Pershing Square Activist Presentation Deck

II. Pershing's View of McDonald's

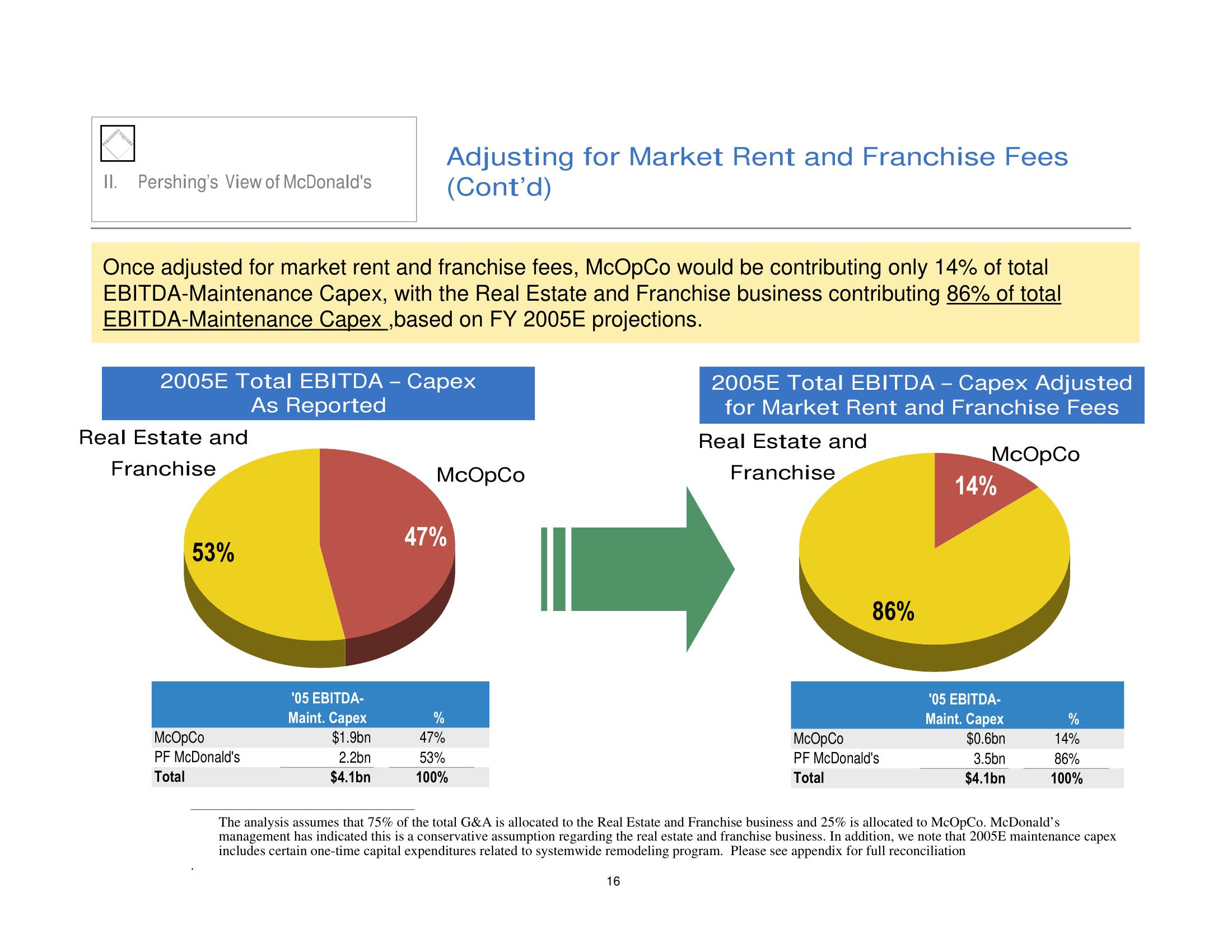

Once adjusted for market rent and franchise fees, McOpCo would be contributing only 14% of total

EBITDA-Maintenance Capex, with the Real Estate and Franchise business contributing 86% of total

EBITDA-Maintenance Capex ,based on FY 2005E projections.

2005E Total EBITDA - Capex

As Reported

Real Estate and

Franchise

53%

Adjusting for Market Rent and Franchise Fees

(Cont'd)

McOpCo

PF McDonald's

Total

'05 EBITDA-

Maint. Capex

$1.9bn

2.2bn

$4.1bn

McOpCo

47%

%

47%

53%

100%

2005E Total EBITDA - Capex Adjusted

for Market Rent and Franchise Fees

16

Real Estate and

Franchise

86%

McOpCo

PF McDonald's

Total

McOpCo

14%

'05 EBITDA-

Maint. Capex

$0.6bn

3.5bn

$4.1bn

%

14%

86%

100%

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. McDonald's

management has indicated this is a conservative assumption regarding the real estate and franchise business. In addition, we note that 2005E maintenance capex

includes certain one-time capital expenditures related to systemwide remodeling program. Please see appendix for full reconciliationView entire presentation