Avantor Results Presentation Deck

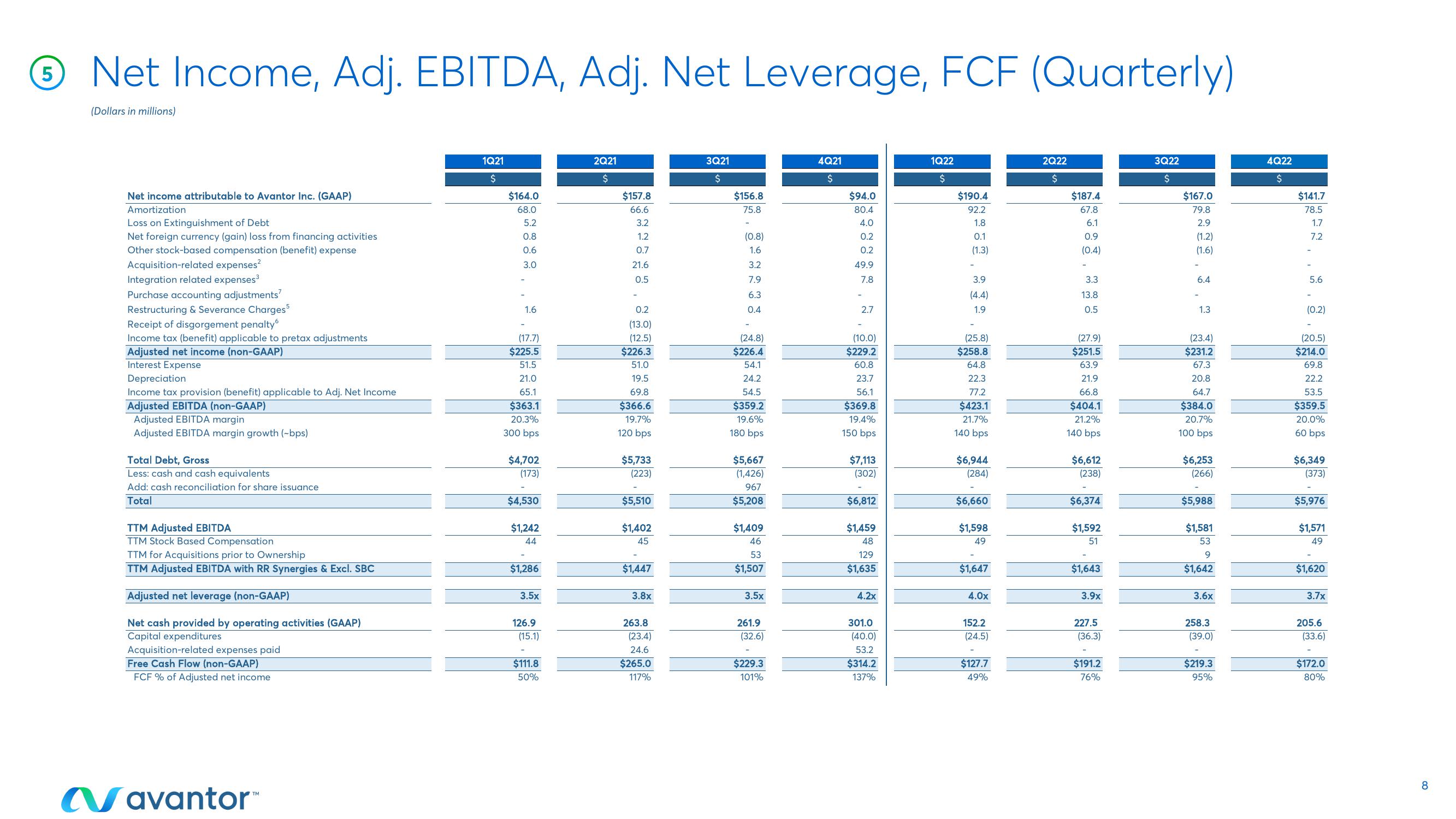

Ⓒ Net Income, Adj. EBITDA, Adj. Net Leverage, FCF (Quarterly)

