FiscalNote SPAC Presentation Deck

41

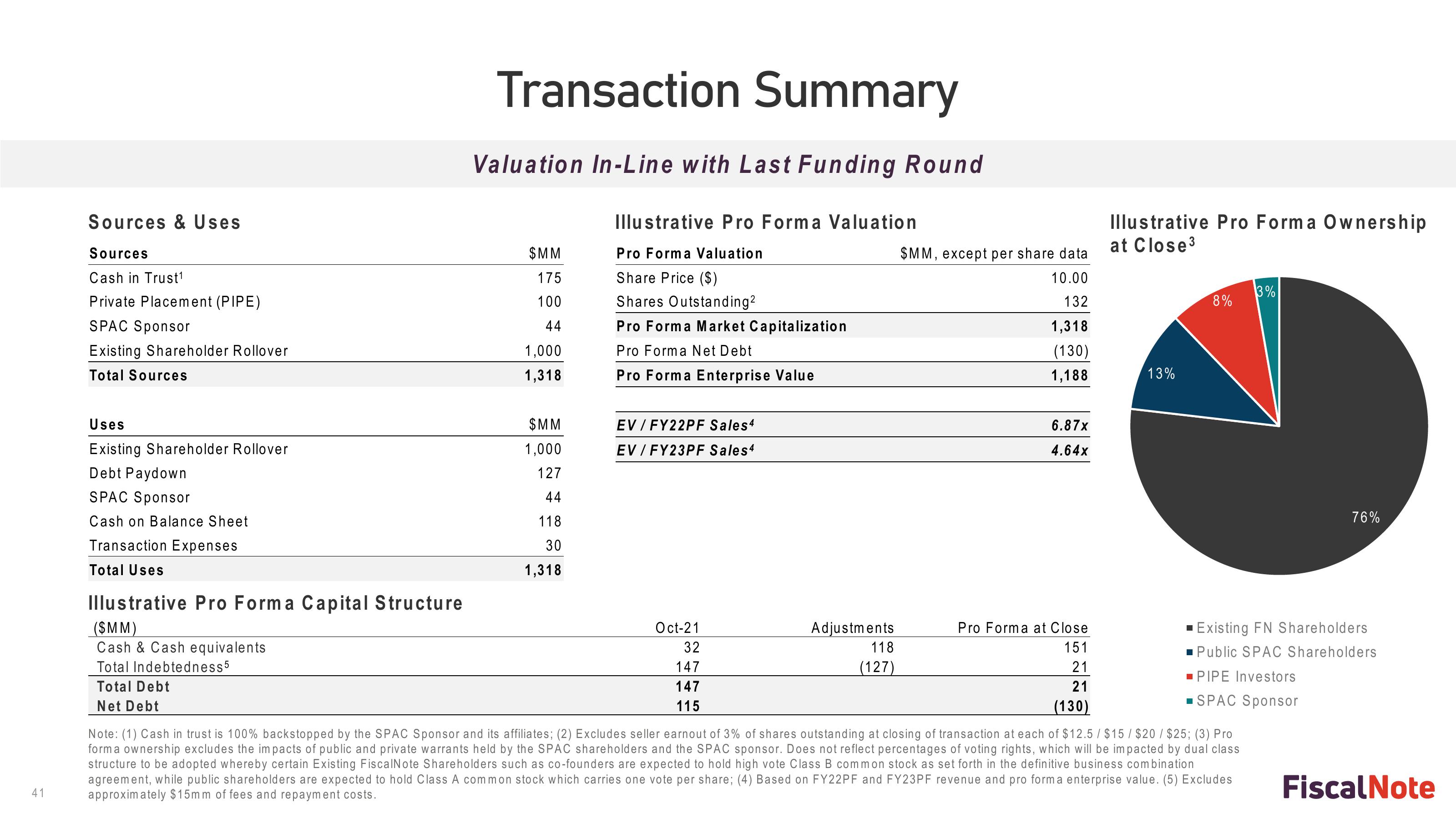

Sources & Uses

Sources

Cash in Trust¹

Private Placement (PIPE)

SPAC Sponsor

Existing Shareholder Rollover

Total Sources

Uses

Existing Shareholder Rollover

Debt Paydown

SPAC Sponsor

Cash on Balance Sheet

Transaction Expenses

Total Uses

Illustrative Pro Forma Capital Structure

(SMM)

Cash & Cash equivalents

Total Indebtedness5

Total Debt

Net Debt

Transaction Summary

Valuation In-Line with Last Funding Round

$MM

175

100

44

1,000

1,318

$MM

1,000

127

44

118

30

1,318

Illustrative Pro Forma Valuation

Pro Forma Valuation

Share Price ($)

Shares Outstanding²

Pro Forma Market Capitalization

Pro Forma Net Debt

Pro Forma Enterprise Value

EV/FY22PF Sales4

EV/FY23PF Sales4

Oct-21

32

147

147

115

Adjustments

118

(127)

$MM, except per share data

10.00

132

1,318

(130)

1,188

6.87x

4.64x

Pro Forma at Close

151

21

21

(130)

Illustrative Pro Forma Ownership

at Close3

13%

8%

3%

▪ Existing FN Shareholders

■ Public SPAC Shareholders

■ PIPE Investors

SPAC Sponsor

Note: (1) Cash in trust is 100% backstopped by the SPAC Sponsor and its affiliates; (2) Excludes seller earnout of 3% of shares outstanding at closing of transaction at each of $12.5 / $15 / $20 / $25; (3) Pro

forma ownership excludes the impacts of public and private warrants held by the SPAC shareholders and the SPAC sponsor. Does not reflect percentages of voting rights, which will be impacted by dual class

structure to be adopted whereby certain Existing FiscalNote Shareholders such as co-founders are expected to hold high vote Class B common stock as set forth in the definitive business combination

agreement, while public shareholders are expected to hold Class A common stock which carries one vote per share; (4) Based on FY22PF and FY23PF revenue and pro forma enterprise value. (5) Excludes

approximately $15mm of fees and repayment costs.

76%

Fiscal NoteView entire presentation