TPG Results Presentation Deck

Non-GAAP Balance Sheet

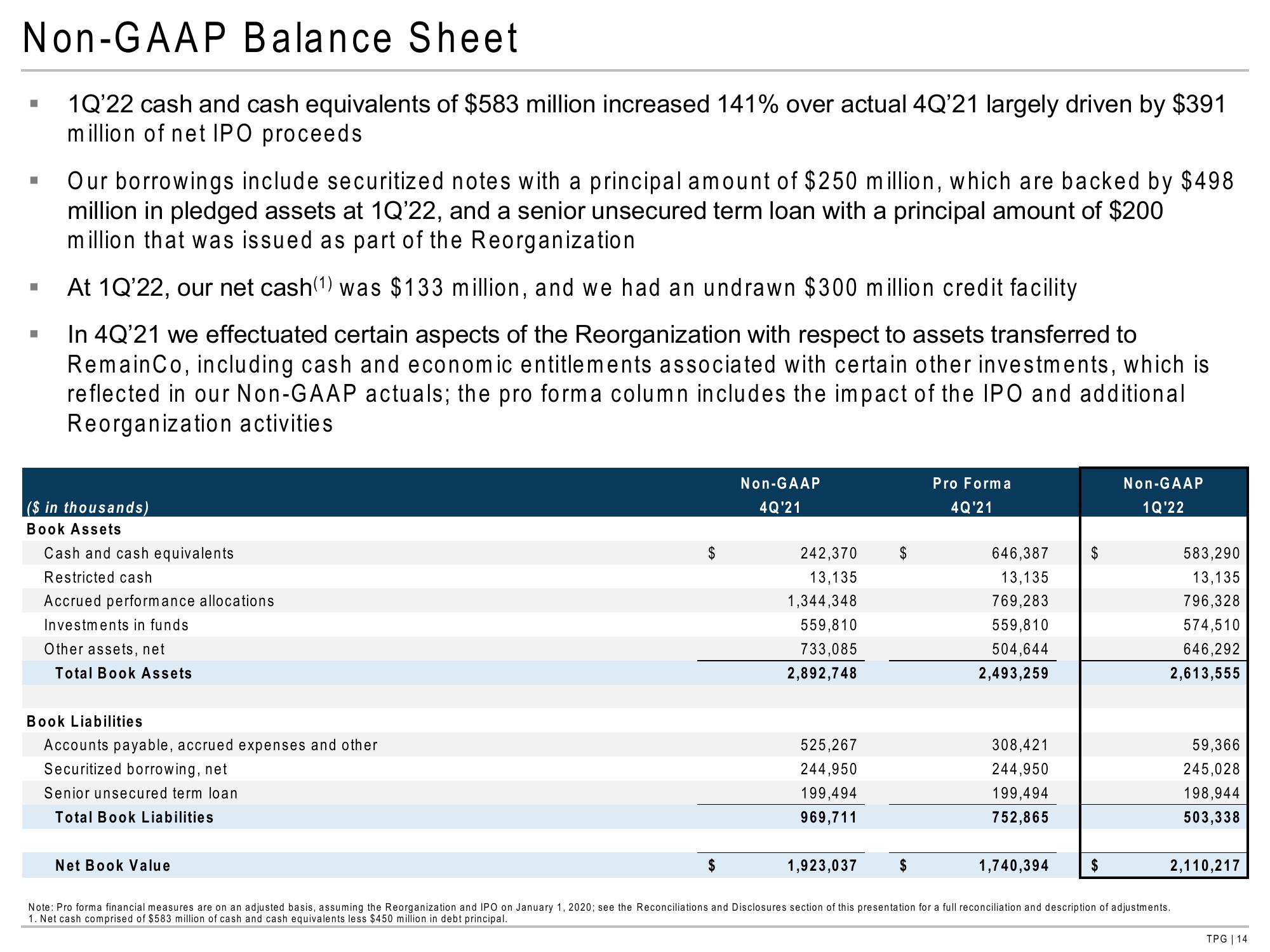

1Q'22 cash and cash equivalents of $583 million increased 141% over actual 4Q'21 largely driven by $391

million of net IPO proceeds

■

■

Our borrowings include securitized notes with a principal amount of $250 million, which are backed by $498

million in pledged assets at 1Q'22, and a senior unsecured term loan with a principal amount of $200

million that was issued as part of the Reorganization

At 1Q'22, our net cash (1) was $133 million, and we had an undrawn $300 million credit facility

In 4Q'21 we effectuated certain aspects of the Reorganization with respect to assets transferred to

RemainCo, including cash and economic entitlements associated with certain other investments, which is

reflected in our Non-GAAP actuals; the pro forma column includes the impact of the IPO and additional

Reorganization activities.

($ in thousands)

Book Assets

Cash and cash equivalents

Restricted cash

Accrued performance allocations

Investments in funds

Other assets, net

Total Book Assets

Book Liabilities

Accounts payable, accrued expenses and other

Securitized borrowing, net

Senior unsecured term loan

Total Book Liabilities

Net Book Value

Non-GAAP

4Q'21

242,370

13,135

1,344,348

559,810

733,085

2,892,748

525,267

244,950

199,494

969,711

1,923,037

$

$

Pro Forma

4Q'21

646,387

13,135

769,283

559,810

504,644

2,493,259

308,421

244,950

199,494

752,865

1,740,394

$

$

Non-GAAP

1Q'22

583,290

13,135

796,328

574,510

646,292

2,613,555

59,366

245,028

198,944

503,338

2,110,217

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

1. Net cash comprised of $583 million of cash and cash equivalents less $450 million in debt principal.

TPG | 14View entire presentation