Asos Results Presentation Deck

© 2022 asoS

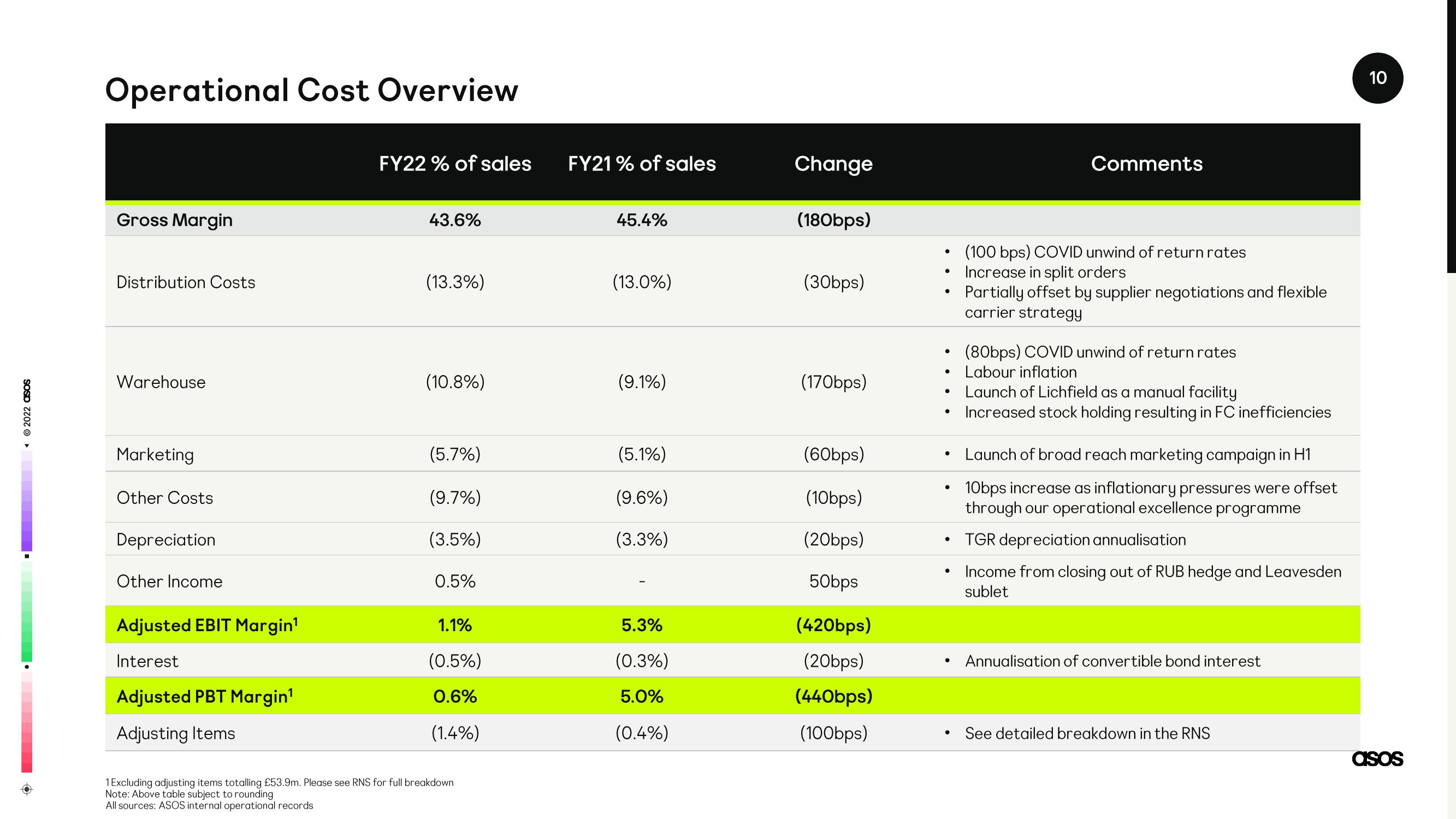

Operational Cost Overview

Gross Margin

Distribution Costs

Warehouse

Marketing

Other Costs

Depreciation

Other Income

Adjusted EBIT Margin¹

Interest

Adjusted PBT Margin¹

Adjusting Items

FY22 % of sales

43.6%

(13.3%)

(10.8%)

(5.7%)

(9.7%)

(3.5%)

0.5%

1.1%

(0.5%)

0.6%

(1.4%)

1 Excluding adjusting items totalling £53.9m. Please see RNS for full breakdown

Note: Above table subject to rounding

All sources: ASOS internal operational records

FY21% of sales

45.4%

(13.0%)

(9.1%)

(5.1%)

(9.6%)

(3.3%)

5.3%

(0.3%)

5.0%

(0.4%)

Change

(180bps)

(30bps)

(170bps)

(60bps)

(10bps)

(20bps)

50bps

(420bps)

(20bps)

(440bps)

(100bps)

●

●

●

●

●

●

●

Comments

(100 bps) COVID unwind of return rate

Increase in split orders

Partially offset by supplier negotiations and flexible

carrier strategy

(80bps) COVID unwind of return rates

Labour inflation

Launch of Lichfield as a manual facility

Increased stock holding resulting in FC inefficiencies

Launch of broad reach marketing campaign in H1

10bps increase as inflationary pressures were offset

through our operational excellence programme

TGR depreciation annualisation

Income from closing out of RUB hedge and Leavesden

sublet

Annualisation of convertible bond interest

See detailed breakdown in the RNS

10

asosView entire presentation