Alcon Q1 2023 Earnings Presentation

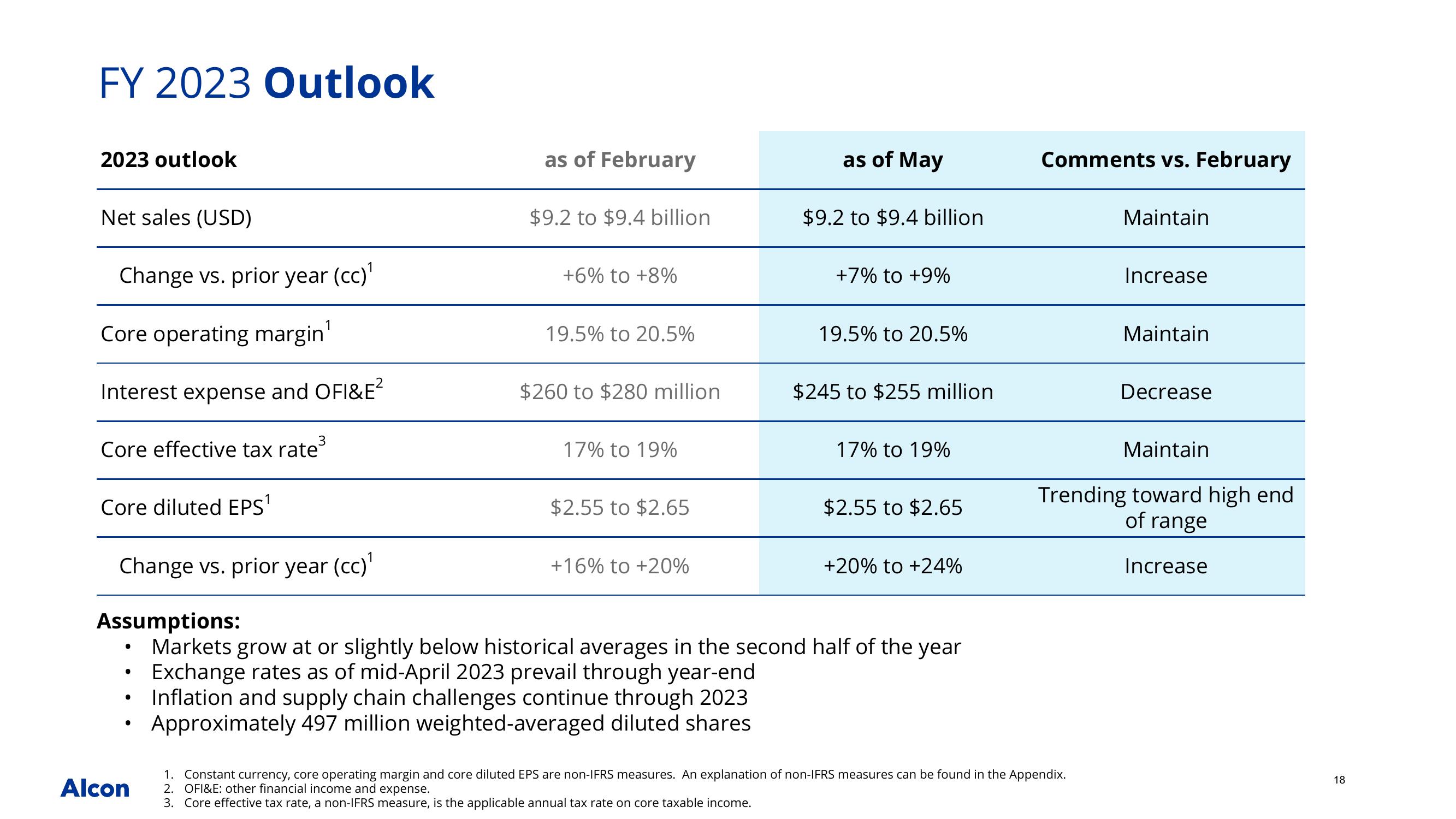

FY 2023 Outlook

2023 outlook

●

Net sales (USD)

Change vs. prior year (cc)¹

Core operating margin'

Interest expense and OFI&E²

3

Core effective tax rate³

Core diluted EPS¹

Change vs. prior year (cc)¹

Assumptions:

Markets grow at or slightly below historical averages in the second half of the year

Exchange rates as of mid-April 2023 prevail through year-end

Inflation and supply chain challenges continue through 2023

Approximately 497 million weighted-averaged diluted shares

●

●

●

Alcon

as of February

1

$9.2 to $9.4 billion

+6% to +8%

19.5% to 20.5%

$260 to $280 million

17% to 19%

$2.55 to $2.65

as of May

+16% to +20%

$9.2 to $9.4 billion

+7% to +9%

19.5% to 20.5%

$245 to $255 million

17% to 19%

$2.55 to $2.65

+20% to +24%

Comments vs. February

Maintain

1. Constant currency, core operating margin and core diluted EPS are non-IFRS measures. An explanation of non-IFRS measures can be found in the Appendix.

2. OFI&E: other financial income and expense.

3. Core effective tax rate, a non-IFRS measure, is the applicable annual tax rate on core taxable income.

Increase

Maintain

Decrease

Maintain

Trending toward high end

of range

Increase

18View entire presentation