $5bn Sustainable

Finance Scheme for GBA

Best Bank for Sustainable Finance in Asia for the fifth time in 2022¹

Expanded product offerings, e.g. green mortgages to retail customers in mainland China,

HK, India

Developed asset management franchise; >$650m commitments in 2022 from joint

venture with climate change investment and advisory firm Pollination

Connected with clients on infrastructure finance, launched Pentagreen Capital, to

finance development of sustainable infrastructure in SE Asia

Supporting Just Energy Transition Partnership with Indonesia and Vietnam, mobilising

capital towards emerging / developing economies to support national climate strategies

69View entire presentation