Apollo Global Management Investor Day Presentation Deck

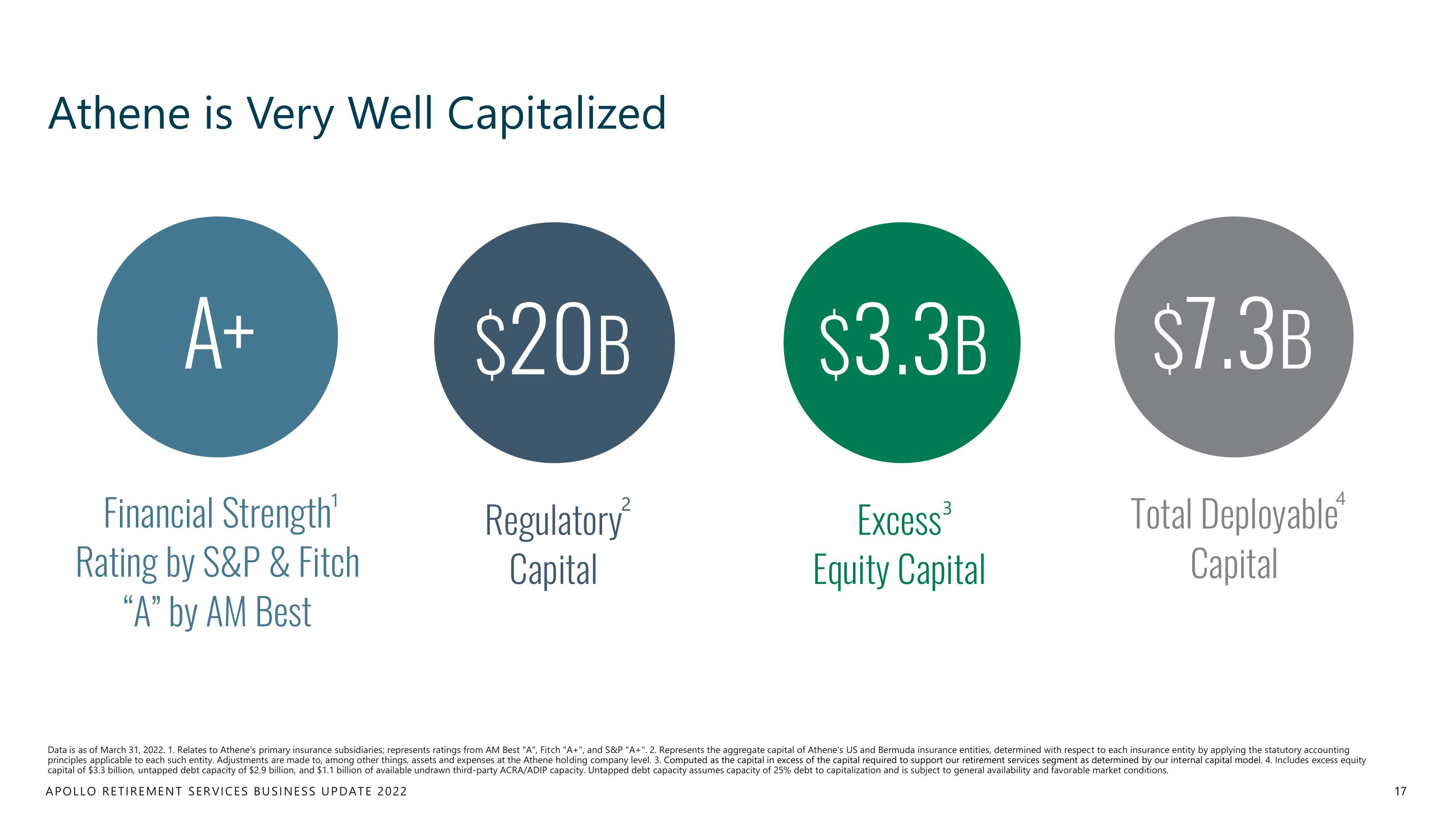

Athene is Very Well Capitalized

A+

Financial Strength¹

Rating by S&P & Fitch

"A" by AM Best

$20B

Regulatory

Capital

$3.3B

Excess³

Equity Capital

$7.3B

Total Deployable

Capital

Data is as of March 31, 2022. 1. Relates to Athene's primary insurance subsidiaries; represents ratings from AM Best "A", Fitch "A+", and S&P "A+". 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting

principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. 3. Computed as the capital in excess of the capital required to support our retirement services segment as determined by our internal capital model. 4. Includes excess equity

capital of $3.3 billion, untapped debt capacity of $2.9 billion, and $1.1 billion of available undrawn third-party ACRA/ADIP capacity. Untapped debt capacity assumes capacity of 25% debt to capitalization and is subject to general availability and favorable market conditions.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

17View entire presentation