SoftBank Results Presentation Deck

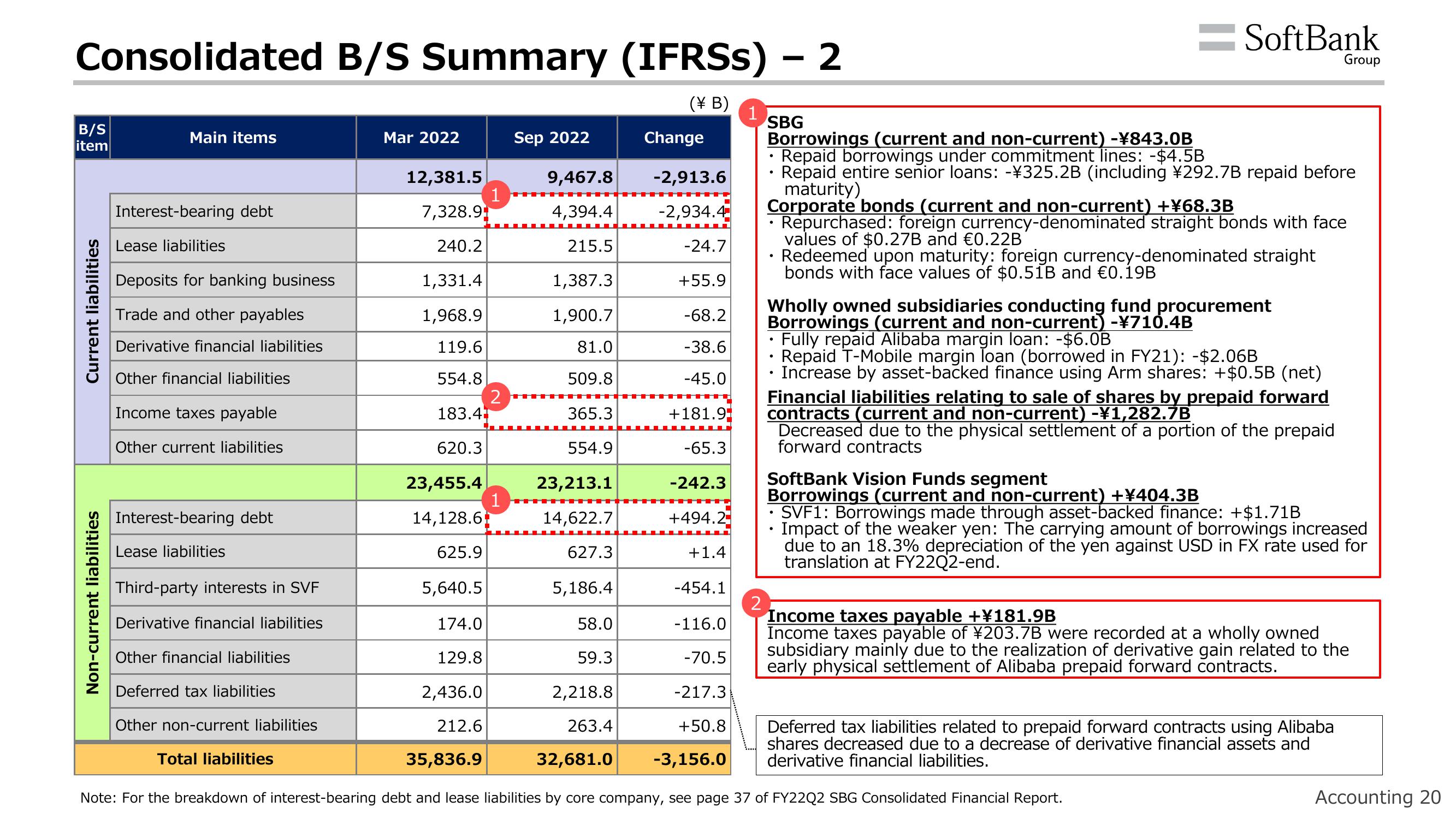

Consolidated B/S Summary (IFRSs) - 2

(\ B)

B/S

item

Current liabilities

Non-current liabilities

Main items

Interest-bearing debt

Lease liabilities

Deposits for banking business

Trade and other payables

Derivative financial liabilities

Other financial liabilities

Income taxes payable

Other current liabilities

Interest-bearing debt

Lease liabilities

Third-party interests in SVF

Derivative financial liabilities

Other financial liabilities

Deferred tax liabilities

Other non-current liabilities

Mar 2022

Total liabilities

12,381.5

7,328.9

240.2

1,331.4

1,968.9

119.6

554.8

183.4

620.3

23,455.4

14,128.6

625.9

5,640.5

174.0

129.8

2,436.0

212.6

1

35,836.9

2

1

Sep 2022

M

9,467.8

4,394.4

215.5

1,387.3

1,900.7

81.0

509.8

365.3

554.9

23,213.1

14,622.7

627.3

5,186.4

TH

58.0

59.3

Change

-2,913.6

-2,934.4

-24.7

+55.9

-68.2

-38.6

-45.0

+181.9

-65.3

-242.3

+494.23

+1.4

-454.1

1

2

SBG

= SoftBank

Borrowings (current and non-current) -¥843.0B

• Repaid borrowings under commitment lines: -$4.5B

• Repaid entire senior loans: -¥325.2B (including ¥292.7B repaid before

maturity)

Corporate bonds (current and non-current) +¥68.3B

Repurchased: foreign currency-denominated straight bonds with face

values of $0.27B and €0.22B

Redeemed upon maturity: foreign currency-denominated straight

bonds with face values of $0.51B and €0.19B

Wholly owned subsidiaries conducting fund procurement

Borrowings (current and non-current) -¥710.4B

• Fully repaid Alibaba margin loan: -$6.0B

Repaid T-Mobile margin loan (borrowed in FY21): -$2.06B

Increase by asset-backed finance using Arm shares: +$0.5B (net)

-116.0

-70.5

-217.3

2,218.8

+50.8

263.4

32,681.0

-3,156.0

Note: For the breakdown of interest-bearing debt and lease liabilities by core company, see page 37 of FY22Q2 SBG Consolidated Financial Report.

Financial liabilities relating to sale of shares by prepaid forward

contracts (current and non-current) -¥1,282.7B

Decreased due to the physical settlement of a portion of the prepaid

forward contracts

Group

SoftBank Vision Funds segment

Borrowings (current and non-current) +¥404.3B

SVF1: Borrowings made through asset-backed finance: +$1.71B

• Impact of the weaker yen: The carrying amount of borrowings increased

due to an 18.3% depreciation of the yen against USD in FX rate used for

translation at FY22Q2-end.

Income taxes payable +¥181.9B

Income taxes payable of ¥203.7B were recorded at a wholly owned

subsidiary mainly due to the realization of derivative gain related to the

early physical settlement of Alibaba prepaid forward contracts.

Deferred tax liabilities related to prepaid forward contracts using Alibaba

shares decreased due to a decrease of derivative financial assets and

derivative financial liabilities.

Accounting 20View entire presentation