Apollo Global Management Investor Day Presentation Deck

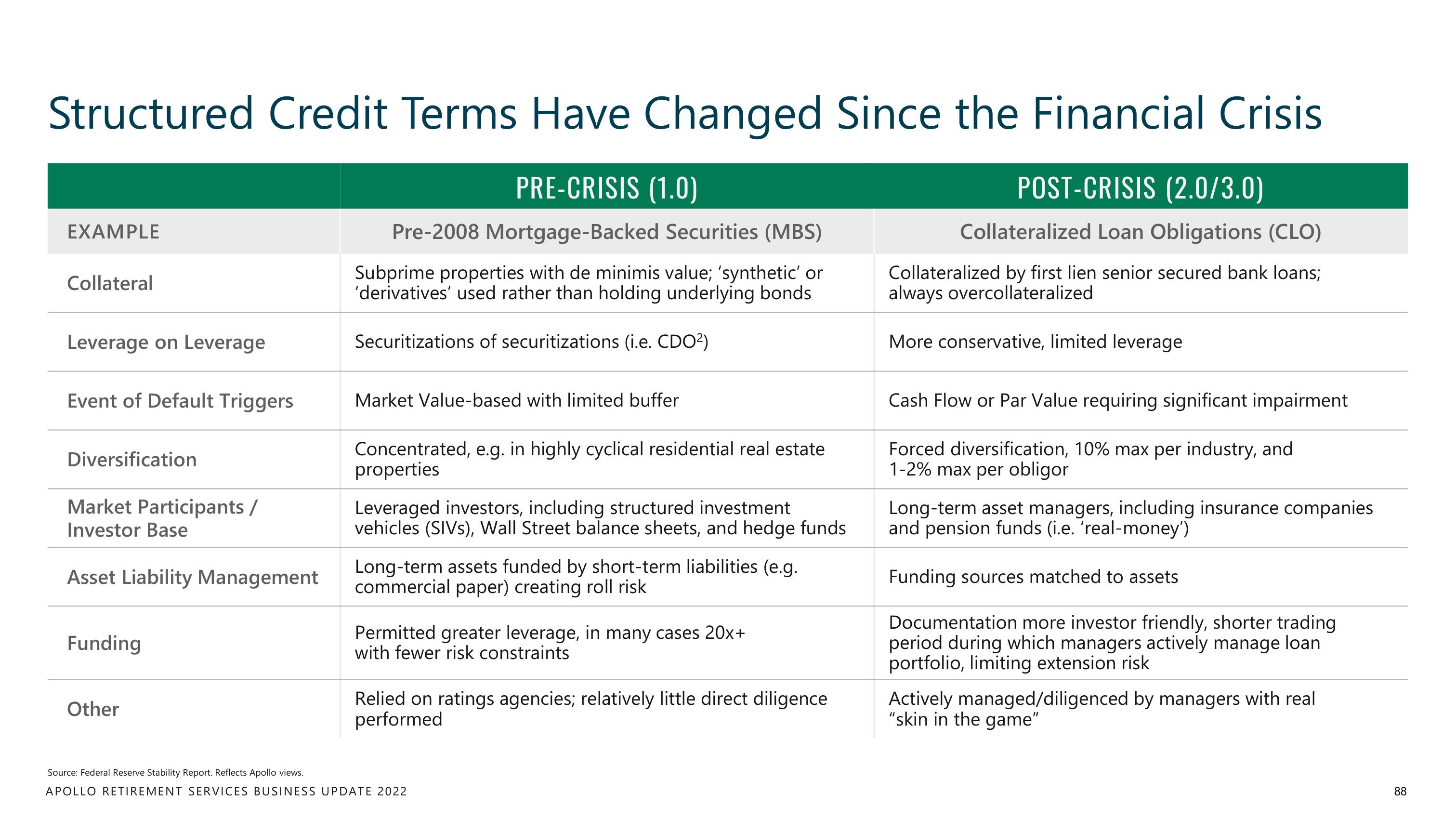

Structured Credit Terms Have Changed Since the Financial Crisis

PRE-CRISIS (1.0)

Pre-2008 Mortgage-Backed Securities (MBS)

Subprime properties with de minimis value; 'synthetic' or

'derivatives' used rather than holding underlying bonds

Securitizations of securitizations (i.e. CDO²)

EXAMPLE

Collateral

Leverage on Leverage

Event of Default Triggers

Diversification

Market Participants /

Investor Base

Asset Liability Management

Funding

Other

Market Value-based with limited buffer

Concentrated, e.g. in highly cyclical residential real estate

properties

Leveraged investors, including structured investment

vehicles (SIVS), Wall Street balance sheets, and hedge funds

Long-term assets funded by short-term liabilities (e.g.

commercial paper) creating roll risk

Permitted greater leverage, in many cases 20x+

with fewer risk constraints

Relied on ratings agencies; relatively little direct diligence

performed

Source: Federal Reserve Stability Report. Reflects Apollo views.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

POST-CRISIS (2.0/3.0)

Collateralized Loan Obligations (CLO)

Collateralized by first lien senior secured bank loans;

always overcollateralized

More conservative, limited leverage

Cash Flow or Par Value requiring significant impairment

Forced diversification, 10% max per industry, and

1-2% max per obligor

Long-term asset managers, including insurance companies

and pension funds (i.e. 'real-money')

Funding sources matched to assets

Documentation more investor friendly, shorter trading

period during which managers actively manage loan

portfolio, limiting extension risk

Actively managed/diligenced by managers with real

"skin in the game"

88View entire presentation