Allwyn Results Presentation Deck

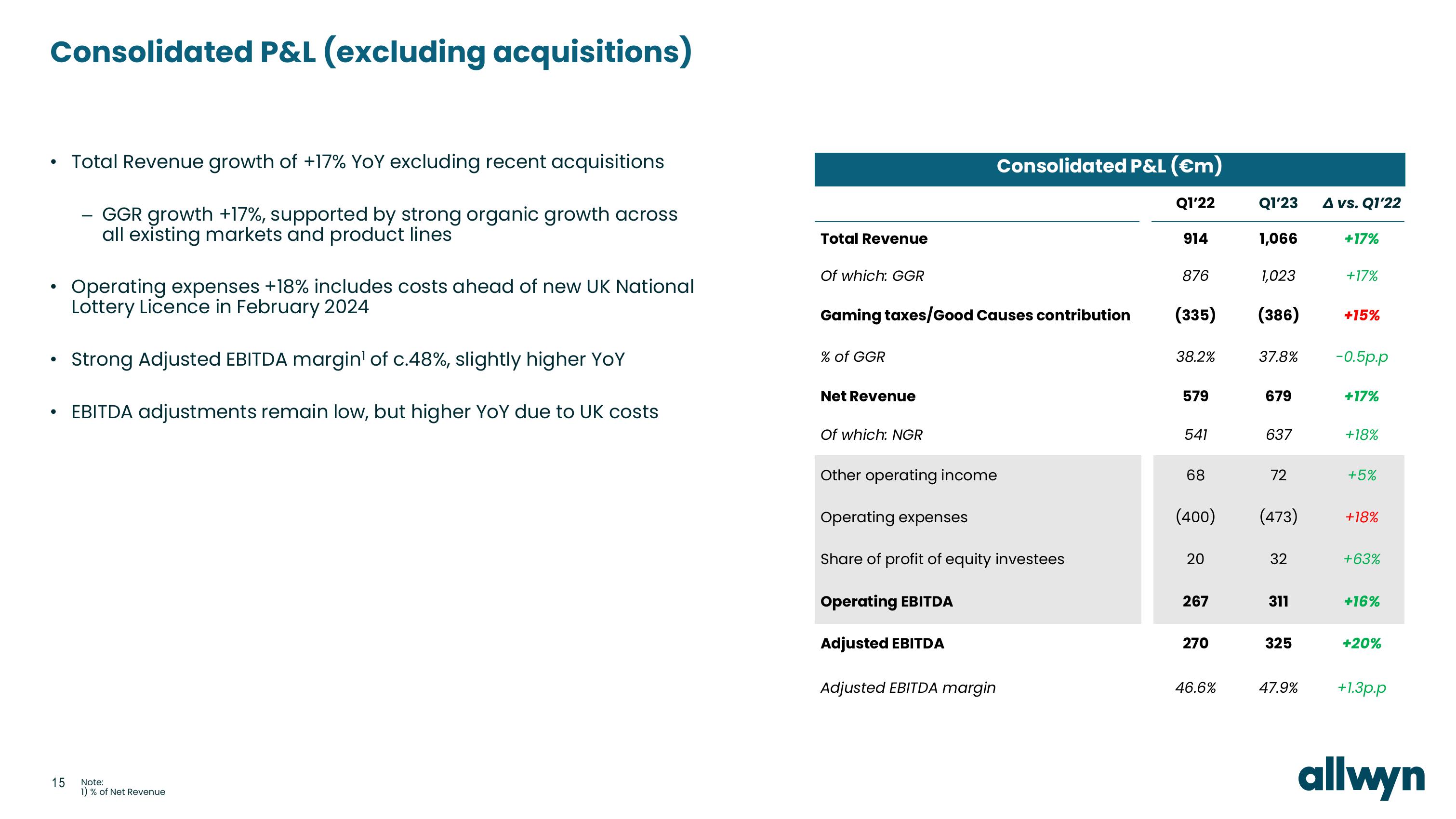

Consolidated P&L (excluding acquisitions)

●

●

●

●

15

Total Revenue growth of +17% YoY excluding recent acquisitions

GGR growth +17%, supported by strong organic growth across

all existing markets and product lines

Operating expenses +18% includes costs ahead of new UK National

Lottery Licence in February 2024

Strong Adjusted EBITDA margin¹ of c.48%, slightly higher YoY

EBITDA adjustments remain low, but higher YoY due to UK costs

Note:

1) % of Net Revenue

Total Revenue

Of which: GGR

Gaming taxes/Good Causes contribution

% of GGR

Net Revenue

Of which: NGR

Other operating income

Consolidated P&L (€m)

Q1'22

Operating expenses

Share of profit of equity investees

Operating EBITDA

Adjusted EBITDA

Adjusted EBITDA margin

914

876

(335)

38.2%

579

541

68

20

267

270

Q1'23

1,066

46.6%

1,023

(386)

37.8%

(400) (473)

679

637

72

32

311

325

47.9%

A vs. Q1'22

+17%

+17%

+15%

-0.5p.p

+17%

+18%

+5%

+18%

+63%

+16%

+20%

+1.3p.p

allwynView entire presentation