Disney Shareholder Engagement Presentation Deck

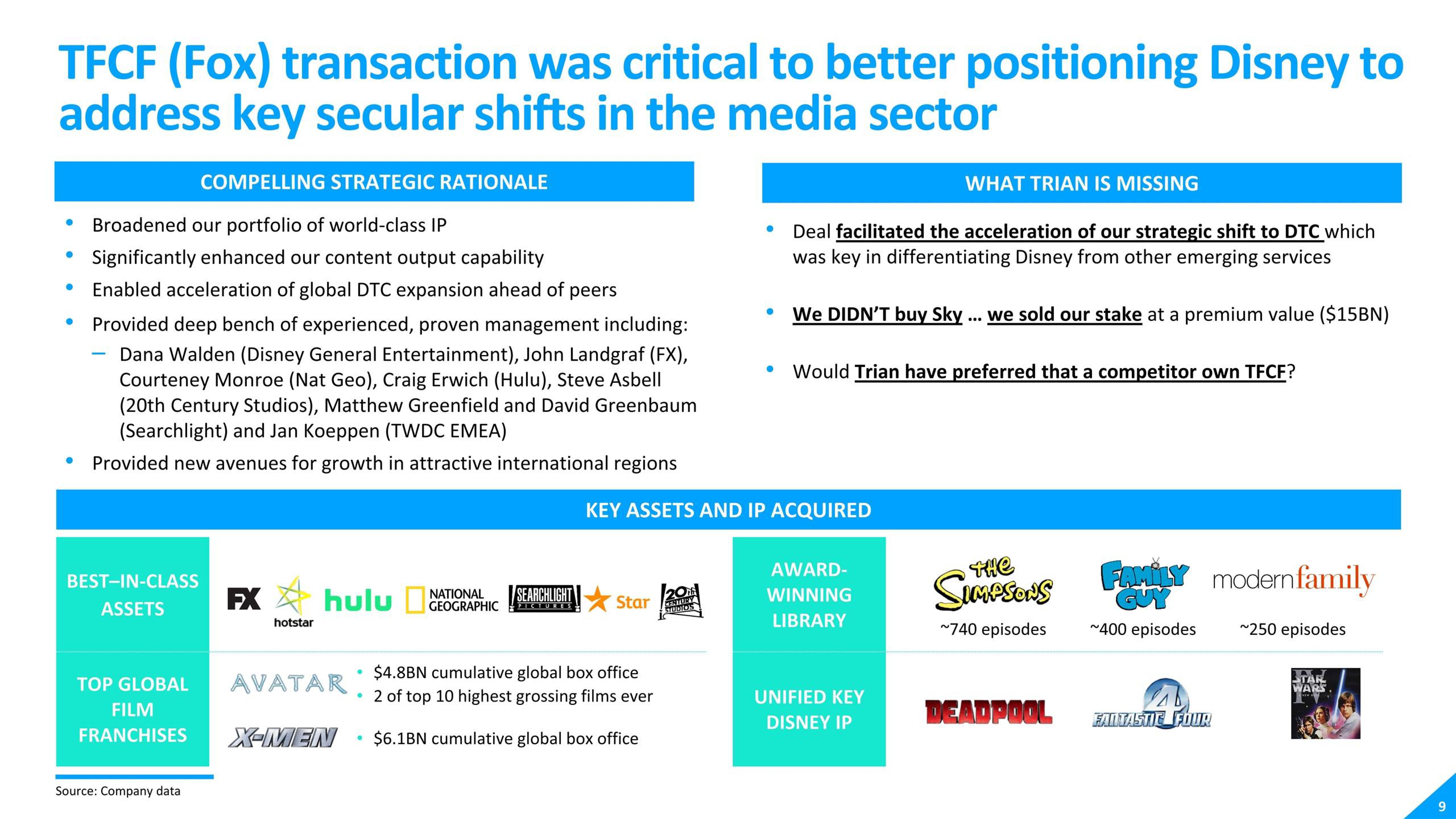

TFCF (Fox) transaction was critical to better positioning Disney to

address key secular shifts in the media sector

●

●

●

●

Broadened our portfolio of world-class IP

Significantly enhanced our content output capability

Enabled acceleration of global DTC expansion ahead of peers

Provided deep bench of experienced, proven management including:

Dana Walden (Disney General Entertainment), John Landgraf (FX),

Courteney Monroe (Nat Geo), Craig Erwich (Hulu), Steve Asbell

(20th Century Studios), Matthew Greenfield and David Greenbaum

(Searchlight) and Jan Koeppen (TWDC EMEA)

Provided new avenues for growth in attractive international regions

BEST-IN-CLASS

ASSETS

TOP GLOBAL

FILM

FRANCHISES

COMPELLING STRATEGIC RATIONALE

Source: Company data

FX

hotstar

hulu

AVATAR

X-MEN

NATIONAL

GEOGRAPHIC

●

SEARCHLIGHT

PICTURES

Star

• $4.8BN cumulative global box office

●

2 of top 10 highest grossing films ever

$6.1BN cumulative global box office

KEY ASSETS AND IP ACQUIRED

WHAT TRIAN IS MISSING

Deal facilitated the acceleration of our strategic shift to DTC which

was key in differentiating Disney from other emerging services

We DIDN'T buy Sky... we sold our stake at a premium value ($15BN)

CENTURY

STUDIOS

Would Trian have preferred that a competitor own TFCF?

AWARD-

WINNING

LIBRARY

UNIFIED KEY

DISNEY IP

THE

SIMPSONS

~740 episodes

DEADPOOL

FAMILY modern family

GUY

~400 episodes ~250 episodes

FANTASTIC FOUR

STAR

WARS

9View entire presentation