AES Panama Investor Presentation

16

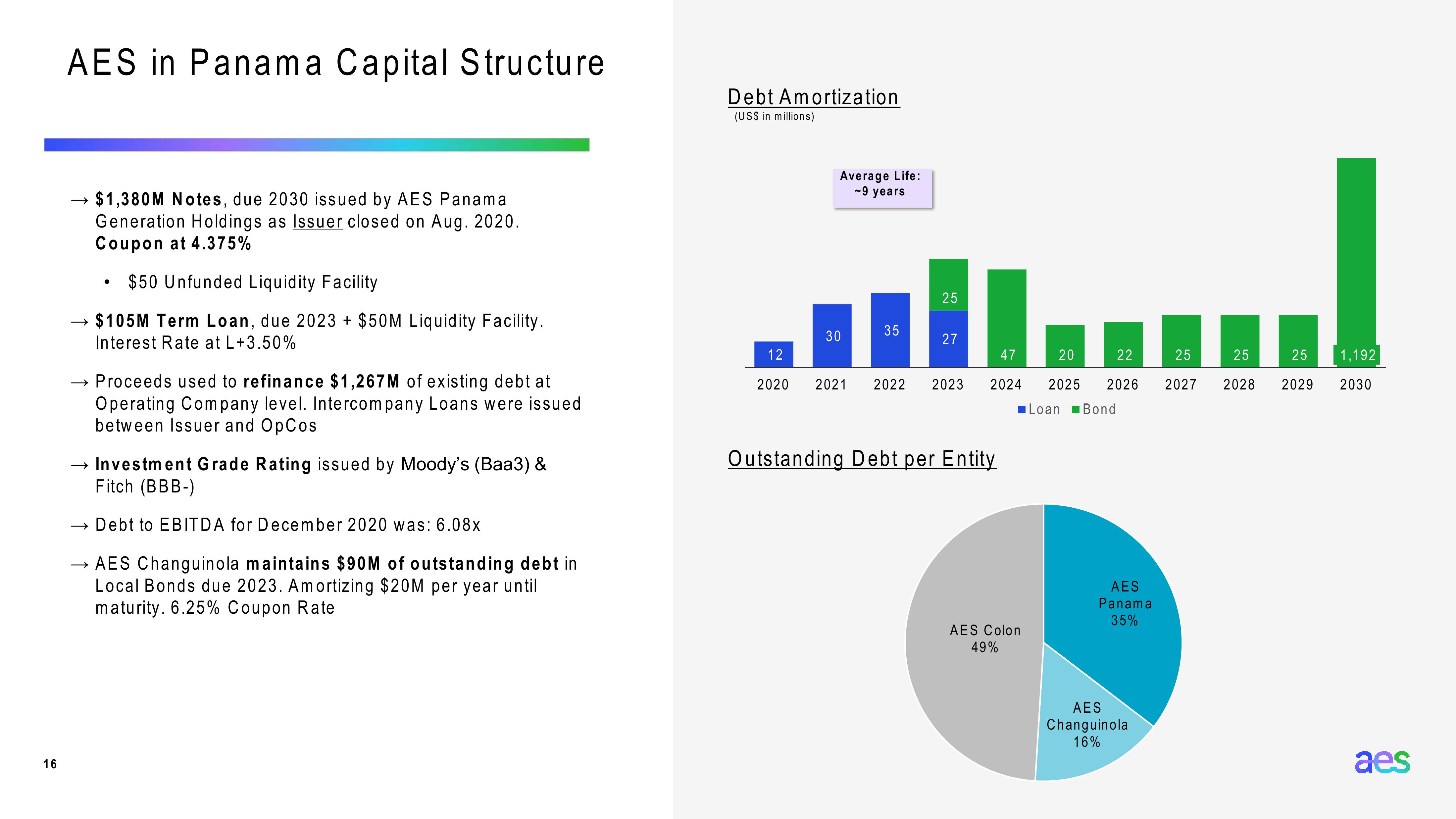

AES in Panama Capital Structure

Debt Amortization

(US$ in millions)

→ $1,380M Notes, due 2030 issued by AES Panama

Generation Holdings as Issuer closed on Aug. 2020.

Coupon at 4.375%

•

$50 Unfunded Liquidity Facility

→ $105M Term Loan, due 2023 + $50M Liquidity Facility.

Interest Rate at L+3.50%

→ Proceeds used to refinance $1,267M of existing debt at

Operating Company level. Intercompany Loans were issued

between Issuer and OpCos

→ Investment Grade Rating issued by Moody's (Baa3) &

Fitch (BBB-)

Debt to EBITDA for December 2020 was: 6.08x

→ AES Changuinola maintains $90M of outstanding debt in

Local Bonds due 2023. Amortizing $20M per year until

maturity. 6.25% Coupon Rate

Average Life:

-9 years

25

35

30

27

12

47

20

22

25

25

25 1,192

2020

2021

2022 2023

2024 2025 2026

2027

2028

2029 2030

■Loan Bond

Outstanding Debt per Entity

AES

Panama

35%

AES Colon

49%

AES

Changuinola

16%

aesView entire presentation