Topps SPAC Presentation Deck

28

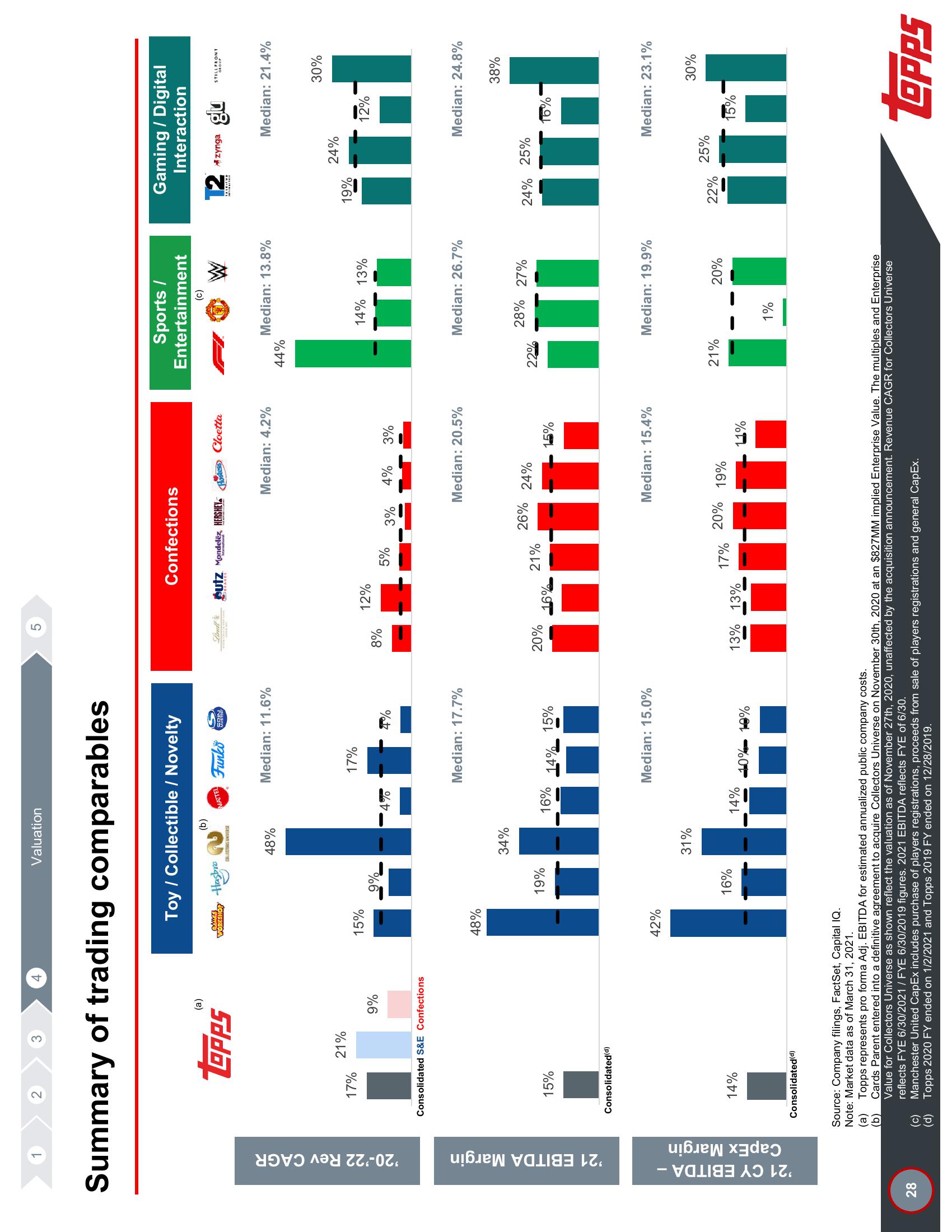

'20-'22 Rev CAGR

Summary of trading comparables

'21 EBITDA Margin

Margin

'21 CY EBITDA -

CapEx

2

topPS

17%

(a)

(b)

(c)

(d)

15%

Consolidated(d)

21%

Consolidated S&E Confections

14%

Consolidated (d)

(a)

4

9%

Toy / Collectible / Novelty

DAMES Hasbro

WORKSHOP

15%

48%

Valuation

42%

Source: Company filings, FactSet, Capital IQ.

Note: Market data as of March 31, 2021.

9%

(b)

COLLETONVER

48%

MATTEL

4%

Funko

S

Median: 11.6%

17%

4%

Median: 17.7%

Lindt

Median: 15.0%

8%

Confections

20%

utz Mondelēz, HERSHEY

BEANDS

12%

5%

3%

ostess

Cloetta

Median: 4.2%

4% 3%

Median: 20.5%

1.5%

Median: 15.4%

Sports /

Entertainment

(c)

44%

1%

W

Median: 13.8%

14% 13%

Median: 26.7%

Median: 19.9%

Gaming / Digital

Interaction

TALE-TUO

Topps represents pro forma Adj. EBITDA for estimated annualized public company costs.

Cards Parent entered into a definitive agreement to acquire Collectors Universe on November 30th, 2020 at an $827MM implied Enterprise Value. The multiples and Enterprise

Value for Collectors Universe as shown reflect the valuation as of November 27th, 2020, unaffected by the acquisition announcement. Revenue CAGR for Collectors Universe

reflects FYE 6/30/2021 / FYE 6/30/2019 figures. 2021 EBITDA reflects FYE of 6/30.

Manchester United CapEx includes purchase of players registrations, proceeds from sale of players registrations and general CapEx.

Topps 2020 FY ended on 1/2/2021 and Topps 2019 FY ended on 12/28/2019.

19%

34%

28% 27%

26% 24%

24% 25%

19%

22%

21%

16%

15%

14%

16%

16%

kika tain ill il

zynga

24%

glu

STILL FRONT

GROUP

Median: 21.4%

12%

30%

Median: 24.8%

31%

25%

21%

20%

22%

20%

17%

19%

16%

15%

14%

13% 13%

10% 1.9%

lika un 13 ini

1%

38%

Median: 23.1%

30%

LOPPSView entire presentation