HSBC Investor Day Presentation Deck

£m

Net interest income

Non interest income

Revenue

ECL

Costs

Adjusted PBT

Significant items

Reported PBT

Reported ROTE, %

Adjusted ROTE, %²

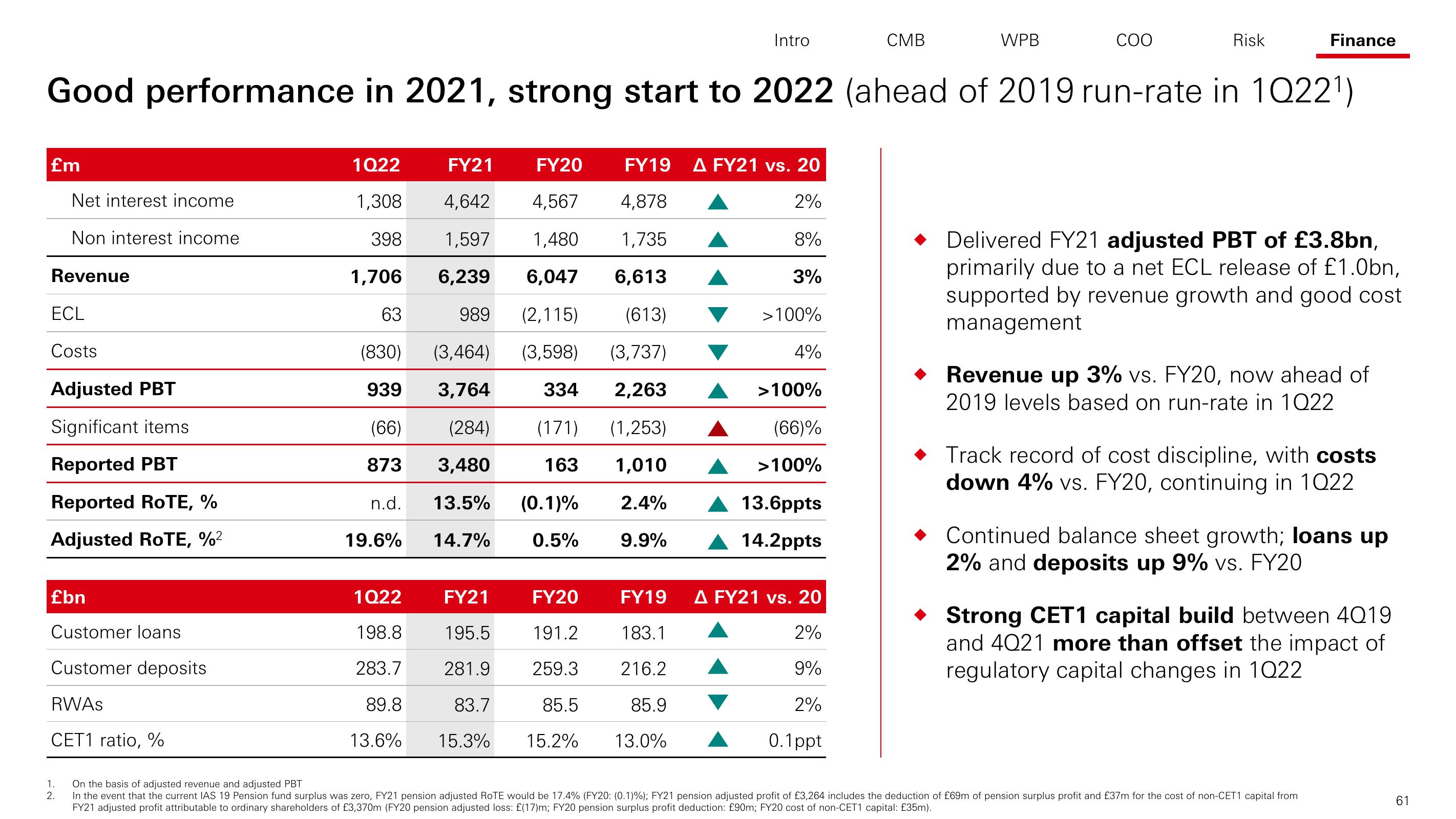

Good performance in 2021, strong start to 2022 (ahead of 2019 run-rate in 1Q22¹)

£bn

Customer loans

Customer deposits

RWAS

CET1 ratio, %

1.

2.

1Q22

FY21

FY20

FY19

1,308

4,642

4,567 4,878

398

1,597

1,480

1,735

1,706

6,239 6,047 6,613

63

989 (2,115)

(613)

(830)

(3,464) (3,598) (3,737)

939 3,764

334 2,263

(66)

873

(284) (171) (1,253)

163 1,010

3,480

n.d. 13.5% (0.1)% 2.4%

19.6%

14.7%

0.5%

9.9%

1Q22

198.8

283.7

89.8

13.6%

FY21

195.5

281.9

83.7

15.3%

Intro

FY20

191.2

259.3

85.5

15.2%

A FY21 vs. 20

2%

8%

3%

>100%

4%

>100%

(66)%

>100%

13.6ppts

14.2ppts

CMB

FY19 A FY21 vs. 20

183.1

2%

216.2

9%

85.9

2%

13.0%

0.1ppt

WPB

COO

Risk

Finance

◆ Delivered FY21 adjusted PBT of £3.8bn,

primarily due to a net ECL release of £1.0bn,

supported by revenue growth and good cost

management

◆ Revenue up 3% vs. FY20, now ahead of

2019 levels based on run-rate in 1022

◆ Track record of cost discipline, with costs

down 4% vs. FY20, continuing in 1022

Continued balance sheet growth; loans up

2% and deposits up 9% vs. FY20

◆ Strong CET1 capital build between 4019

and 4021 more than offset the impact of

regulatory capital changes in 1022

On the basis of adjusted revenue and adjusted PBT

In the event that the current IAS 19 Pension fund surplus was zero, FY21 pension adjusted ROTE would be 17.4% (FY20: (0.1) %); FY21 pension adjusted profit of £3,264 includes the deduction of £69m of pension surplus profit and £37m for the cost of non-CET1 capital from

FY21 adjusted profit attributable to ordinary shareholders of £3,370m (FY20 pension adjusted loss: £(17)m; FY20 pension surplus profit deduction: £90m; FY20 cost of non-CET1 capital: £35m).

61View entire presentation