Apollo Global Management Investor Presentation Deck

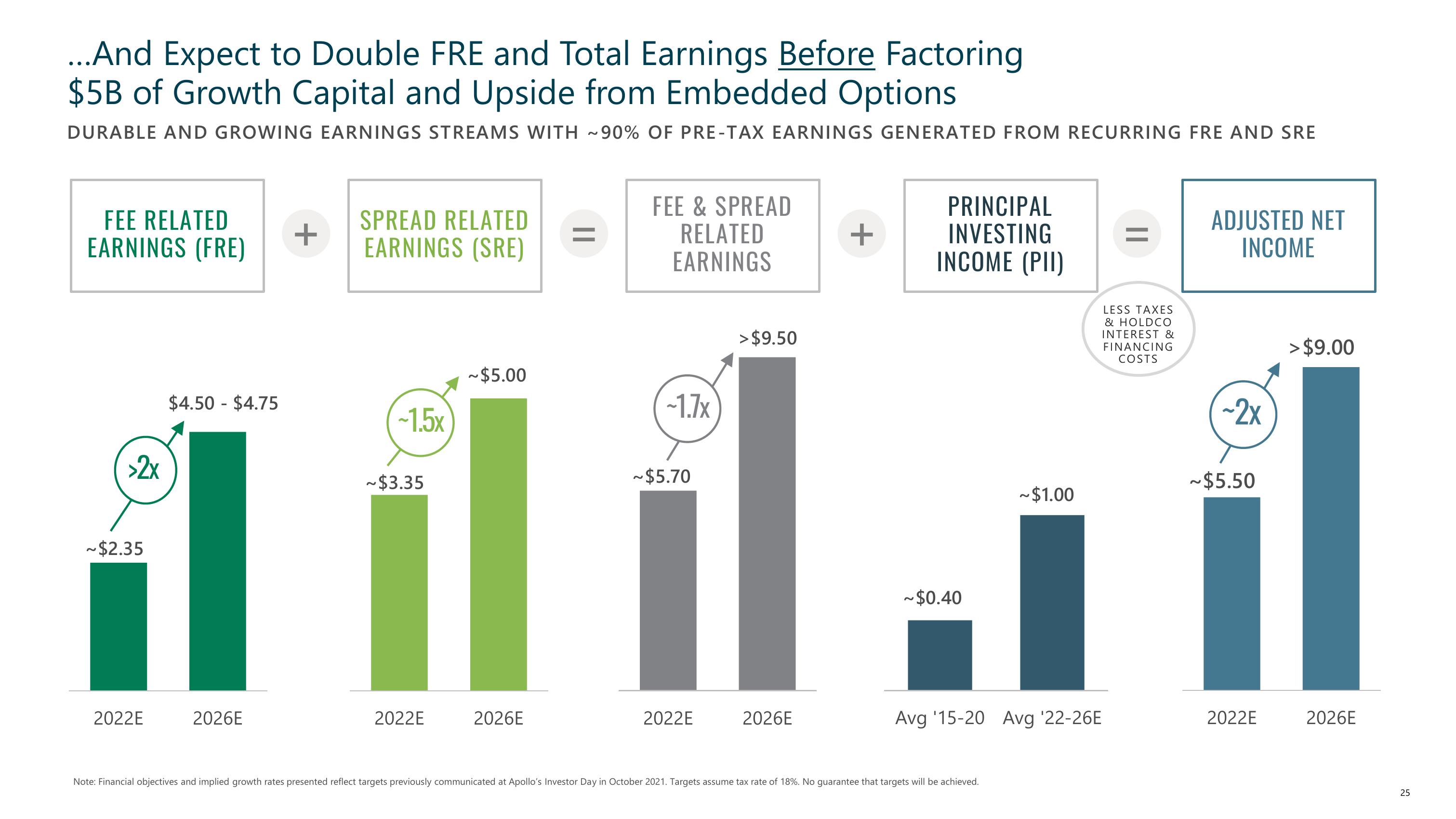

...And Expect to Double FRE and Total Earnings Before Factoring

$5B of Growth Capital and Upside from Embedded Options

DURABLE AND GROWING EARNINGS STREAMS WITH ~90% OF PRE-TAX EARNINGS GENERATED FROM RECURRING FRE AND SRE

FEE RELATED

EARNINGS (FRE)

>2x

~$2.35

2022E

$4.50 - $4.75

2026E

+

SPREAD RELATED

EARNINGS (SRE)

-15x

~$3.35

2022E

~$5.00

2026E

=

FEE & SPREAD

RELATED

EARNINGS

~1.7x

~$5.70

2022E

> $9.50

2026E

+

PRINCIPAL

INVESTING

INCOME (PII)

~$0.40

~$1.00

Avg '15-20 Avg '22-26E

Note: Financial objectives and implied growth rates presented reflect targets previously communicated at Apollo's Investor Day in October 2021. Targets assume tax rate of 18%. No guarantee that targets will be achieved.

=

LESS TAXES

& HOLDCO

INTEREST &

FINANCING

COSTS

ADJUSTED NET

INCOME

~2x

~$5.50

2022E

> $9.00

2026E

5555

25View entire presentation