J.P.Morgan Investment Banking Pitch Book

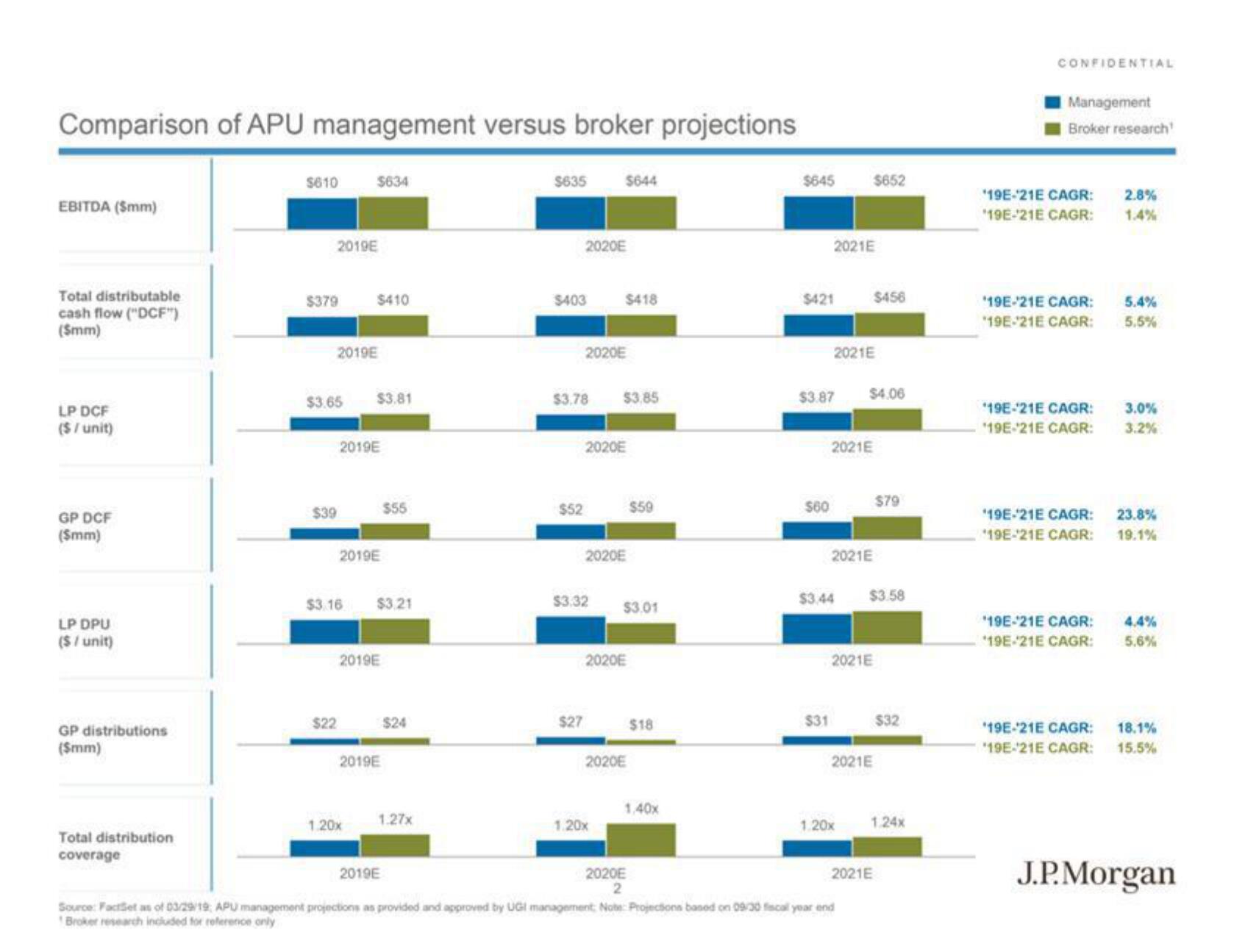

Comparison of APU management versus broker projections

EBITDA (5mm)

Total distributable

cash flow ("DCF")

(Smm)

LP DCF

($ / unit)

GP DCF

($mm)

LP DPU

($ / unit)

GP distributions

($mm)

Total distribution

coverage

$610

2019E

$379

2019E

$39

$634

$3.65 $3.81

$22

$410

$3.16

2019E

2019E

1.20x

2019E

$3.21

2019E

$55

2019E

$24

1.27x

$635

2020E

$403 $418

$3.78

2020E

$52

$27

$644

$3.32

2020E

$3,85

2020E

1.20x

2020E

$3.01

2020E

$59

2020E

2

$18

1,40x

$645

$421 $456

$60

2021E

$3.87

$31

2021E

2021E

$3.44

2021E

$4.06

$652

2021E

1.20x

2021E

Source: FactSet as of 03/29/19; APU management projections as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end

Broker research included for reference only

$3.58

2021E

$79

$32

1248

CONFIDENTIAL

Management

Broker research

'19E-21E CAGR:

*19E-¹21E CAGR:

19E-21E CAGR:

19E-21E CAGR:

19E-21E CAGR:

19E-21E CAGR:

'19E-21E CAGR:

19E-21E CAGR:

19E-21E CAGR:

19E-21E CAGR:

'19E-21E CAGR:

19E-21E CAGR:

2.8%

1.4%

5.4%

5.5%

3.0%

3.2%

23.8%

19.1%

4.4%

5.6%

18.1%

15.5%

J.P.MorganView entire presentation