Hertz Investor Presentation Deck

DIP FINANCING SIZING OVERVIEW (CONT'D)

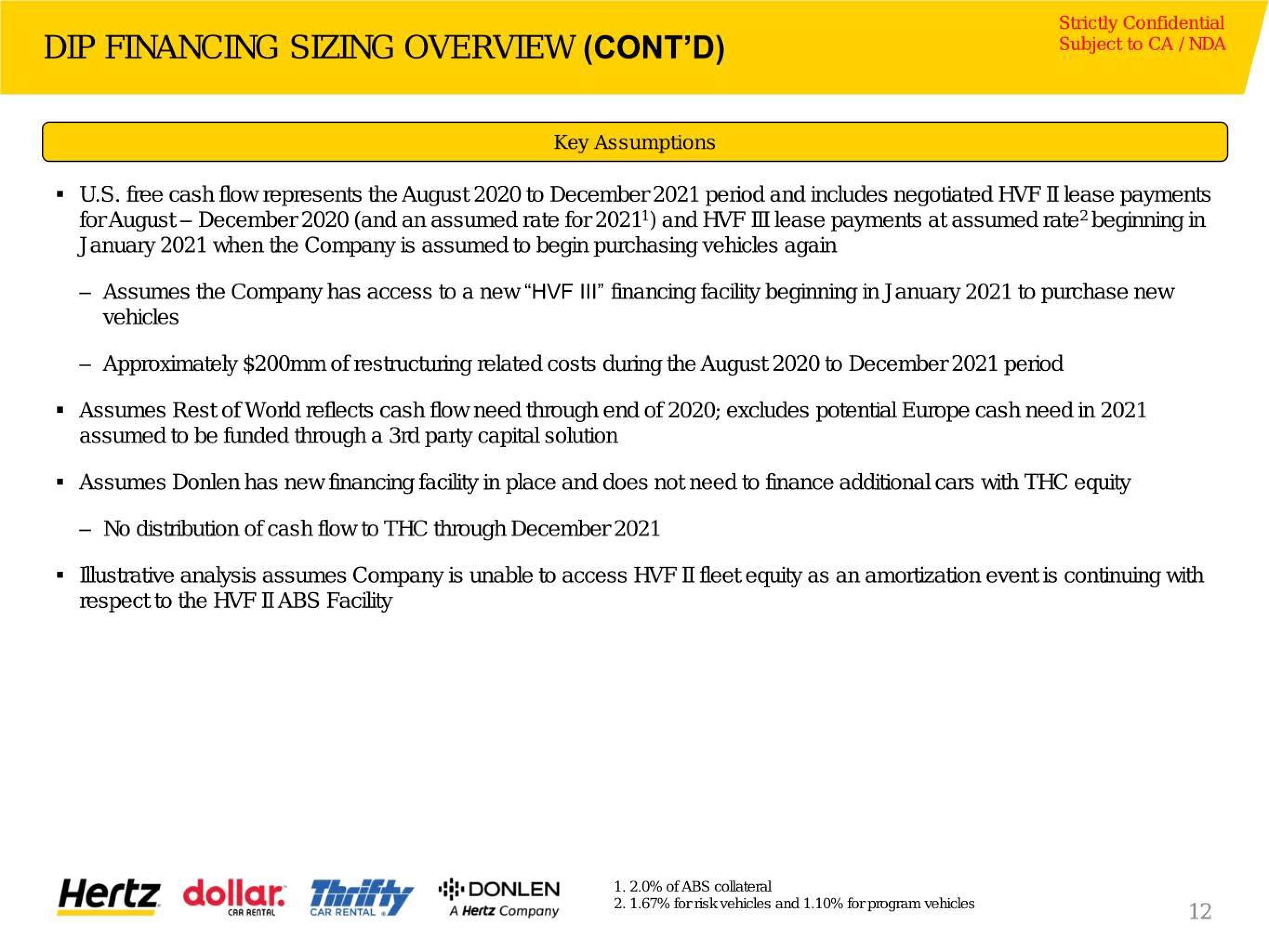

Key Assumptions

▪ U.S. free cash flow represents the August 2020 to December 2021 period and includes negotiated HVF II lease payments

for August - December 2020 (and an assumed rate for 2021¹) and HVF III lease payments at assumed rate² beginning in

January 2021 when the Company is assumed to begin purchasing vehicles again

-

■

Strictly Confidential

Subject to CA/ NDA

Assumes the Company has access to a new "HVF III" financing facility beginning in January 2021 to purchase new

vehicles

- Approximately $200mm of restructuring related costs during the August 2020 to December 2021 period

▪ Assumes Rest of World reflects cash flow need through end of 2020; excludes potential Europe cash need in 2021

assumed to be funded through a 3rd party capital solution

▪ Assumes Donlen has new financing facility in place and does not need to finance additional cars with THC equity

No distribution of cash flow to THC through December 2021

Illustrative analysis assumes Company is unable to access HVF II fleet equity as an amortization event is continuing with

respect to the HVF II ABS Facility

Hertz dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

1. 2.0% of ABS collateral

2. 1.67% for risk vehicles and 1.10% for program vehicles

12View entire presentation