Citi Investment Banking Pitch Book

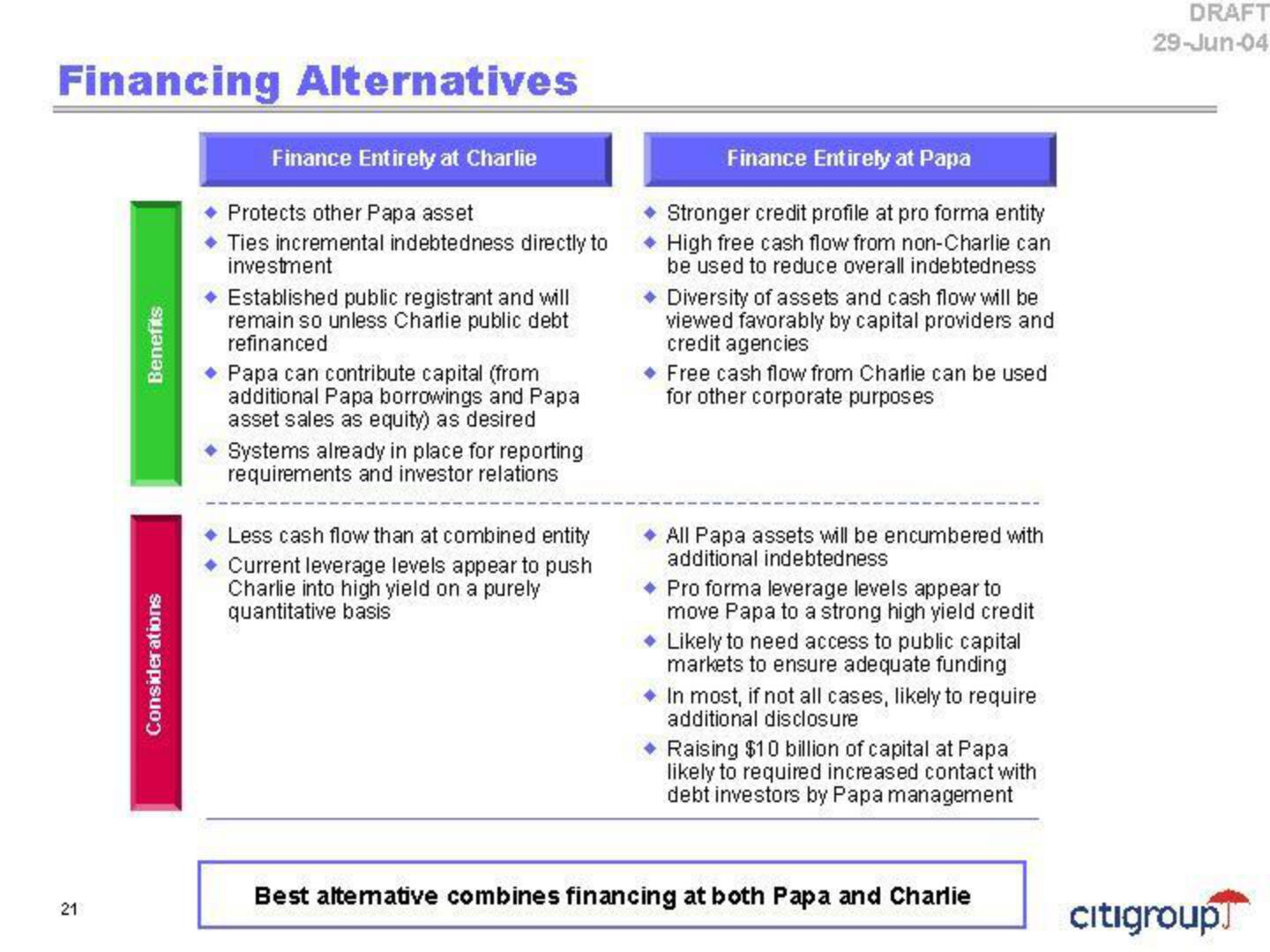

Financing Alternatives

21

Benefits

Considerations

Finance Entirely at Charlie

Protects other Papa asset

◆ Ties incremental indebtedness directly to

investment

Established public registrant and will

remain so unless Charlie public debt

refinanced

• Papa can contribute capital (from

additional Papa borrowings and Papa

asset sales as equity) as desired

Systems already in place for reporting

requirements and investor relations

◆ Less cash flow than at combined entity

Current leverage levels appear to push

Charlie into high yield on a purely

quantitative basis

Finance Entirely at Papa

Stronger credit profile at pro forma entity

◆ High free cash flow from non-Charlie can

be used to reduce overall indebtedness

Diversity of assets and cash flow will be

viewed favorably by capital providers and

credit agencies

◆ Free cash flow from Charlie can be used

for other corporate purposes

All Papa assets will be encumbered with

additional indebtedness

◆ Pro forma leverage levels appear to

move Papa to a strong high yield credit

◆ Likely to need access to public capital

markets to ensure adequate funding

◆ In most, if not all cases, likely to require

additional disclosure

Raising $10 billion of capital at Papa

likely to required increased contact with

debt investors by Papa management

Best alternative combines financing at both Papa and Charlie

DRAFT

29-Jun-04

citigroupView entire presentation