5

(Dollars in millions)

Net income attributable to Avantor Inc. (GAAP)

Amortization

Loss on Extinguishment of Debt

Net foreign currency (gain) loss from financing activities

Other stock-based compensation (benefit) expense

Acquisition-related expenses²

Integration related expenses³

Purchase accounting adjustments

Restructuring & Severance Charges5

Receipt of disgorgement penalty

Income tax (benefit) applicable to pretax adjustments

Adjusted net income (non-GAAP)

Interest Expense

Depreciation

Income tax provision (benefit) applicable to Adj. Net Income

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA margin

Adjusted EBITDA margin growth (~bps)

Total Debt, Gross

Less: cash and cash equivalents

Add: cash reconciliation for share issuance

Total

TTM Adjusted EBITDA

TTM Stock Based Compensation

TTM for Acquisitions prior to Ownership

TTM Adjusted EBITDA with RR Synergies & Excl. SBC

Adjusted net leverage (non-GAAP)

Net cash provided by operating activities (GAAP)

Capital expenditures

Acquisition-related expenses paid

Free Cash Flow (non-GAAP)

FCF % of Adjusted net income

Navantor™

1Q21

$

$164.0

68.0

5.2

0.8

0.6

3.0

1.6

(17.7)

$225.5

51.5

21.0

65.1

$363.1

20.3%

300 bps

$4,702

(173)

$4,530

$1,242

44

$1,286

3.5x

126.9

(15.1)

$111.8

50%

2Q21

$

$157.8

66.6

3.2

1.2

0.7

21.6

0.5

0.2

(13.0)

(12.5)

$226.3

51.0

19.5

69.8

$366.6

19.7%

120 bps

$5,733

(223)

$5,510

$1,402

45

$1,447

3.8x

263.8

(23.4)

24.6

$265.0

117%

3Q21

$

$156.8

75.8

(0.8)

1.6

3.2

7.9

6.3

0.4

(24.8)

$226.4

54.1

24.2

54.5

$359.2

19.6%

180 bps

$5,667

(1,426)

967

$5,208

$1,409

46

53

$1,507

3.5x

261.9

(32.6)

$229.3

101%

4Q21

$

$94.0

80.4

4.0

0.2

0.2

49.9

7.8

2.7

(10.0)

$229.2

60.8

23.7

56.1

$369.8

19.4%

150 bps

$7,113

(302)

$6,812

$1,459

48

129

$1,635

4.2x

301.0

(40.0)

53.2

$314.2

137%

1Q22

$

$190.4

92.2

1.8

0.1

(1.3)

3.9

(4.4)

1.9

(25.8)

$258.8

64.8

22.3

77.2

$423.1

21.7%

140 bps

$6,944

(284)

$6,660

$1,598

49

$1,647

4.0x

152.2

(24.5)

$127.7

49%

2Q22

$

$187.4

67.8

6.1

0.9

(0.4)

3.3

13.8

0.5

(27.9)

$251.5

63.9

21.9

66.8

$404.1

21.2%

140 bps

$6,612

(238)

$6,374

$1,592

51

$1,643

3.9x

227.5

(36.3)

$191.2

76%

3Q22

$

$167.0

79.8

2.9

(1.2)

(1.6)

6.4

-

1.3

(23.4)

$231.2

67.3

20.8

64.7

$384.0

20.7%

100 bps

$6,253

(266)

$5,988

$1,581

53

9

$1,642

3.6x

258.3

(39.0)

$219.3

95%

4Q22

$

$141.7

78.5

1.7

7.2

5.6

(0.2)

(20.5)

$214.0

69.8

22.2

53.5

$359.5

20.0%

60 bps

$6,349

(373)

$5,976

$1,571

49

$1,620

3.7x

205.6

(33.6)

$172.0

80%

8View entire presentation