J.P.Morgan Shareholder Engagement Presentation Deck

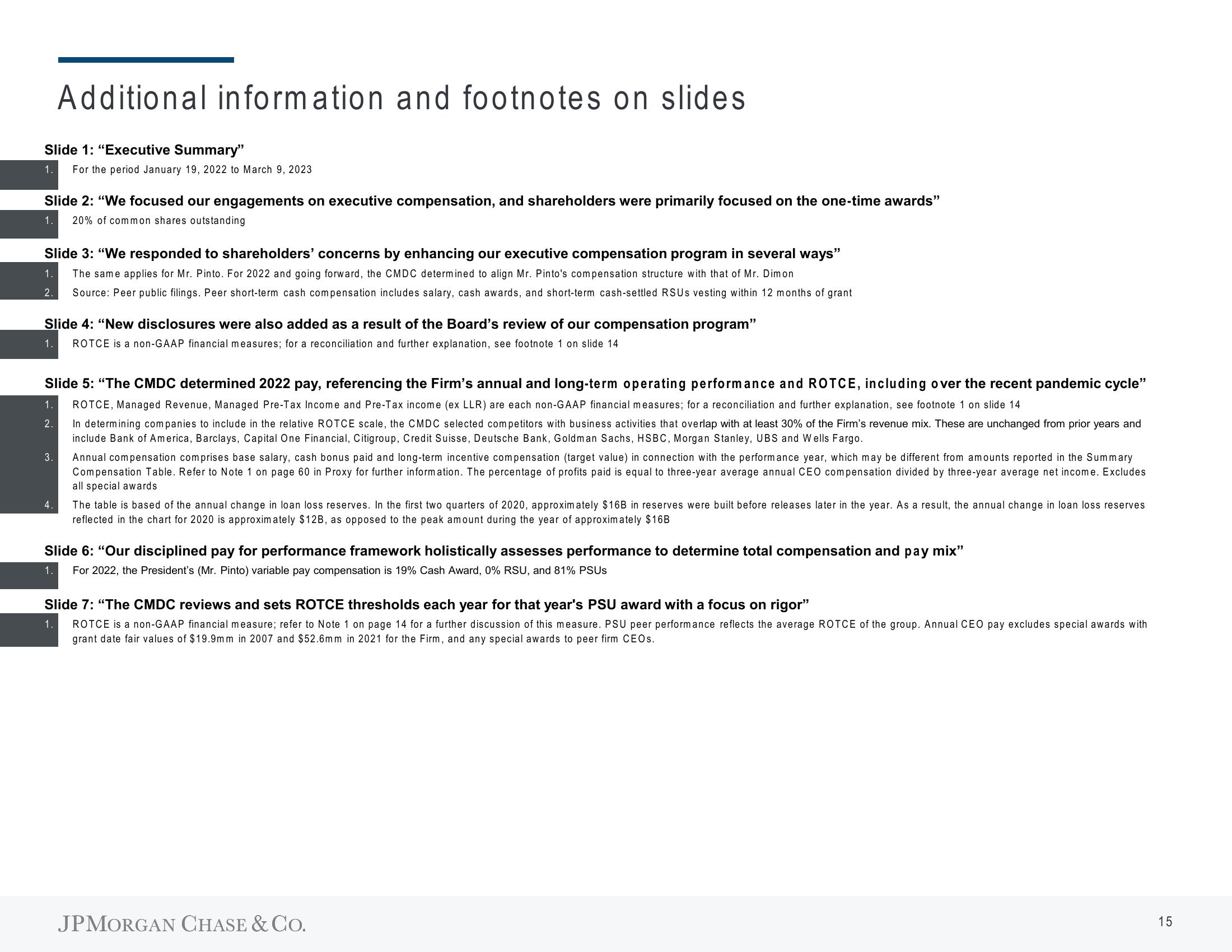

Slide 1: "Executive Summary"

1. For the period January 19, 2022 to March 9, 2023

Additional information and footnotes on slides

Slide 2: "We focused our engagements on executive compensation, and shareholders were primarily focused on the one-time awards"

1. 20% of common shares outstanding

Slide 3: "We responded to shareholders' concerns by enhancing our executive compensation program in several ways"

1.

The same applies for Mr. Pinto. For 2022 and going forward, the CMDC determined to align Mr. Pinto's compensation structure with that of Mr. Dimon

2. Source: Peer public filings. Peer short-term cash compensation includes salary, cash awards, and short-term cash-settled RSUS vesting within 12 months of grant

Slide 4: "New disclosures were also added as a result of the Board's review of our compensation program"

1 ROTCE is a non-GAAP financial measures; for a reconciliation and further explanation, see footnote 1 on slide 14

Slide 5: "The CMDC determined 2022 pay, referencing the Firm's annual and long-term operating performance and ROTCE, including over the recent pandemic cycle"

ROTCE, Managed Revenue, Managed Pre-Tax Income and Pre-Tax income (ex LLR) are each non-GAAP financial measures; for a reconciliation and further explanation, see footnote 1 on slide 14

1.

2.

In determining companies to include in the relative ROTCE scale, the CMDC selected competitors with business activities that overlap with at least 30% of the Firm's revenue mix. These are unchanged from prior years and

include Bank of America, Barclays, Capital One Financial, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, Morgan Stanley, UBS and Wells Fargo.

3.

4.

Annual compensation comprises base salary, cash bonus paid and long-term incentive compensation (target value) in connection with the performance year, which may be different from amounts reported in the Summary

Compensation Table. Refer to Note 1 on page 60 in Proxy for further information. The percentage of profits paid is equal to three-year average annual CEO compensation divided by three-year average net income. Excludes

all special awards

The table is based of the annual change in loan loss reserves. In the first two quarters of 2020, approximately $16B in reserves were built before releases later in the year. As a result, the annual change in loan loss reserves

reflected in the chart for 2020 is approximately $12B, as opposed to the peak amount during the year of approximately $16B

Slide 6: "Our disciplined pay for performance framework holistically assesses performance to determine total compensation and pay mix"

1.

For 2022, the President's (Mr. Pinto) variable pay compensation is 19% Cash Award, 0% RSU, and 81% PSUs

Slide 7: "The CMDC reviews and sets ROTCE thresholds each year for that year's PSU award with a focus on rigor"

1.

ROTCE is a non-GAAP financial measure; refer to Note 1 on page 14 for a further discussion of this measure. PSU peer performance reflects the average ROTCE of the group. Annual CEO pay excludes special awards with

grant date fair values of $19.9mm in 2007 and $52.6mm in 2021 for the Firm, and any special awards to peer firm CEOs.

JPMORGAN CHASE & CO.

15View entire presentation