Trian Partners Activist Presentation Deck

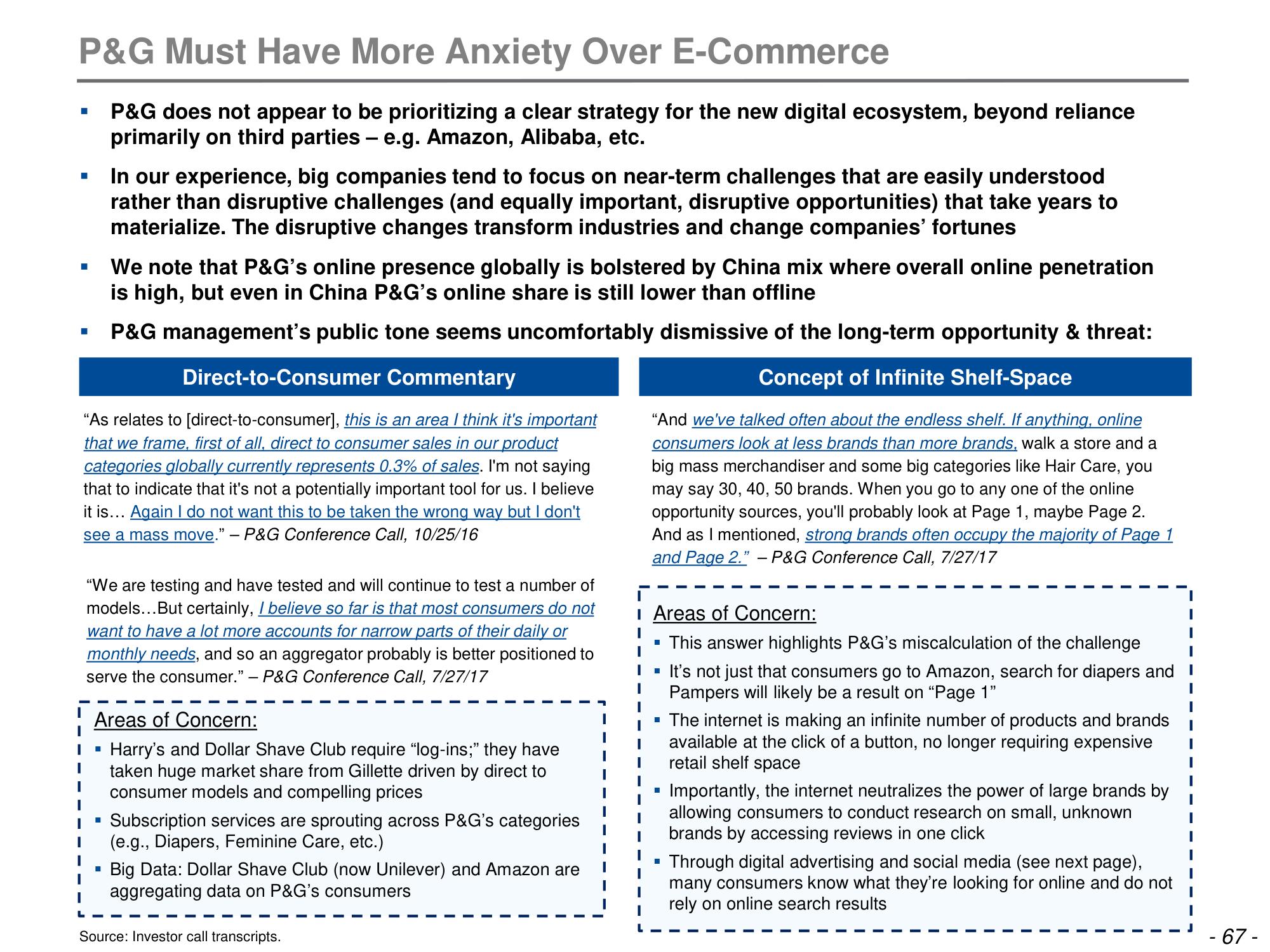

P&G Must Have More Anxiety Over E-Commerce

P&G does not appear to be prioritizing a clear strategy for the new digital ecosystem, beyond reliance

primarily on third parties - e.g. Amazon, Alibaba, etc.

■

■

■

■

I

I

Direct-to-Consumer Commentary

"As relates to [direct-to-consumer], this is an area I think it's important

that we frame, first of all, direct to consumer sales in our product

categories globally currently represents 0.3% of sales. I'm not saying

that to indicate that it's not a potentially important tool for us. I believe

it is... Again I do not want this to be taken the wrong way but I don't

see a mass move." - P&G Conference Call, 10/25/16

In our experience, big companies tend to focus on near-term challenges that are easily understood

rather than disruptive challenges (and equally important, disruptive opportunities) that take years to

materialize. The disruptive changes transform industries and change companies' fortunes

We note that P&G's online presence globally is bolstered by China mix where overall online penetration

is high, but even in China P&G's online share is still lower than offline

P&G management's public tone seems uncomfortably dismissive of the long-term opportunity & threat:

Concept of Infinite Shelf-Space

"And we've talked often about the endless shelf. If anything, online

consumers look at less brands than more brands, walk a store and a

big mass merchandiser and some big categories like Hair Care, you

may say 30, 40, 50 brands. When you go to any one of the online

opportunity sources, you'll probably look at Page 1, maybe Page 2.

And as I mentioned, strong brands often occupy the majority of Page 1

and Page 2." - P&G Conference Call, 7/27/17

"We are testing and have tested and will continue to test a number of

models... But certainly, I believe so far is that most consumers do not

want to have a lot more accounts for narrow parts of their daily or

monthly needs, and so an aggregator probably is better positioned to

serve the consumer." - P&G Conference Call, 7/27/17

■

Areas of Concern:

Harry's and Dollar Shave Club require "log-ins;" they have

taken huge market share from Gillette driven by direct to

consumer models and compelling prices

■

I

1 Subscription services are sprouting across P&G's categories

(e.g., Diapers, Feminine Care, etc.)

I

Big Data: Dollar Shave Club (now Unilever) and Amazon are

aggregating data on P&G's consumers

Source: Investor call transcripts.

I Areas of Concern:

▪ This answer highlights P&G's miscalculation of the challenge

I

I

I

■

■

1

It's not just that consumers go to Amazon, search for diapers and

Pampers will likely be a result on "Page 1"

The internet is making an infinite number of products and brands I

available at the click of a button, no longer requiring expensive

retail shelf space

|

Importantly, the internet neutralizes the power of large brands by

allowing consumers to conduct research on small, unknown

brands by accessing reviews in one click

Through digital advertising and social media (see next page),

many consumers know what they're looking for online and do not

rely on online search results

- 67 -View entire presentation