Melrose Results Presentation Deck

Highlights

Melrose

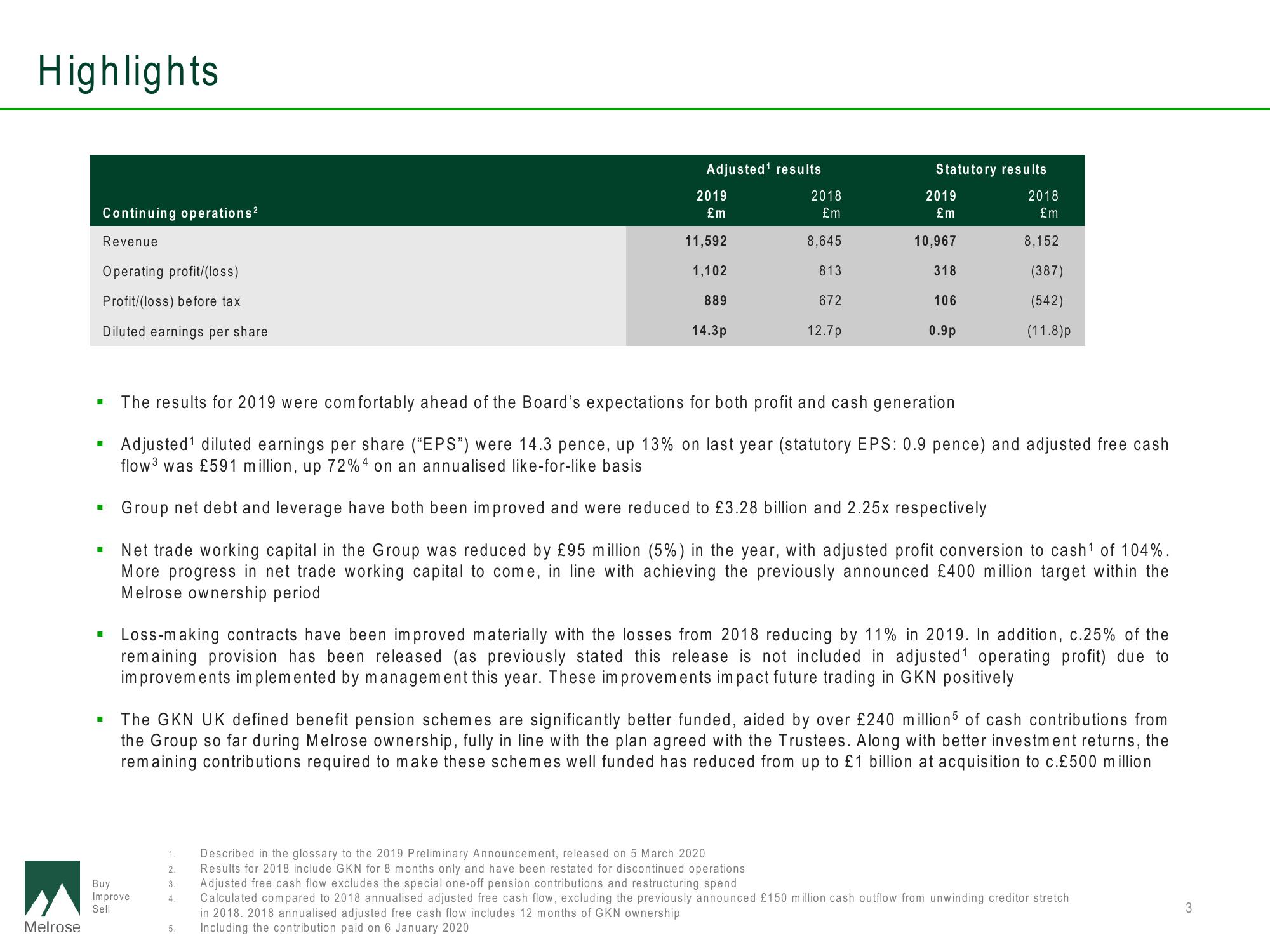

Continuing operations²

Revenue

Operating profit/(loss)

Profit/(loss) before tax

Diluted earnings per share

■

■

■

H

Buy

Improve

Sell

Adjusted¹ results

2019

£m

11,592

1,102

1.

2.

3.

4.

889

5.

14.3p

2018

£m

8,645

in 2018. 2018 annualised adjusted free cash flow includes 12 months of GKN ownership

Including the contribution paid on 6 January 2020

813

672

12.7p

Statutory results

2019

£m

10,967

318

106

The results for 2019 were comfortably ahead of the Board's expectations for both profit and cash generation

Adjusted¹ diluted earnings per share ("EPS") were 14.3 pence, up 13% on last year (statutory EPS: 0.9 pence) and adjusted free cash

flow was £591 million, up 72% 4 on an annualised like-for-like basis

Group net debt and leverage have both been improved and were reduced to £3.28 billion and 2.25x respectively

Net trade working capital in the Group was reduced by £95 million (5%) in the year, with adjusted profit conversion to cash¹ of 104%.

More progress in net trade working capital to come, in line with achieving the previously announced £400 million target within the

Melrose ownership period

0.9p

Loss-making contracts have been improved materially with the losses from 2018 reducing by 11% in 2019. In addition, c.25% of the

remaining provision has been released (as previously stated this release is not included in adjusted¹ operating profit) due to

improvements implemented by management this year. These improvements impact future trading in GKN positively

2018

£m

8,152

The GKN UK defined benefit pension schemes are significantly better funded, aided by over £240 millions of cash contributions from

the Group so far during Melrose ownership, fully in line with the plan agreed with the Trustees. Along with better investment returns, the

remaining contributions required to make these schemes well funded has reduced from up to £1 billion at acquisition to c.£500 million

(387)

(542)

(11.8)p

Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

Results for 2018 include GKN for 8 months only and have been restated for discontinued operations

Adjusted free cash flow excludes the special one-off pension contributions and restructuring spend

Calculated compared to 2018 annualised adjusted free cash flow, excluding the previously announced £150 million cash outflow from unwinding creditor stretch

3View entire presentation