Snap Inc Investor Presentation Deck

Snap Inc.

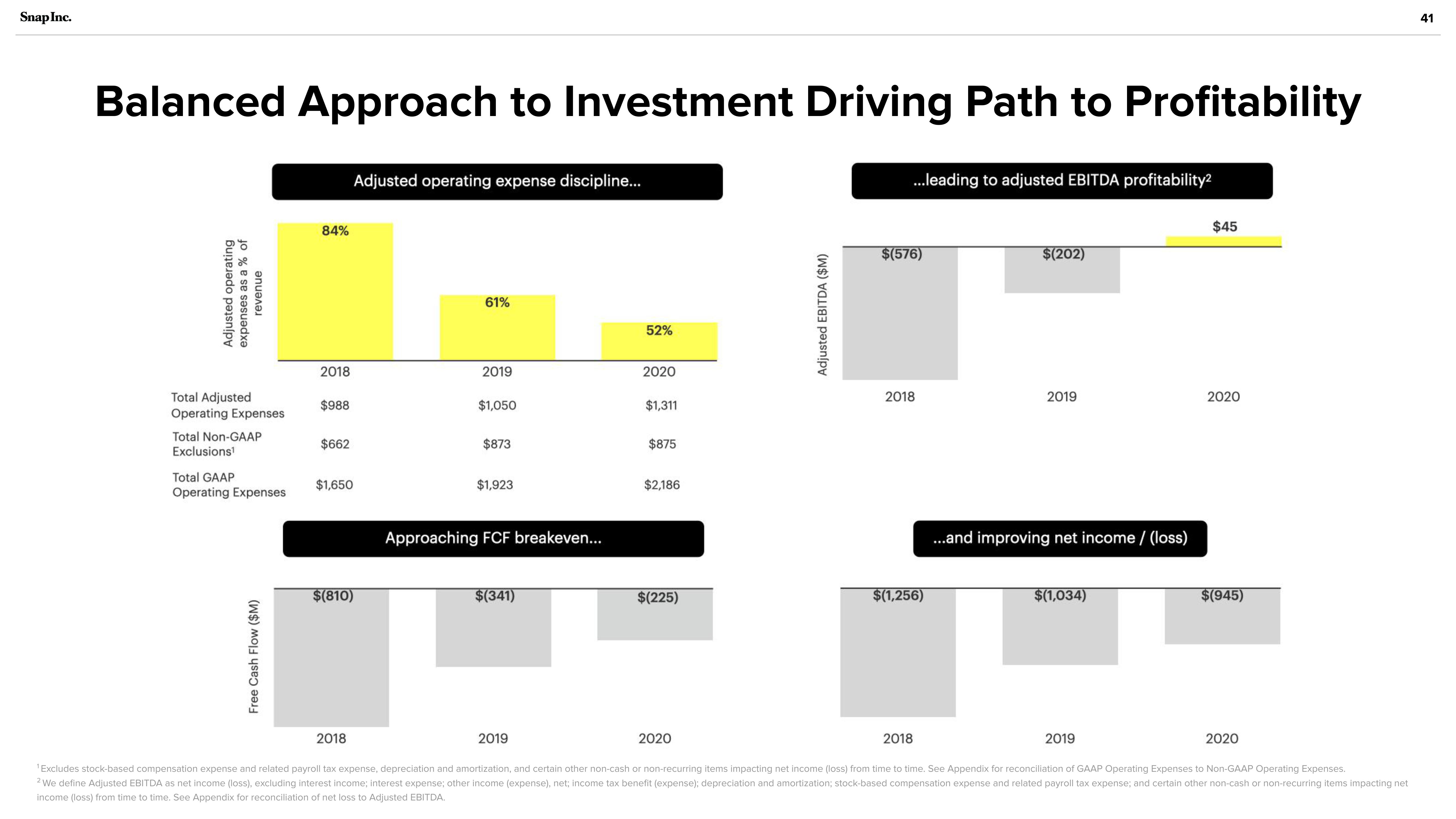

Balanced Approach to Investment Driving Path to Profitability

Adjusted operating

expenses as a % of

revenue

Total Adjusted

Operating Expenses

Total Non-GAAP

Exclusions¹

Total GAAP

Operating Expenses

Free Cash Flow ($M)

84%

2018

$988

$662

Adjusted operating expense discipline...

$1,650

$(810)

2018

61%

2019

$1,050

$873

$1,923

Approaching FCF breakeven...

$(341)

2019

52%

2020

$1,311

$875

$2,186

$(225)

2020

Adjusted EBITDA ($M)

...leading to adjusted EBITDA profitability2

$(576)

2018

$(1,256)

2018

$(202)

2019

...and improving net income / (loss)

$(1,034)

2019

$45

2020

$(945)

2020

¹Excludes stock-based compensation expense and related payroll tax expense, depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time. See Appendix for reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses.

2 We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and related payroll tax expense; and certain other non-cash or non-recurring items impacting net

income (loss) from time to time. See Appendix for reconciliation of net loss to Adjusted EBITDA.

41View entire presentation